In 2025, derivatives trading continues to be a popular and profitable strategy for many investors, with platforms like Bybit playing a crucial role in facilitating such trades. However, the high volatility and risk associated with trading derivatives require robust risk management strategies to protect investments and secure long-term profitability. This article explores the key aspects of risk management in derivatives trading on Bybit, including position sizing, stop loss orders, and diversification techniques, to help traders navigate the complexities of the market.

Derivatives are financial instruments whose value is derived from the price of an underlying asset, such as Bitcoin, or Ethereum, or traditional assets like commodities and stocks. Bybit, one of the leading cryptocurrency exchanges, has established itself as a go-to platform for derivatives trading. Bybit offers traders the ability to trade perpetual contracts, which allow for long or short positions, providing flexibility in both rising and falling markets.

Position Sizing

One of the most crucial aspects of risk management in derivatives trading is determining the appropriate position size. Position sizing refers to the amount of capital a trader allocates to a single trade, which directly impacts the level of risk they are exposed to. Trading with the right position size is essential to ensure that traders do not overexpose themselves to the market and can absorb potential losses without affecting their overall portfolio.

How to Calculate Position Size

Calculating the appropriate position size is a vital part of risk management when trading derivatives on Bybit. Proper position sizing ensures that traders are not overexposing themselves to the market, which can result in significant losses. By calculating position size correctly, traders can maintain consistent risk levels across all trades, helping them to avoid large drawdowns and keep their account balance intact, even in the face of volatile market conditions.

- Account Size: The account size refers to the total capital in your trading account. It’s crucial to determine how much of your account you can afford to risk on a single trade. A larger account allows for larger position sizes, but this also means that potential losses could be more significant. The key is to avoid overexposure, which could deplete the account too quickly if multiple trades go wrong.

- Risk Tolerance: Risk tolerance is the percentage of your total account balance that you’re willing to risk on any one trade. A commonly recommended approach is to risk no more than 1-2% of your total capital per trade. For instance, if you have a $10,000 account and choose to risk 1%, your maximum risk per trade would be $100. This prevents excessive losses and ensures that even a series of losing trades won’t drastically affect your account balance.

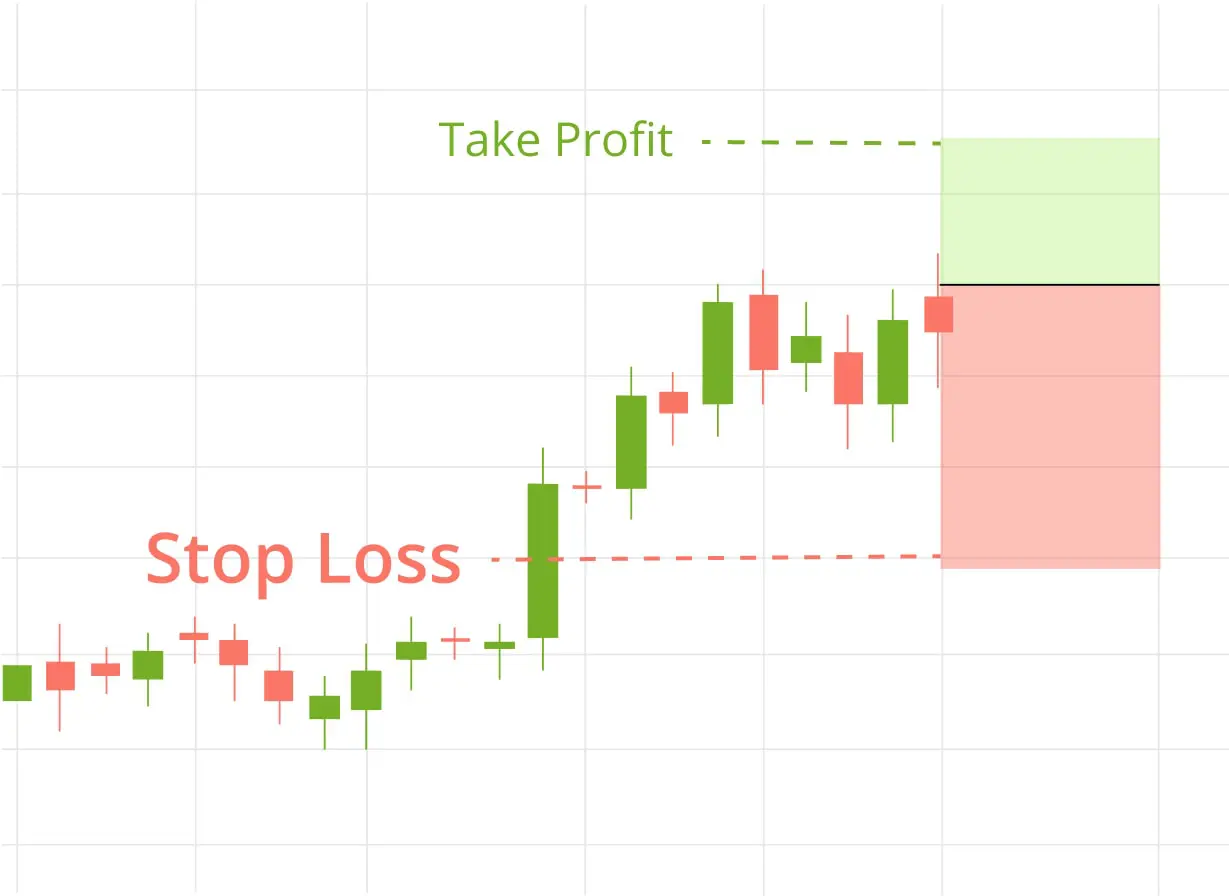

- Stop Loss Distance: The stop loss is the price level at which your position is automatically closed to limit losses. The distance between your entry price and stop loss level plays a significant role in position sizing. The wider the stop loss, the smaller your position size should be to keep your risk within the acceptable limit.

To calculate the position size, use the following formula:

Position Size = Risk Amount/Stop Loss Distance

For example, if your risk amount is $100 and your stop loss distance is $500, your position size would be 0.2 contracts. This calculation ensures you maintain proper risk management, regardless of market volatility, and helps safeguard your capital while trading derivatives on Bybit.

Example of Position Sizing in Derivatives Trading

Let’s consider an example of position sizing using Bybit’s perpetual contracts for Bitcoin. Assume the trader has an account balance of $10,000 and is willing to risk 1% of their account on a single trade. The trader analyzes the market and places a stop loss 10% away from the entry price.

- Account balance: $10,000

- Risk per trade: 1% of $10,000 = $100

- Stop loss distance: 10% of the entry price

In this scenario, the trader should calculate the position size by dividing the risk per trade ($100) by the distance to the stop loss (10% of the entry price). This ensures that even if the trade hits the stop loss, the loss will be limited to the desired risk amount.

Stop Loss Orders

A stop-loss order is a key tool for managing risk in derivatives trading. It is a predetermined order that automatically closes a position once the price of the underlying asset reaches a specific level, limiting the trader’s losses. Stop-loss orders help traders avoid emotional decision-making during market fluctuations and can be a vital tool in preserving capital, especially when the market moves quickly.

Types of Stop Loss Orders on Bybit

Bybit offers several types of stop-loss orders, allowing traders to tailor their risk management strategies:

- Limit Stop Loss Order: This type of stop loss order executes when the price reaches the specified level, but only if it is possible to execute the order at that price or better. Traders use limit stop-loss orders to avoid slippage during periods of high volatility.

- Market Stop Loss Order: A market stop loss order will execute immediately once the price reaches the stop level, regardless of the price at execution. This ensures that the position is closed, but it could result in slippage if the market moves quickly.

- Trailing Stop Loss Order: A trailing stop loss is a dynamic stop loss that moves in the direction of the trade. As the price of the asset increases, the stop loss order moves up (for long positions) or down (for short positions), locking in profits while still protecting reversals.

Benefits of Using Stop Loss Orders

The primary benefit of using stop-loss orders is that they help traders limit potential losses by automatically closing a position when the market moves against them. In volatile markets, where prices can change rapidly, relying on manual execution of trades can be risky. Stop-loss orders offer a fail-safe mechanism to ensure that traders do not experience catastrophic losses.

For example, let’s say a trader buys a Bitcoin perpetual contract at $30,000 and places a stop loss at $29,000. If the market moves against the trader and the price drops to $29,000, the stop-loss order will automatically close the position, limiting the loss to $1,000.

Diversification Techniques

Diversification is another vital aspect of risk management in derivatives trading. Diversification involves spreading risk across different assets or markets, reducing the impact of any single trade’s failure. By diversifying, traders can minimize the overall risk of their portfolio while still taking advantage of market opportunities.

How to Diversify a Derivatives Trading Portfolio on Bybit

On Bybit, traders can diversify their portfolios by trading a variety of derivative contracts across different cryptocurrencies or even traditional financial instruments like commodities or indices. Here are some strategies for diversifying a derivatives trading portfolio:

- Trade Different Cryptocurrencies: Bybit offers a range of perpetual contracts for different cryptocurrencies, such as Bitcoin, Ethereum, and others. Traders can spread their positions across various cryptocurrencies, reducing the risk that a downturn in a single asset will significantly affect the portfolio.

- Use Different Timeframes: Another diversification technique is to trade different timeframes. For example, a trader could hold both short-term and long-term positions in the same market. This allows the trader to balance short-term volatility with longer-term trends.

- Incorporate Traditional Assets: Although Bybit is primarily a cryptocurrency exchange, many traders also diversify by incorporating traditional assets like gold, oil, or stock indices through CFDs (Contracts for Difference) or similar products. This reduces the correlation risk between cryptocurrencies and traditional assets.

Example of Diversification on Bybit

Let’s say a trader has $10,000 to invest in derivatives on Bybit. Instead of putting all of their funds into Bitcoin perpetual contracts, they might choose to allocate the funds as follows:

- 40% into Bitcoin perpetual contracts

- 30% into Ethereum perpetual contracts

- 20% into oil CFDs

- 10% into a traditional stock index CFD

This diversified portfolio helps mitigate the risk of a single asset underperforming. If Bitcoin experiences a significant drop, the trader’s Ethereum and oil positions may help offset the losses.

The Importance of Risk Management in Derivatives Trading on Bybit

Effective risk management is essential for long-term success. Bybit offers a range of tools and features that can help traders manage their risk, including position sizing, stop-loss orders, and diversification techniques. By carefully considering these strategies, traders can protect their capital, reduce exposure to market volatility, and increase their chances of achieving consistent profitability.

In 2025, the key to thriving in derivatives trading on Bybit is to strike a balance between risk and reward. By adhering to sound risk management practices, traders can confidently navigate the volatile markets and unlock the full potential of derivatives trading. Whether you are a beginner or an experienced trader, mastering risk management is the foundation of a successful trading strategy.