Investing in cryptocurrencies can be highly rewarding, but it is essential to track and calculate your earnings accurately to maximize profits. Bybit Earn offers various earning products, such as Flexible Savings, Fixed Savings, and Staking, all of which generate interest over time. Understanding how earnings are calculated and learning the best tracking methods can help investors make informed financial decisions.

Bybit Earn provides a transparent earnings system where users can monitor their daily interest, compound their returns, and withdraw profits whenever needed. This article will explore the different ways earnings are calculated on Bybit Earn, the benefits of compounding interest, and how to effectively track your earnings to optimize your investment strategy.

How Earnings Are Calculated

Earnings on Bybit Earn are influenced by several key factors, including the type of earning product selected, the amount of funds deposited, the applicable Annual Percentage Yield (APY), and whether interest is compounded. Understanding these factors is crucial for investors who want to optimize their earnings and maximize returns over time.

Each Bybit Earn product follows a specific earnings calculation model, and the interest payout varies based on whether the funds are in a flexible or fixed-term product or staked for blockchain rewards. Below, we break down the earning calculations for different investment options on Bybit Earn.

Flexible Savings Earnings Calculation

Overview: Flexible Savings allows users to earn passive income on idle crypto assets without locking them up for a specific period. Interest is accrued daily and credited directly to the user’s account. This product is ideal for investors who want liquidity while still earning returns.

Calculation Formula:

Since interest is calculated daily, the formula used for Flexible Savings is:

Daily Earnings = (Deposited Amount × APY) / 365

Example Calculation:

Assume a user deposits 1,000 USDT into a Flexible Savings plan with an APY of 5%. The daily interest earned would be:

(1,000 × 5%) / 365 = 0.136 USDT per day

If the user maintains this balance for a full month (30 days), the total earnings would be:

0.136 × 30 = 4.08 USDT

Over a full year, without any additional deposits or withdrawals, the total earnings would be:

0.136 × 365 = 49.64 USDT

This calculation demonstrates how users can earn a passive income while keeping their funds accessible at all times.

Fixed Savings Earnings Calculation

Overview: Fixed Savings offers a higher APY than Flexible Savings but requires users to lock their funds for a specified duration (e.g., 30, 60, or 90 days). This option is suitable for users who can commit to a holding period in exchange for more attractive returns.

Calculation Formula:

Since funds are locked for a predetermined period, the total earnings can be calculated as:

Total Earnings = (Deposited Amount × APY × Lock-up Days) / 365

Example Calculation:

A user deposits 1,000 USDT into a 90-day Fixed Savings plan with an 8% APY. The total interest earned at the end of the term would be:

(1,000 × 8% × 90) / 365 = 19.73 USDT

At the end of the 90 days, the investor receives the initial 1,000 USDT plus the earned 19.73 USDT, bringing the total balance to 1,019.73 USDT.

Advantages of Fixed Savings:

- Higher APY compared to Flexible Savings.

- Guaranteed returns since the interest rate is locked in.

- No impact from market fluctuations—interest remains stable.

Considerations:

Funds cannot be withdrawn before the end of the lock-up period.

If APYs increase during the lock-up, users cannot benefit from the new rates.

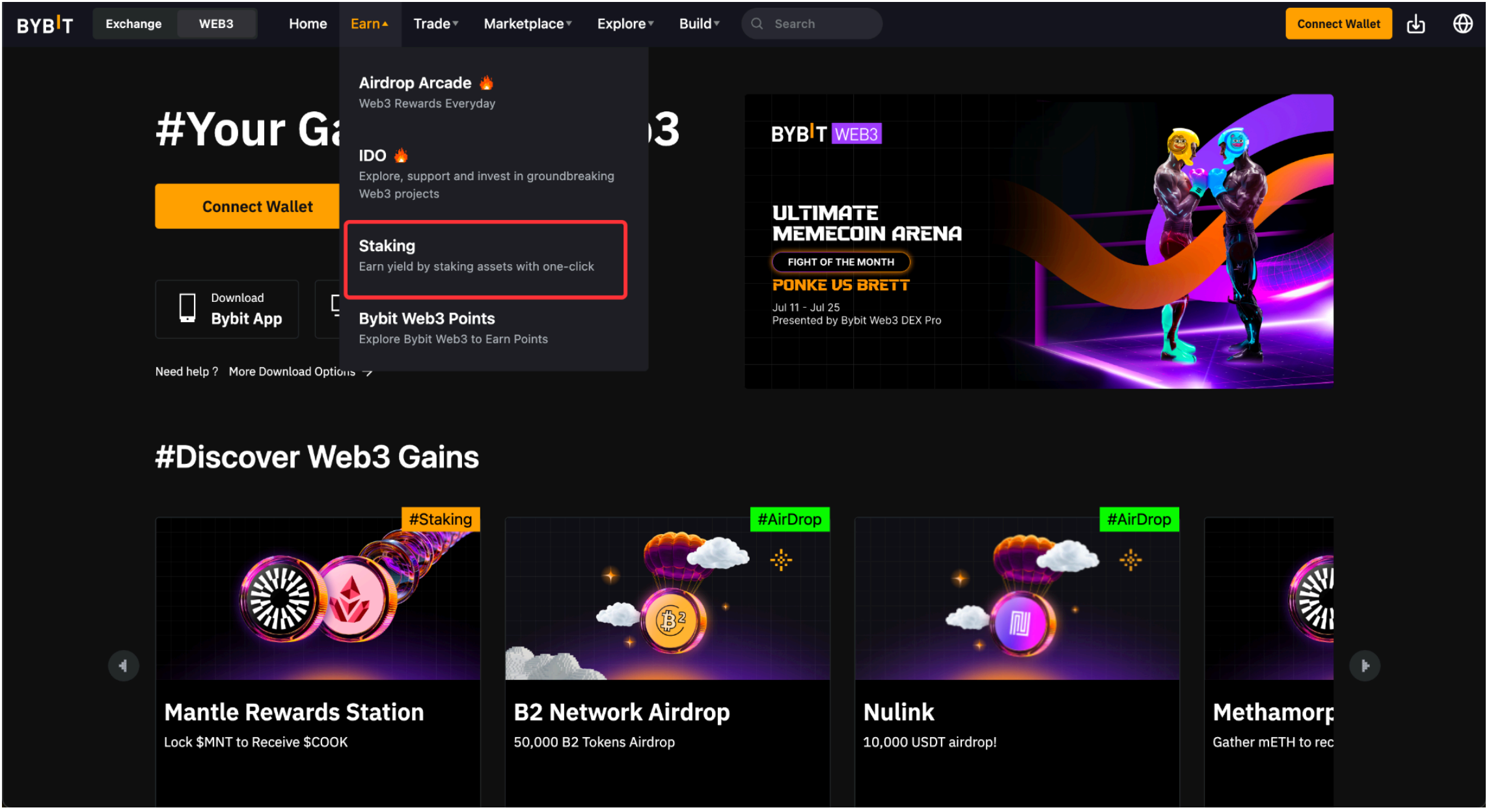

Staking Earnings Calculation

Overview: Staking allows users to earn rewards by locking up their tokens to support blockchain networks. Staking returns depend on network conditions, reward rates, and total staked amounts.

Calculation Formula:

The rewards from staking are determined by:

Staking Rewards = (Staked Amount × APY × Staking Period) / 365

Example Calculation:

A user stakes 10 ETH in a staking pool with an APY of 6% for 180 days. The total rewards earned would be:

(10 × 6% × 180) / 365 = 0.295 ETH

At the end of the staking period, the user receives their initial 10 ETH plus the 0.295 ETH in staking rewards, bringing the total balance to 10.295 ETH.

Factors Affecting Staking Rewards:

- Network conditions: If more people stake on the same network, individual rewards may decrease.

- Token price fluctuations: While rewards are earned in tokens, their value in USD can vary due to market changes.

- Lock-up periods: Some staking options allow unstaking at any time, while others may have fixed durations.

Additional Earnings Factors to Consider

Beyond the standard calculations above, users should be aware of several additional elements that can affect their earnings:

APY Fluctuations

- Flexible Savings APY may change based on the demand and supply of funds in the liquidity pool.

- Fixed Savings APY remains constant for the locked period.

- Staking APY depends on network participation and may increase or decrease over time.

Compounding Interest

- Some Bybit Earn products allow automatic compounding, which reinvests earned interest to generate even higher returns over time.

- Compounding maximizes earnings as the interest starts earning additional interest over multiple periods.

Withdrawal and Subscription Timing

- Flexible Savings interest is paid daily, so users benefit most by keeping funds deposited for longer.

- Fixed Savings and Staking may have early withdrawal penalties, reducing total earnings.

Compounding Interest

Compounding interest is one of the most effective financial strategies for maximizing passive income, especially in the world of crypto investments. Unlike simple interest, which only accrues on the initial principal, compound interest enables users to earn interest on both their principal and accumulated returns. This snowball effect leads to exponential growth in earnings over time, making it a crucial element of any long-term investment strategy.

Bybit Earn offers various earning products that support compounding interest, allowing users to automate their reinvestment process effortlessly. Whether through Flexible Savings, Fixed-Term investments, or staking pools, compounding enables users to optimize their returns without requiring constant manual intervention.

How Compounding Interest Works

At its core, compounding interest works by continuously reinvesting earnings, increasing the principal amount used to generate future interest. Over time, this results in increasingly larger returns as the compounding effect builds upon itself. The key formula for calculating compound interest is:

Future Value = Principal × (1 + APY / n) ^ (n × t)

Where:

- The principal is the initial investment amount.

- APY is the annual percentage yield.

- n is the number of compounding periods per year.

- t is the number of years invested.

Example of Compounded Earnings

To illustrate how compounding interest works in real-world scenarios, let’s compare a simple interest investment with a compounded investment:

- Suppose you deposit 1,000 USDT into a Bybit Flexible Savings product offering 6% APY.

- If interest is compounded daily, your balance will grow significantly over time compared to a non-compounding option.

1,000 × (1 + 6% / 365) ^ (365 × 1) = 1,061.83 USDT

Compared to simple interest, which would yield only 1,060 USDT, compounding generates an extra 1.83 USDT. The longer the funds remain reinvested, the greater the effect of compounding.

Benefits of Compounding Interest

- Higher Returns Over Time: Reinvested earnings continue to generate new interest.

- Maximized Growth Potential: The longer funds remain invested, the greater the rewards.

- Best for Long-Term Investors: Ideal for users who don’t need immediate liquidity.

Tracking Your Earnings

Monitoring earnings is essential for optimizing investment strategies. Bybit Earn provides multiple tools to track rewards in real time.

Dashboard Overview

The Bybit Earn dashboard displays key financial metrics, including:

- Total Equity (Earn): The total value of all funds in Bybit Earn products.

- Daily Yields: Displays daily earnings from Flexible Savings, Fixed Savings, and Staking.

- My Earnings: A historical record of past earnings and growth.

- Order History: Tracks deposits, withdrawals, and reinvestments.

Users can check their earnings summary directly on the dashboard, ensuring full transparency over their investments.

Using the Bybit Mobile App

For users on the go, the Bybit mobile app provides instant access to earnings data. Features include:

- Push Notifications: Alerts on earnings updates and new investment opportunities.

- One-Tap Withdrawal: Easily withdraw earnings directly from the app.

- Auto-Subscription: Automatically reinvests earnings into selected products for compounding benefits.

Exporting Transaction Reports

Investors who need detailed earnings analysis can export transaction reports from Bybit Earn. These reports include:

- APY Changes Over Time: Historical tracking of interest rate fluctuations.

- Detailed Profit Breakdown: A report on how much each investment product has generated.

- Tax Reporting Support: Useful for compliance with crypto taxation regulations.

Third-Party Portfolio Trackers

For investors who want to streamline their portfolio management, Bybit Earn integrates with various third-party tracking tools that provide real-time insights into earnings, asset allocation, and staking rewards. These tools help users monitor their investments efficiently without manually calculating returns.

- CoinStats – A comprehensive crypto portfolio tracker offering real-time data on APYs, staking rewards, and historical performance.

- Delta Investment Tracker – Syncs with Bybit and other exchanges, providing automated earnings tracking and performance analysis.

- CoinGecko Portfolio – Allows users to track staking rewards and investment performance across multiple platforms in one place.

By using these portfolio trackers, investors can gain a clear overview of their Bybit Earn returns and make informed financial decisions.

Conclusion

Understanding how earnings are calculated, utilizing compounding interest, and effectively tracking investments are crucial for optimizing profits on Bybit Earn. By leveraging Bybit’s user-friendly dashboard, mobile app features, and advanced tracking tools, investors can monitor their earnings in real-time and adjust their strategies accordingly.

To maximize returns, users should explore different earning products, consider compounding interest, and stay updated on APY fluctuations. Bybit Earn provides a transparent and efficient earnings calculation system, allowing users to take full control of their crypto investments.

For those new to Bybit Earn, starting with Flexible Savings is a great way to earn passive income while maintaining liquidity. More experienced investors can explore Fixed Savings or staking options for higher yields. Regardless of investment preference, proper tracking and calculation of earnings will ensure a more profitable and seamless experience on Bybit Earn.