Crypto exchanges play a central role in the digital asset economy, enabling users to buy, sell, and trade cryptocurrencies 24/7. But behind their sleek mobile apps and trading dashboards lies a complex, highly profitable business model. From trading fees to token launches and interest-bearing accounts, crypto exchanges generate billions in annual revenue.

In this article, we break down how crypto exchanges make money, what services they monetize, and how users unknowingly contribute to their profitability.

1. Trading Fees – The Core Revenue Stream

Most crypto exchanges charge trading fees on every transaction. These fees typically follow a maker-taker model:

-

Maker fees apply when you place a limit order that adds liquidity to the order book.

-

Taker fees apply when you place a market order that matches existing liquidity.

Typical Rates:

-

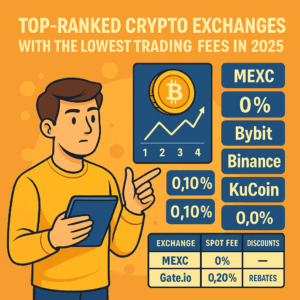

Binance: 0.10% standard fee (discounts with BNB)

-

Coinbase: 0.50% for retail users

-

Kraken: 0.16% (maker), 0.26% (taker)

-

Bybit/MEXC: 0% spot fees, low futures fees

Even a 0.1% fee on billions in daily volume results in significant revenue.

2. Withdra wal and Deposit Fees

Many crypto exchanges impose fees when you transfer assets out of their platform. While crypto deposits are typically free, withdrawals can be:

-

Fixed fees: e.g., 0.0005 BTC per withdrawal

-

Dynamic fees: Based on blockchain congestion

For fiat transactions, exchanges may also charge for:

-

Bank transfers

-

Credit card deposits

-

Currency conversions

These hidden costs can quietly contribute millions in revenue.

3. Spread and Slippage

Some exchanges, especially beginner-friendly platforms like Coinbase, earn money from spreads—the difference between buy and sell prices offered to users.

-

Example: You buy Bitcoin at $30,200 and can only sell it at $29,800

-

That $400 difference (spread) is partially pocketed by the exchange

Unlike transparent trading fees, spreads are built into the price and less noticeable.

4. Staking and Earn Products

Crypto exchanges often offer staking, savings, and lending products under labels like “Earn.” While users receive yield (e.g., 5% APY), the exchange may earn a higher percentage from the underlying protocol.

-

Example: The protocol yields 7%

-

Exchange keeps 2%, pays 5% to the user

Staking-as-a-service has become a major source of passive but predictable income for top crypto exchanges.

5. Token Listings and Launchpads

Emerging crypto projects pay significant fees to be listed on major exchanges. In return, they receive:

-

Immediate liquidity

-

Access to millions of potential investors

-

Launchpad promotions (e.g., Binance Launchpad)

Crypto exchanges may charge listing fees ranging from $50,000 to over $1 million depending on the platform’s size and market exposure.

Additionally, exchanges often hold or receive native tokens of listed projects—gaining value as the tokens increase in price.

6. Margin and Derivatives Trading

Advanced crypto exchanges like Bybit, OKX, and Binance offer:

-

Margin trading: Borrowing funds to increase position size

-

Futures contracts: Betting on price movement

These services come with:

-

Interest rates on borrowed funds

-

Funding fees and liquidation penalties

Because leverage multiplies volume, it also multiplies the fees—making derivatives one of the most profitable segments for crypto exchanges.

7. Market Making and Internal Liquidity

Some exchanges act as their own market makers, especially in illiquid pairs. By doing this, they:

-

Earn from spreads and arbitrage

-

Maintain control over price movements

-

Create internal order flow to increase engagement

This in-house strategy gives crypto exchanges more control over fees, user behavior, and volume distribution.

8. Institutional Services and API Access

Leading crypto exchanges monetize B2B services, including:

-

White-label exchange solutions

-

API-based trading infrastructure

-

Custody services for funds and institutions

They also offer tiered VIP trading plans, where high-volume users pay lower fees but contribute millions in aggregate volume.

9. Native Tokens and Ecosystem Integration

Many crypto exchanges issue their own tokens (e.g., BNB for Binance, KCS for KuCoin). These tokens often:

-

Offer trading fee discounts

-

Provide access to exclusive products

-

Are burned over time to reduce supply

As demand grows, so does the value of the token—and the crypto exchange’s influence over its ecosystem.

Conclusion

Crypto exchanges make money through a diverse set of monetization channels—some transparent, others subtle. Trading fees remain the foundation, but smart platforms now earn through token economics, financial products, institutional services, and ecosystem control.

As a user, understanding how crypto exchanges make money helps you become more informed, strategic, and cost-efficient in your trading. Whether you’re using a beginner-friendly app or managing multi-million-dollar portfolios, you’re contributing to the revenue engine behind one of the fastest-growing industries in the world.