Understanding the spot trading fees on an exchange like Bybit is crucial for any trader looking to optimize trading costs and maximize profitability. Fees may seem small at first glance, but they can significantly impact your bottom line, especially for high-frequency traders and institutions.

Bybit, one of the leading cryptocurrency exchanges, offers a tiered fee structure that rewards high-volume traders with lower costs. Knowing how Bybit’s spot trading fees work can help you reduce unnecessary expenses, whether you are a casual trader or a professional managing large portfolios.

In this guide, we will analyze Bybit’s transaction fees, compare them with other major exchanges, and explore strategies to manage and minimize trading costs in 2025 effectively.

Transaction Fees on Bybit

Spot trading on Bybit involves the direct buying and selling of cryptocurrencies at real-time market prices. Unlike futures trading, where contracts are settled at a later date, spot trading means that transactions are executed immediately based on current supply and demand. However, every trade incurs a transaction fee, and understanding how these fees are structured can help traders optimize their strategies and minimize costs.

Maker vs. Taker Fees on Bybit

Like most leading cryptocurrency exchanges, Bybit employs a maker-taker fee model to manage liquidity and incentivize different types of trading activity.

- Maker Fees: These fees apply when a trader places a limit order that is not immediately executed, meaning the order is added to the exchange’s order book and contributes to market liquidity. Since these orders help stabilize market pricing, exchanges typically reward market makers with lower fees.

- Taker Fees: In contrast, taker fees are charged when a trader places a market order (or executes an existing limit order from the order book), which removes liquidity from the market. Takers generally pay higher fees because they contribute to short-term volatility by executing trades instantly.

On Bybit, maker fees are lower than taker fees to encourage liquidity provision. This fee structure ensures that traders contributing to market depth are rewarded, while those executing instant transactions pay slightly higher costs.

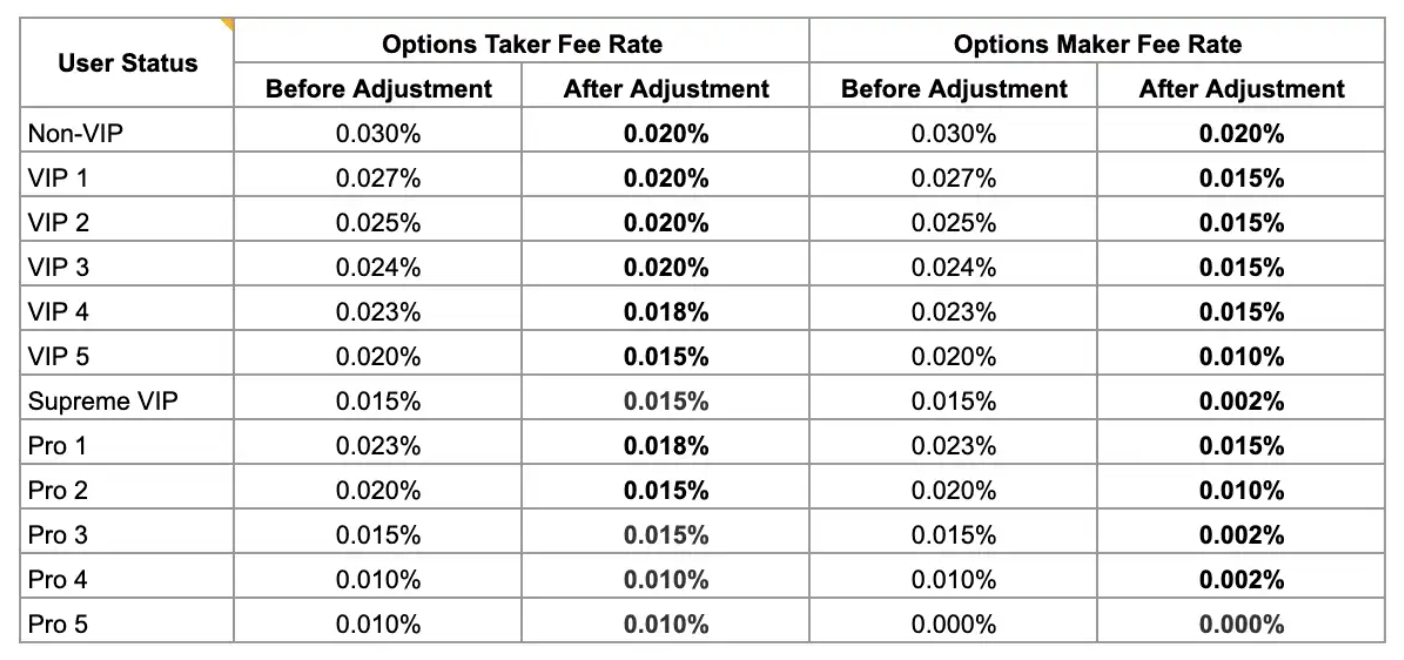

Bybit’s Spot Trading Fee Structure in 2025

Bybit’s spot trading fees are determined based on a trader’s 30-day trading volume, following a VIP tier system. This means that traders who engage in larger transaction volumes receive lower fees, making Bybit particularly attractive for institutional traders and high-frequency traders who seek cost efficiency.

At the base VIP 0 level, traders with less than $100,000 in monthly trading volume are charged a 0.10% taker fee and a 0.10% maker fee. As a trader’s activity increases, they move up the VIP ladder and unlock progressively lower fees. For example, traders who surpass $1 million in 30-day trading volume qualify for VIP 1 status, where taker fees drop to 0.08% and maker fees decrease to 0.0675%.

Further up, at VIP 2, traders must reach $5 million in monthly volume, reducing their taker fee to 0.0775% and maker fee to 0.065%. The reductions continue across the tiers, with VIP 3 (for traders exceeding $10 million) benefiting from 0.075% taker fees and 0.0625% maker fees. At VIP 4, requiring $25 million in trading volume, the fees further decline to 0.06% for takers and 0.05% for makers.

For VIP 5, which includes traders with over $50 million in trading volume, the fees are 0.05% for takers and 0.04% for makers. Those who reach Supreme VIP status by trading at least $100 million monthly enjoy some of the lowest fees at 0.045% for takers and 0.03% for makers.

In addition to the VIP levels, Bybit also offers Pro tiers for even higher-volume traders. Pro 1 status, starting at $25 million in volume, carries a 0.06% taker fee and 0.04% maker fee, which is similar to VIP 4. However, as traders progress through Pro 2, Pro 3, Pro 4, and beyond, the fees drop significantly.

At Pro 2, requiring $50 million in trading volume, traders see their taker fees reduced to 0.05% and maker fees to 0.03%. Pro 3 (for traders exceeding $100 million) offers a 0.04% taker fee and 0.02% maker fee, making it an attractive option for hedge funds and institutional players. Pro 4, for traders handling at least $200 million monthly, further cuts fees to 0.03% for takers and 0.015% for makers.

Bybit’s most competitive rates are available at the highest Pro tiers. Pro 5, for traders exceeding $500 million, reduces fees to 0.02% for takers and 0.01% for makers. Finally, at Pro 6, traders executing over $1 billion in trading volume per month pay an ultra-low 0.015% taker fee and 0.005% maker fee—making Bybit one of the most cost-effective spot trading platforms for institutional and professional traders.

This tiered fee structure ensures that traders with higher trading volumes receive significant fee reductions, helping them maximize profits while maintaining high liquidity in the market.

Other Trading Costs to Consider on Bybit

While spot trading fees are the most direct costs, traders must also consider additional expenses that can impact their overall trading efficiency.

Deposit and Withdrawal Fees

Bybit does not charge any deposit fees, making it easy for traders to fund their accounts without incurring extra costs. However, withdrawals are subject to blockchain network fees, which vary based on network congestion. For example, withdrawing Bitcoin (BTC) may have a higher fee during peak demand periods due to increased transaction costs on the blockchain.

Slippage Costs

Slippage occurs when a large market order is executed at a price that is different from the expected price due to a lack of sufficient liquidity. For example, if a trader places a high-value buy order in a thinly traded market, the final execution price may be higher than anticipated, leading to additional indirect costs. Traders can minimize slippage by using limit orders instead of market orders and by trading during high-liquidity periods.

Spread Costs

The spread refers to the difference between the bid price (what buyers are willing to pay) and the asking price (what sellers are asking for). In highly volatile markets, spreads can widen significantly, increasing the cost per trade. This is particularly relevant for traders engaging in high-frequency strategies, where even small differences in spread can affect profitability over time.

Comparing Spot Trading Fees

When selecting a cryptocurrency exchange for spot trading, fees play a critical role in maximizing profitability. Bybit has gained popularity due to its competitive fee structure, but how does it compare to other major platforms such as Binance, Kraken, and Coinbase? Each exchange has its pricing model, and understanding these differences helps traders make informed decisions about where to execute their trades.

At the base level, Bybit and Binance stand out as the most cost-effective options, both charging a 0.10% taker fee and a 0.10% maker fee. This makes them attractive choices for traders looking to minimize costs, especially those engaging in high-frequency trading or large transaction volumes. Binance, however, offers additional discounts for users who hold and pay fees with Binance Coin (BNB), allowing them to reduce their trading costs even further. Bybit, on the other hand, does not rely on token-based discounts but instead offers VIP and Pro tier reductions based solely on 30-day trading volume. This approach makes it particularly advantageous for institutional traders who conduct significant trading activity and prefer a straightforward volume-based reduction structure.

Kraken and Coinbase, in contrast, have substantially higher base fees, which can eat into profits, particularly for active traders. Kraken’s base taker fee starts at 0.26%, while the maker fee begins at 0.16%, making it less attractive compared to Bybit and Binance. However, Kraken does offer Pro account tiers, where fees gradually decrease for high-volume traders, though they remain above the industry-leading rates of Bybit’s VIP and Pro tiers.

Coinbase is by far the most expensive among the four exchanges, charging a 0.60% taker fee and a 0.40% maker fee at the base level. This makes it one of the least favorable platforms for frequent traders or institutional investors. Unlike Binance and Bybit, which provide extensive fee reduction options, Coinbase does not offer significant discounts for high-volume traders, further limiting its appeal to professionals looking to optimize their trading costs.

For traders who execute large transactions on a regular basis, Bybit’s Pro tiers offer some of the lowest fees in the industry. As traders move up the VIP and Pro levels based on their 30-day trading volume, they can achieve fees as low as 0.015% for takers and 0.005% for makers at the highest Pro tier. This makes Bybit particularly appealing for institutional traders, hedge funds, and professional investors seeking to minimize costs while maintaining high liquidity.

In summary, when comparing spot trading fees across major exchanges, Bybit and Binance emerge as the most cost-efficient platforms due to their low base fees and structured discount systems. While Binance’s fee reductions depend on holding BNB, Bybit provides purely volume-based fee reductions, making it more predictable and accessible for traders who prefer not to rely on exchange tokens. Kraken and Coinbase, with their higher fees, may still appeal to specific user groups but remain less attractive to those prioritizing cost efficiency and frequent trading.

Managing and Reducing Trading Costs on Bybit

Spot trading fees can quickly add up, but traders can take specific steps to minimize costs. Here are the best strategies to keep trading expenses low.

Use Limit Orders Instead of Market Orders

Market orders incur taker fees, which are generally higher than maker fees. Traders can reduce costs by placing limit orders, ensuring their orders add liquidity rather than take it.

For example, a $1,000,000 trade at VIP 5:

- A market order (taker fee 0.05%) would cost $500.

- A limit order (maker fee 0.04%) would cost $400, saving $100 per trade.

Increase Trading Volume to Unlock VIP Discounts

Bybit’s VIP tiers offer progressively lower fees, so increasing monthly trading volume can yield substantial savings. Traders who frequently execute high-value trades should aim to advance through the VIP ranks as quickly as possible.

Monitor Withdrawal Fees and Optimize Transfers

Although Bybit does not charge deposit fees, withdrawals are subject to blockchain network fees. Planning withdrawals during periods of low congestion can reduce costs.

For example:

- Bitcoin (BTC) withdrawals typically cost 0.0005 BTC but may be lower if timed correctly.

- Using lower-fee cryptocurrencies like USDT on Tron (TRC-20) can further reduce withdrawal costs.

Leverage Bybit’s Promotions and Trading Competitions

Bybit frequently runs trading competitions and promotional events that offer rebates, fee reductions, and bonuses. Keeping an eye on these opportunities can help traders offset costs.

Is Bybit the Best Exchange for Low Spot Trading Fees in 2025?

Bybit spot trading fees are among the most competitive in the industry. With its VIP and Pro tier structure, the platform effectively rewards high-volume traders, making it an ideal choice for both retail and institutional users.

Advantages of Bybit’s Fee Structure:

- Competitive base fees of 0.10%, on par with Binance.

- Pro trader tiers offer fees as low as 0.015% taker / 0.005% maker.

No deposit fees and reasonable withdrawal fees.

Potential Drawbacks:

- No additional discounts via a native exchange token like Binance’s BNB.

- Requires high trading volume to unlock the lowest fee tiers.

For traders looking to minimize spot trading costs in 2025, Bybit remains one of the best exchanges available. Understanding the fee structure and applying cost-saving strategies can significantly enhance profitability over time.