Peer-to-peer (P2P) trading has become a cornerstone of the cryptocurrency ecosystem, offering users a direct and flexible way to buy and sell digital assets. HTX P2P, a standout feature of the HTX exchange, provides a secure and efficient platform for such transactions. Originally launched as part of Huobi Global in 2013 and rebranded to HTX in 2023, this Seychelles-based platform serves millions of users across more than 160 countries. This in-depth guide, exceeding 2500 words, explores the peer-to-peer trading experience on HTX, detailing its mechanics, benefits, and practical steps for engaging in HTX P2P trading.

What Is Peer-to-Peer Trading on HTX?

Peer-to-peer trading allows individuals to buy and sell cryptocurrencies directly with each other, eliminating the need for traditional intermediaries like centralized exchanges. HTX P2P facilitates this process by providing a marketplace where buyers and sellers can connect, negotiate terms, and execute trades securely. The 2023 rebranding from Huobi to HTX, with “H” representing Huobi, “T” for TRON, and “X” for exchange, reflects its commitment to innovation and global expansion.

The platform supports major cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and USDT, alongside over 30 fiat currencies, including USD, EUR, and INR. By integrating robust security features like cold wallet storage, two-factor authentication (2FA), and an escrow system, HTX P2P ensures a safe environment for users to trade. This section will dive into the mechanics of peer-to-peer trading on HTX and how HTX P2P trading operates within this framework.

How Peer-to-Peer Trading Works on HTX

The peer-to-peer trading system on HTX functions as a marketplace where users can directly exchange assets, supported by an escrow mechanism to ensure trust and security. Unlike centralized exchanges, this method allows users to set their prices and choose their preferred payment methods, offering greater flexibility.

Transaction Process

When a trade is initiated, the cryptocurrency being sold is held in escrow by the platform until the buyer’s payment is confirmed by the seller. This escrow system minimizes the risk of fraud, ensuring that both parties fulfill their obligations. Once the seller verifies the payment, the platform releases the crypto to the buyer, completing the transaction. This process ensures that peer-to-peer trading on HTX remains secure and reliable.

Supported Assets and Payment Methods

The platform supports a variety of digital assets, including USDT, BTC, ETH, and the native HTX token, paired with fiat currencies like USD, EUR, and VND. Payment methods range from bank transfers to digital wallets, accommodating diverse user preferences and making the process accessible globally.

Security Measures

Security is a top priority for peer-to-peer trading on HTX. The majority of funds are stored in offline cold wallets, reducing the risk of hacks. Mandatory 2FA and regular audits further enhance the safety of transactions, providing users with confidence in their trading activities.

Getting Started with HTX P2P

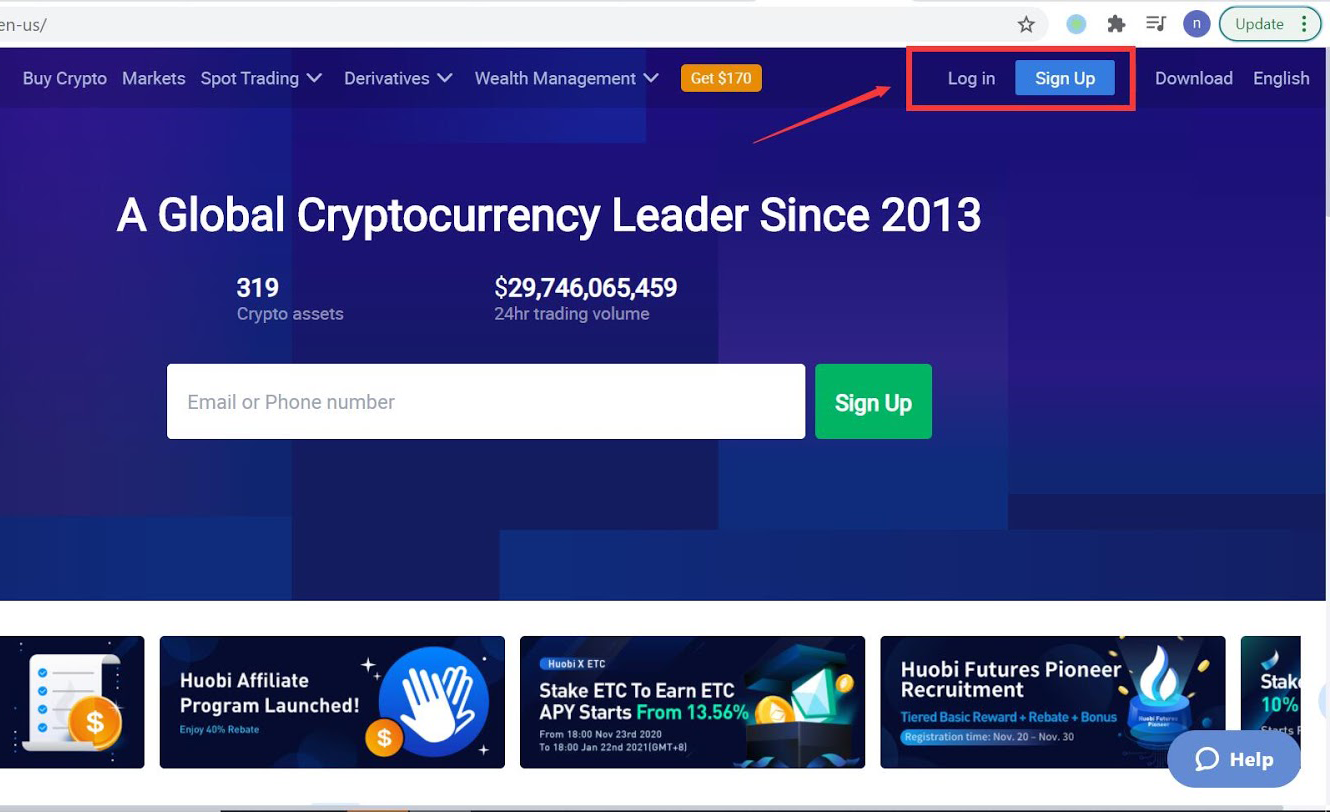

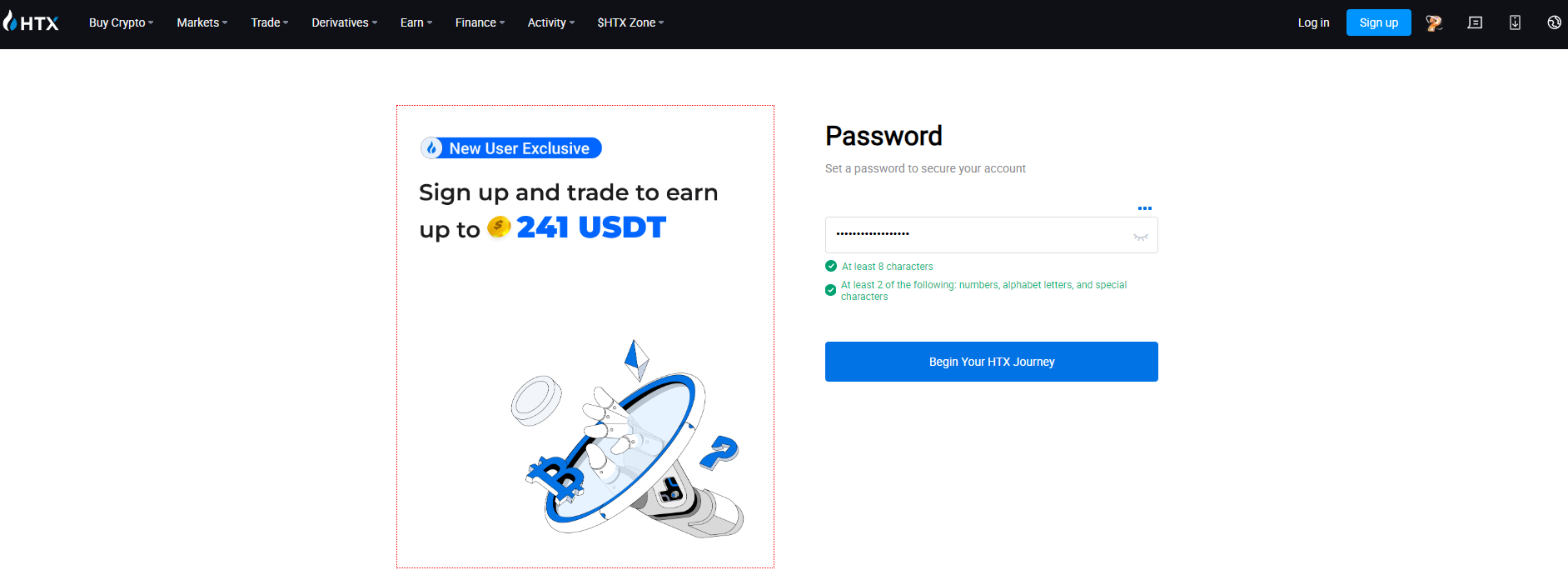

To begin trading on this platform, users need to set up an account and complete the necessary steps. Here’s a detailed guide as of March 11, 2025:

Account Setup

- Registration: Visit htx.com and click “Register.” Provide your email or phone number and create a secure password.

- Verification: Confirm your account by clicking the verification link sent via email.

- Identity Verification: Complete KYC by submitting a government-issued ID (e.g., passport) under the “Identification” section to unlock full trading capabilities.

Preparing for Trading

- Deposit Funds: While trades typically involve direct fiat-to-crypto exchanges, you can deposit crypto (e.g., USDT) or fiat (e.g., USD via bank transfer) to your wallet for added flexibility. Most crypto deposits are free of charge.

- Access the Marketplace: Navigate to the “Trade” tab, select “Fiat,” and then “P2P” to enter the trading area.

Initial Tips

- Start with small transactions to get comfortable with the process.

- Ensure your payment methods are verified and ready for use.

- Review merchant profiles to select reliable trading partners based on their history and ratings.

Step-by-Step Guide to HTX P2P Trading

HTX P2P trading offers a clear process for both buying and selling cryptocurrencies. Below is a detailed guide to executing trades on the platform:

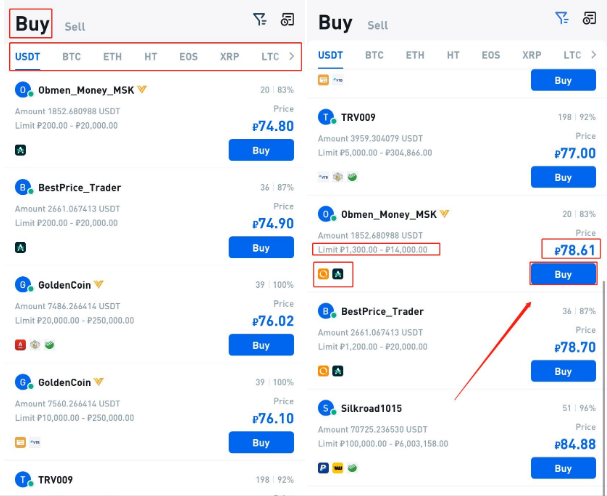

Buying Crypto via HTX P2P

- Access the P2P Market: From the HTX interface, select “Buy Crypto” and choose your preferred fiat currency (e.g., USD).

- Review Offers: Browse available listings, filtering by price and payment method to find a suitable match.

- Initiate a Trade: Enter the desired amount within 45 seconds and confirm the order, placing the crypto in escrow.

- Complete Payment: Transfer funds using the seller’s specified method (e.g., bank transfer) and upload proof if required.

- Receive Assets: Once the seller verifies payment, the platform releases the crypto to your wallet.

- Confirm Receipt: Check your wallet under “Assets” to ensure the transaction is complete.

Selling Crypto via HTX P2P

- Create a Listing: Go to “Sell Crypto,” select your currency (e.g., USDT), choose a payment method, and set your price.

- Await a Buyer: A buyer will accept your offer to initiate the trade.

- Verify Payment: Confirm the buyer’s fund transfer to ensure payment has been received.

- Release Funds: Approve the release of the crypto from escrow to finalize the transaction.

- Check History: Review your transaction records to confirm the sale.

Resolving Common Issues

- Delayed Confirmation: If the seller doesn’t release funds promptly, contact platform support with payment evidence.

- Disputes: Submit transaction screenshots to resolve any conflicts with assistance from the support team.

- Payment Mistakes: Double-check payment details before sending to prevent errors.

Benefits of Peer-to-Peer Trading on HTX

This trading method offers several advantages that enhance the user experience:

- No Transaction Fees: Unlike many centralized exchanges, there are no fees for trades, reducing costs for participants.

- Variety of Payment Options: Supports over 30 fiat currencies and methods like bank transfers and digital wallets, increasing accessibility.

- Global Participation: Caters to users across different regions with its wide currency support.

- Secure Transactions: The escrow system ensures funds are safe until the trade is verified.

- Personalized Control: Users can negotiate prices and terms directly, offering a tailored trading experience.

These features make the platform a strong choice for those seeking direct crypto exchanges.

Risks and Mitigation Strategies

While the platform provides a secure environment, certain risks should be considered:

Potential Risks

- Fraud Attempts: Some sellers may attempt to deceive buyers with fake payment confirmations.

- Payment Delays: Slow fund transfers can lead to transaction issues or cancellations.

- Price Fluctuations: Crypto prices may change during the trade process, affecting its value.

- Regulatory Shifts: Changes in local laws could impact available payment methods or trading options.

Mitigation Strategies

- Select Reputable Sellers: Choose merchants with high ratings and a solid track record to minimize fraud risks.

- Timely Transfers: Complete payments promptly to avoid delays or cancellations.

- Monitor Market Trends: Stay updated on price movements to ensure fair trades.

- Follow Updates: Check platform announcements for any regulatory changes that might affect trading.

- Strengthen Security: Enable 2FA and verify payment details to protect your transactions.

These steps help ensure a safer and more efficient trading experience.

Comparing HTX P2P with Other Platforms

To assess the platform’s position, let’s compare it with Binance P2P, OKX P2P, and Paxful based on available insights:

| Platform | Fees | Payment Methods | Assets Supported | Security Features |

|---|---|---|---|---|

| HTX P2P | 0% | 30+ fiat, wallets | USDT, BTC, ETH | Escrow, 2FA |

| Binance P2P | 0% | 700+ options | BTC, ETH, BNB | Escrow |

| OKX P2P | 0% | Multiple regional | BTC, ETH, USDC | Escrow, 2FA |

| Paxful | 0.5%-5% | 350+ methods | BTC | Escrow |

- HTX P2P vs. Binance P2P: Binance offers more payment methods, but HTX matches its zero-fee model, providing a competitive alternative for peer-to-peer trading.

- HTX P2P vs. OKX P2P: Both platforms offer zero fees, but HTX supports a wider variety of fiat currencies, enhancing its global reach.

- HTX P2P vs. Paxful: HTX’s lack of fees and broader asset support give it an edge over Paxful’s fee-based structure.

Advanced Tips for HTX P2P Trading

For users looking to optimize their experience, consider these strategies:

- Market Arbitrage: Take advantage of price differences between HTX P2P and other platforms to maximize returns.

- Negotiate Terms: Work with merchants to secure better rates based on current market conditions.

- Automate Processes: Utilize the platform’s API to streamline trading activities.

- Diversify Payments: Set up multiple payment methods to broaden your trading options.

- Maintain Records: Keep detailed logs of transactions for tax and compliance purposes.

The Future of Peer-to-Peer Trading on HTX

As of March 11, 2025, HTX P2P is poised for further growth with its integration of TRON technology and potential new features like Telegram-based trading apps. These advancements could enhance user accessibility, attracting more participants to the platform’s peer-to-peer trading offerings. Its focus on security and zero-fee transactions positions it as a key player in the evolving crypto market.

Conclusion

Peer-to-peer trading on HTX offers a secure, cost-effective, and flexible way to exchange cryptocurrencies with no fees and a variety of payment options. The escrow system and strong security features ensure a trustworthy environment, making it suitable for users worldwide, whether they’re new to crypto or experienced traders. HTX P2P trading provides the tools to engage in direct transactions with confidence and ease.