Cryptocurrency investment has rapidly evolved, and launchpads like Bybit have become essential for investors looking to participate in early-stage token sales. Bybit Launchpad offers access to carefully selected blockchain projects, providing an opportunity to invest in tokens before they reach the open market. However, investing in these projects requires a well-thought-out strategy to maximize returns and mitigate risks.

This comprehensive guide will cover the most effective investment strategies for Bybit Launchpad in 2025, including how to research projects before investing, analyze market trends, and implement proper risk management techniques. Whether you are an experienced trader or a newcomer to the space, these insights will help you make informed decisions.

Researching Projects Before Investing

One of the most important aspects of investing in token sales is conducting thorough research. The success of an investment largely depends on the project’s fundamentals, its team, tokenomics, and market potential.

Evaluating the Project’s Whitepaper and Roadmap

A project’s whitepaper serves as its foundation, detailing its objectives, technology, use case, and financial structure. Before investing, it is crucial to assess the following:

- Problem and Solution: Does the project solve a real-world problem, or is it simply riding on hype?

- Use Case: What role does the token play in the ecosystem? Is it necessary for the project’s success?

- Development Roadmap: Does the project have clear and realistic goals? Have they met past milestones on time?

- Partnerships and Collaborations: Are there any reputable industry partners backing the project?

For example, a project with a well-defined roadmap and strategic partnerships with established companies is more likely to succeed than one with vague goals and an unproven team.

Assessing the Team and Advisors

A project’s team plays a crucial role in its long-term success. Investors should research the backgrounds of key team members, including:

- Founders and Developers: Do they have prior experience in blockchain or fintech?

- Advisors and Investors: Are there any notable figures or venture capital firms backing the project?

- Transparency: Does the team actively engage with the community and provide regular updates?

For instance, a project led by a team with previous successful blockchain ventures is more credible than one where team members have no track record.

Understanding Tokenomics and Supply Distribution

Tokenomics refers to the economic structure of a cryptocurrency. Understanding the distribution and supply dynamics of a token is essential before investing. Consider:

- Total Supply and Circulating Supply: A lower circulating supply with high demand can drive price appreciation.

- Initial Token Distribution: How many tokens are allocated to early investors, the development team, and the community?

- Vesting Schedules: Long-term vesting for team members prevents immediate sell-offs, ensuring stability.

For example, projects that allocate a large percentage of their tokens to the community instead of insiders tend to have healthier price performance.

Examining Community Engagement and Social Presence

A project’s community plays a vital role in its adoption and success. Investors should assess:

- Social Media Activity: Is the project active on Twitter, Telegram, and Discord?

- Developer Engagement: Are developers actively improving the project and addressing community concerns?

- Community Feedback: Is there genuine excitement, or does engagement appear artificial?

Projects with strong, organic community engagement tend to perform better than those with inflated social media numbers.

Analyzing Market Trends

Even if a project has strong fundamentals, its performance can be affected by overall market conditions. Understanding market trends allows investors to make more strategic investment decisions.

Understanding Market Cycles

Cryptocurrency markets operate in cycles, including:

- Bull Markets: Characterized by high demand, rising prices, and investor optimism.

- Bear Markets: Defined by price declines, low trading volumes, and reduced investor confidence.

- Consolidation Phases: Periods of sideways movement where the market accumulates momentum before a breakout.

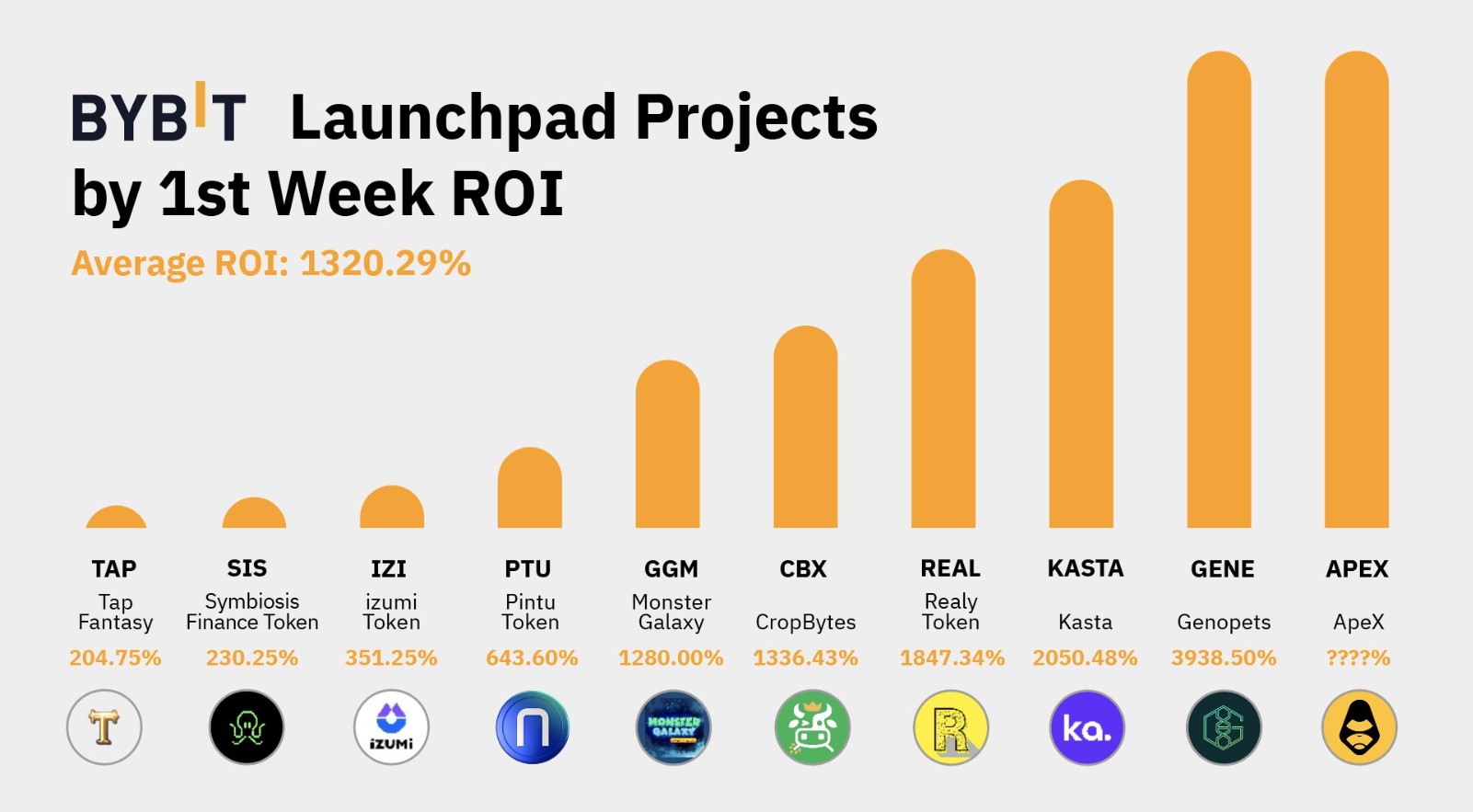

For example, during the 2021 bull market, token sales on Bybit Launchpad saw significant growth, with some tokens gaining over 600% post-launch. In contrast, during bear markets, new tokens often struggle to gain traction.

Tracking Bitcoin and Ethereum Movements

Since Bitcoin and Ethereum influence the overall crypto market, investors should monitor their price trends before participating in token sales. Key indicators include:

- Bitcoin Dominance: High Bitcoin dominance often means capital is concentrated in BTC, reducing demand for altcoins.

- Ethereum Gas Fees: High gas fees may indicate increased network activity, affecting token valuations.

- Whale Movements: Large transactions by whales can signal major market shifts.

For example, if Bitcoin is experiencing a strong rally, new token launches may see increased investor demand.

Analyzing Trading Volume and Liquidity

A token’s liquidity and trading volume impact its price stability. Investors should consider:

- Exchange Listings: Will the token be listed on Bybit or other major exchanges?

- Daily Trading Volume: Higher trading volume generally indicates strong market interest.

- Liquidity Pools: Sufficient liquidity prevents extreme price swings.

For instance, tokens with low liquidity often experience sharp price declines after an initial pump.

Examining Competitor Projects

Comparing a new project with existing competitors helps determine its potential success. Consider:

- Market Positioning: What makes this project different from others in the same space?

- User Adoption: Are there active users or partnerships that increase adoption?

- Technology and Innovation: Does the project offer a unique advantage over competitors?

By analyzing competing projects, investors can gauge whether a new token is overvalued or has growth potential.

Risk Management Tips

Investing in early-stage tokens through Bybit Launchpad presents lucrative opportunities, but it also comes with significant risks. The volatility of cryptocurrency markets, regulatory uncertainties, and unpredictable project developments can impact investment outcomes. Therefore, it is crucial to implement a solid risk management strategy to protect capital and maximize returns. Below are four essential risk management techniques tailored for Bybit Launchpad investors.

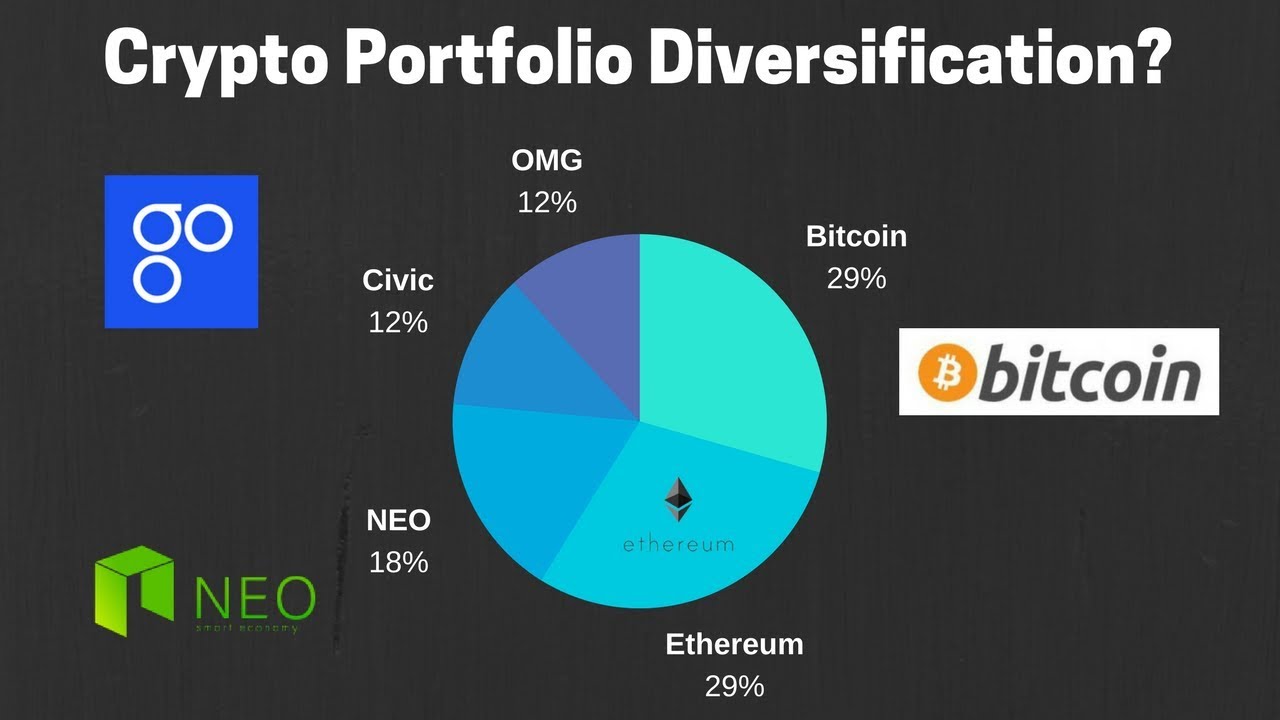

Diversification of Investments: Reducing Exposure to a Single Project

One of the most effective ways to manage risk in cryptocurrency investing is through diversification. Rather than putting all funds into a single token sale, investors should spread their capital across multiple projects. This strategy helps mitigate potential losses if one project underperforms or fails to meet expectations.

Ways to Diversify Investments on Bybit Launchpad

- Investing in Multiple Projects: Instead of committing all funds to one launch, consider participating in several token sales to spread risk.

- Balancing Between Established and New Tokens: Allocate a portion of your investment into well-known, stable cryptocurrencies while setting aside funds for high-potential, new launches.

- Diversifying Across Sectors: Investing in different blockchain sectors (e.g., DeFi, GameFi, metaverse, infrastructure) reduces the impact of downturns in a single category.

Example of a Diversified Investment Strategy

Imagine an investor has $5,000 allocated for Bybit Launchpad token sales. Instead of committing the full amount to one project, they could diversify as follows:

- $2,000 into a high-potential DeFi project with strong tokenomics.

- $1,500 into a blockchain gaming token with a large community.

- $1,500 into an infrastructure project that supports interoperability.

By diversifying, the investor reduces the risk of total capital loss while maintaining exposure to multiple growth opportunities.

Setting Profit Targets and Stop-Losses: Protecting Gains and Minimizing Losses

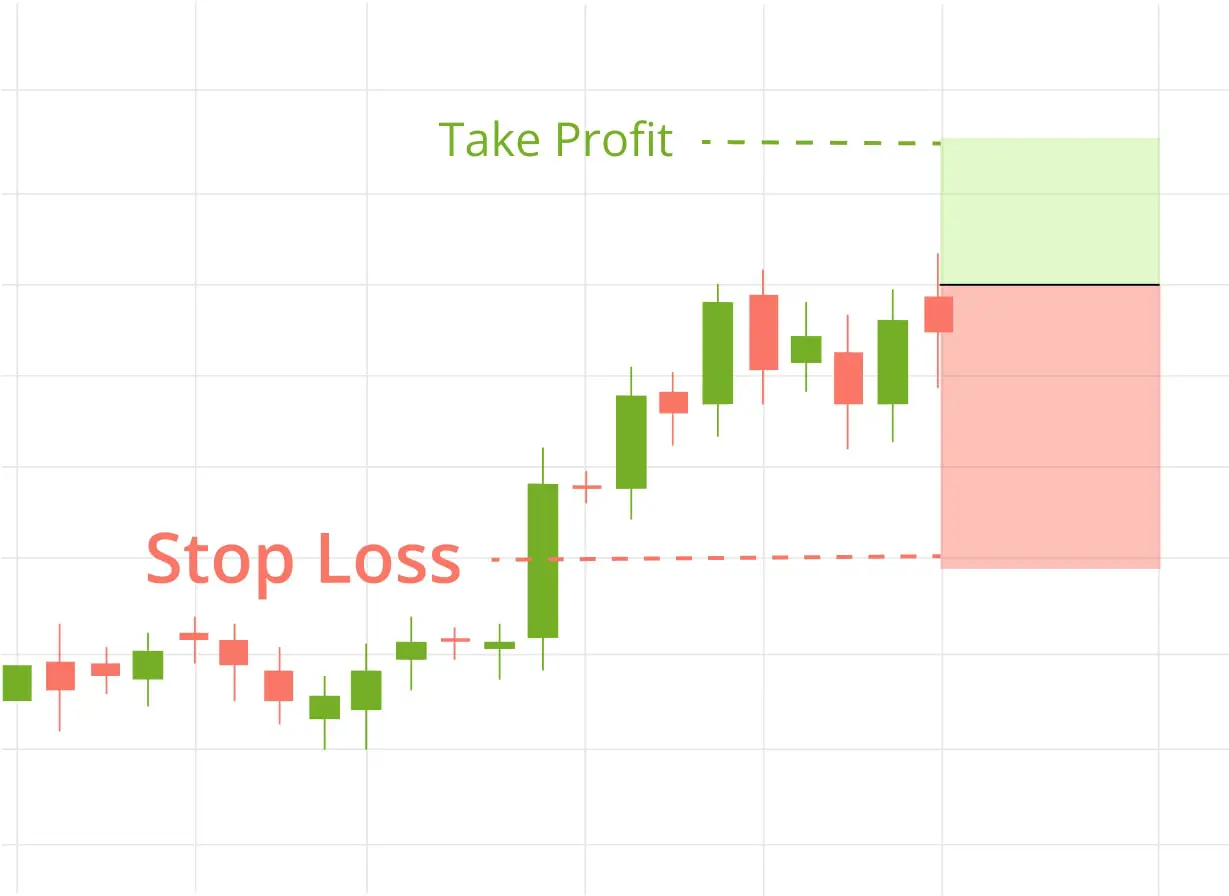

Cryptocurrency markets are highly volatile, and prices can experience drastic swings within short periods. To manage this volatility effectively, investors should set clear profit targets and stop-loss orders to protect their investments.

How to Set Profit Targets on Bybit Launchpad Investments

A profit target is a predetermined price at which an investor decides to take profits to secure gains. Here’s how to determine a suitable target:

- Set realistic goals: Aiming for a 2x to 5x return on launchpad tokens is common, but aggressive targets beyond that can be risky.

- Take incremental profits: Selling a percentage (e.g., 25–50%) of holdings at each profit milestone helps lock in gains while allowing room for further upside.

- Consider market conditions: If the crypto market is in a strong bull phase, holding for higher returns may be reasonable. In bearish conditions, taking profits earlier is safer.

The Importance of Stop-Loss Orders

A stop-loss order is an automatic sell order that activates when a token’s price drops to a predetermined level. This mechanism prevents excessive losses by exiting a position before further declines occur.

- Setting a stop-loss at 20–30% below the entry price helps limit downside risks.

- Trailing stop-losses adjust automatically as the token price rises, locking in profits.

- Avoid panic selling: Stop-losses should be based on solid technical analysis rather than emotions.

Example of Profit and Stop-Loss Strategy

An investor buys a token on Bybit Launchpad at $0.10 per token and sets:

- A profit target at $0.30 (3x gain) to sell 50% of holdings.

- A stop-loss at $0.07 (30% loss) to minimize downside risk.

- This approach ensures that the investor secures profits while protecting capital from severe losses.

Avoiding Hype and FOMO: Making Rational Investment Decisions

The cryptocurrency space is notorious for hype-driven investing, where projects gain excessive attention due to influencers, social media promotions, or aggressive marketing. Many investors fall into Fear of Missing Out (FOMO) and make impulsive decisions, leading to losses.

How to Avoid FOMO and Hype-Driven Investing

- Stick to a Defined Investment Strategy: Have a clear plan before participating in token sales and avoid deviating due to external hype.

- Ignore Projects With No Strong Fundamentals: If a project lacks a solid use case, experienced team, or realistic roadmap, it may be a short-term pump-and-dump scheme.

- Evaluate Market Valuation Before Buying Post-Launch: Some tokens experience an immediate price surge after launch but then decline. Buying at peak prices often results in losses.

Avoid Blindly Following Social Media Trends: Many influencers promote projects without disclosing financial incentives. Always verify information independently.

Example of a FOMO Trap

A token launches at $0.05 per token on Bybit Launchpad, but due to heavy marketing and hype, it skyrockets to $0.50 within a few hours. A FOMO-driven investor enters at the peak price, expecting further gains. However, the price crashed to $0.08 as early investors took profits, leading to a significant loss.

Instead of making impulsive trades, investors should analyze a project’s long-term potential and only invest when it aligns with their risk tolerance.

Staying Updated on Market Regulations: Avoiding Legal and Compliance Risks

Regulatory changes can have a significant impact on token sales and investor security. With governments worldwide tightening cryptocurrency regulations, investors must stay informed about legal frameworks affecting token launches on Bybit.

Key Regulatory Considerations for Bybit Launchpad Investors

- Verify If a Token Sale Complies With Local Laws: Some jurisdictions have restrictions on participating in Initial Exchange Offerings (IEOs) and token sales. Ensure compliance before investing.

- Check Bybit’s Terms and Conditions: Bybit imposes specific KYC (Know Your Customer) and geographical restrictions. Investors must complete verification to participate.

- Monitor Global Crypto Regulations: Governments in the U.S., EU, and Asia frequently update cryptocurrency policies. Regulatory shifts may impact token liquidity and exchange listings.

- Avoid Investing in Unlicensed or Unregulated Projects: If a project lacks regulatory compliance, it could face legal action, leading to asset freezes or token delistings.

Example of a Regulatory Risk Scenario

In 2023, several exchanges faced lawsuits for listing unregistered securities, resulting in delistings and liquidity issues for affected tokens. Investors who failed to assess the regulatory status of these tokens faced unexpected losses.

To mitigate such risks, investors should only participate in legally compliant token sales and avoid projects with ambiguous legal standing.

Maximizing Success on Bybit Launchpad

Bybit Launchpad provides excellent opportunities for investors to gain early access to promising crypto projects. However, successful investing requires a combination of thorough research, market analysis, and risk management.

Key Takeaways:

- Researching a project’s fundamentals, team, and tokenomics is essential.

- Market trends, Bitcoin price movements, and liquidity levels influence token performance.

- Diversification, stop-loss strategies, and avoiding FOMO can reduce investment risks.

- Staying updated on regulations ensures compliance and long-term security.

By applying these strategies, investors can increase their chances of making profitable and well-informed investment strategies on Bybit Launchpad in 2025.