Barry Silbert, the founder of Digital Currency Group, recently made bold comments about the current state of the cryptocurrency market. In a podcast interview, he claimed that 99.99% of crypto tokens are worthless.

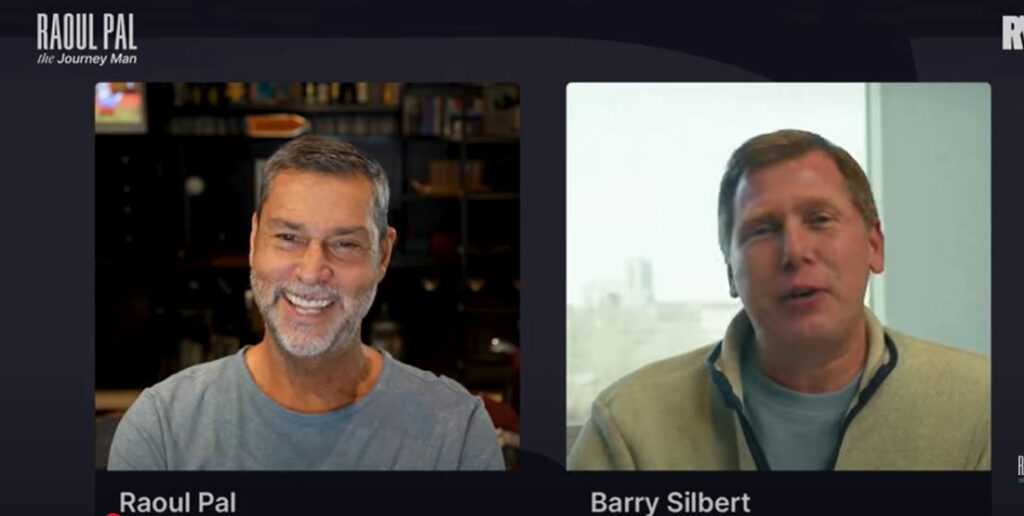

Silbert, often called a “crypto king,” shared his views during an episode of The Journeyman podcast, hosted by financial analyst Raoul Pal. The conversation took place in April 2025 and has quickly sparked debate across the crypto community.

Only a Tiny Fraction of Tokens Matter

Silbert didn’t hold back during the interview. He reflected on his 13-year journey in crypto and how his perspective has evolved.

“Over the last…13 years since I first bought Bitcoin…I’ve always been intellectually curious about everything else that’s coming out of our space,” he said.

“I think, for the most part, 99.9% of crypto tokens that are out there have no reason to exist and are worthless.”

This comment highlights his skepticism toward most of the 20,000+ tokens that now flood the market. His standards for investing in a new token, he said, are “really, really high.”

Early Bitcoin Investor Since 2011

Silbert revealed that he first entered the crypto world back in 2011. At the time, Bitcoin was trading at just $7. Like many early adopters, he experienced the rollercoaster of emotions tied to price swings.

“I thought I was a genius for buying it…Then I thought it was a waste of money when the price crashed.”

But instead of giving up, Silbert shifted his focus. He began investing in companies building infrastructure around Bitcoin. This move helped him grow Digital Currency Group into one of the most powerful firms in crypto.

Interestingly, he admitted that simply holding onto his original Bitcoin stash might have yielded better returns than backing startups:

“Had I just held on to the Bitcoin, I actually would have done better than making those investments.”

Still Bullish on Privacy Coins

While Silbert believes most crypto tokens are junk, he hasn’t given up on all of them. One category he still supports is privacy coins, such as Zcash.

He explained that financial privacy is a growing concern among users worldwide.

“People are going to realize financial privacy is important to them…there’s a version of Bitcoin that’s private.”

This shows that despite his critical view of the broader crypto landscape, he sees a future for privacy-focused cryptocurrencies, especially in a world with increasing surveillance and regulation.

Why His Words Matter

Barry Silbert isn’t just any investor. He’s the founder of Digital Currency Group (DCG), one of the biggest companies in the crypto world. This firm owns and invests in many important businesses.

One of them is Grayscale Investments, which manages the largest crypto asset fund in the world. Another is Foundry, a company that plays a big role in Bitcoin mining. DCG also owns Luno, a well-known crypto exchange used by many people. Besides these, the company supports several other blockchain startups.

Because of his position and experience, Barry Silbert’s opinions carry a lot of weight. When he speaks, people in the crypto industry pay attention.

A Familiar Critique with a New Twist

Silbert’s statement that 99.99% of tokens are worthless echoes what other experts have said before. Many have compared today’s crypto world to the dot-com boom of the late 1990s, where only a handful of companies survived.

But the .01% that Silbert still believes in could represent the next wave of valuable digital assets. His message is clear: be cautious, do your research, and don’t fall for hype.

He is not alone in this thinking. Many experienced investors have warned that the market is flooded with useless tokens launched with little purpose, other than making a quick profit.

Lessons from a Crypto Veteran

Silbert’s journey offers valuable lessons for new investors:

- Timing matters: Buying Bitcoin at $7 changed his life, but holding it would’ve done even more.

- Infrastructure is key: He focused on building the ecosystem, not just chasing token prices.

- Skepticism is healthy: He doesn’t follow trends blindly. He looks for real-world value.

What Comes Next?

The crypto market is still evolving. As regulations tighten and users become more educated, there may be a cleanup of low-value projects. Silbert believes the industry is maturing, and the real winners will be the ones solving real problems.

He’s optimistic about Bitcoin and certain types of crypto tokens that offer real utility, especially those focused on privacy, scalability, and financial innovation.

With voices like his guiding the conversation, the next phase of crypto may see fewer tokens, but stronger, more useful ones.

Barry Silbert’s claim that 99.99% of crypto tokens are worthless may sound extreme, but it’s grounded in experience. After over a decade in the space, he’s seen trends come and go. While many projects may fail, a few strong ones could shape the future of finance.

As investors and developers look ahead, Silbert’s message serves as a reminder to focus on quality over quantity and to always question what gives a token real value.