In a landmark move that could reshape the future of Ripple’s native cryptocurrency, the Chicago Mercantile Exchange (CME) is set to launch XRP futures contracts on Monday, May 20, 2025. This event marks a significant leap for XRP, pushing it into the realm of regulated crypto derivatives, an area long dominated by Bitcoin and Ethereum.

While XRP has spent much of 2025 in the shadow of ongoing legal uncertainty, this latest development signals a potential turning point. The introduction of futures on a regulated exchange not only adds credibility but also opens the door to greater institutional involvement. With XRP prices hovering near a critical $2.35 level and anticipation building around the legal front, CME’s decision may be the spark needed for a bullish breakout.

What the CME XRP Futures Launch Means

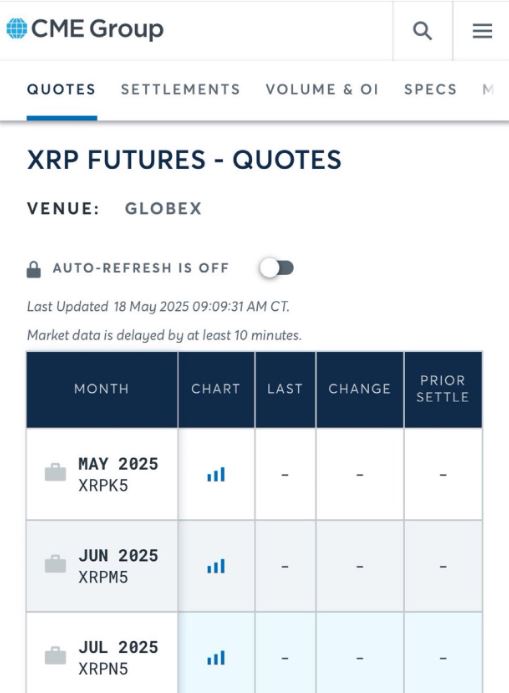

Starting Monday, traders on the CME Globex electronic trading platform will have access to two new XRP futures contracts. One standard contract will represent 50,000 XRP, while a smaller micro contract will be sized at 2,500 XRP. Both contracts will be cash-settled, based on the CME CF XRP-Dollar Reference Rate.

Clearing will take place via CME ClearPort, ensuring risk management and operational transparency. These features aim to attract a broad range of participants—from institutional players to sophisticated retail traders—eager to gain regulated exposure to XRP without dealing directly in spot markets.

This move comes as part of CME’s broader strategy to diversify its crypto offerings. Following recent futures introductions for altcoins like Solana, the addition of XRP is further proof that institutional interest in non-Bitcoin digital assets is on the rise.

Ripple’s Legal Rollercoaster Continues

The timing of this launch is particularly notable. Just last week, Judge Analisa Torres delivered a blow to Ripple in its long-standing case with the U.S. Securities and Exchange Commission (SEC). Her refusal to vacate the ban on institutional XRP sales—and her denial of Ripple’s request to reduce a $125 million penalty—cast fresh doubt on the possibility of an XRP exchange-traded fund (ETF) in the near future.

The ruling triggered a sharp price reaction. XRP briefly touched $2.65 before retreating to $2.29. Since then, the price has stabilized around $2.35. However, legal experts suggest the story is far from over. John Deaton, a prominent crypto lawyer, believes the SEC might soon be forced to admit that XRP is not a security. If that happens, it could clear the path for future ETF approval and possibly trigger a significant market rally.

Eleanor Terrett, host of Crypto America, offered her take on the situation, saying:

“Judge Torres is making Ripple and the SEC work for a resolution. The court isn’t going to let either party walk away easily. But she has left the door open—if they can meet certain legal standards, there may still be room for settlement or even ETF approval down the road.”

Behind the Scenes: Ripple’s Global Impact

Despite the courtroom chaos, Ripple is staying active on the ground. The company recently launched its second major pilot project of the year, this time focused on Colombia’s agricultural sector.

Partnering with Mercy Corps and traceability platform WËIA, Ripple is using the XRP Ledger to deliver transparency and financial access to rural farmers. Through blockchain-based data sharing and microfinance solutions, the initiative aims to strengthen Colombia’s supply chains and improve livelihoods in underserved communities.

Though this development hasn’t attracted the same headlines as Coinbase relistings or ETF rumors, it underscores an important point: XRP continues to build utility beyond speculation.

Whale Activity Suggests Institutional Positioning

In parallel with regulatory developments, blockchain watchers have observed significant whale movement in XRP. Over $350 million in tokens have been shifted recently, with large transfers between Ripple wallets and centralized exchanges like Crypto.com.

While the intent behind these transfers remains unclear, previous over-the-counter (OTC) activity between Ripple and institutions offers a clue. This may be a sign that some players are positioning themselves ahead of what could be a pivotal legal or market shift.

Adding to the optimism, Polymarket currently shows 83% odds that an XRP-spot ETF will be approved by December 2025. With the SEC under increasing political and legal pressure, such a development could serve as a powerful bullish trigger.

CME Futures as a Market Catalyst

The introduction of XRP futures by CME adds a layer of legitimacy and flexibility to XRP trading. It provides hedging tools for institutions, enhances liquidity, and creates more reliable price discovery.

This move could also ease the path for future ETF products. Regulators often look for strong, regulated derivatives markets before greenlighting ETFs, and CME’s new contracts check that box.

Moreover, the availability of micro contracts makes it easier for retail traders to participate, without requiring exposure to massive amounts of capital. This democratization of access could bring in a fresh wave of interest in XRP.

Compared to Bitcoin: The Rise of BTCBULL

While XRP battles in court and on charts, Bitcoin continues to dominate headlines—now trading above $103,000, with some analysts targeting $116K in the near term. In that backdrop, BTCBULL, a token tied to Bitcoin’s rise, is gaining traction.

BTCBULL rewards holders every time Bitcoin reaches new milestones. Each $50,000 jump from $125K triggers supply burns and airdrops, creating a compounding reward structure for long-term believers. As of now, BTCBULL is still available for presale at $0.00251, with just days left before it lists publicly.

For investors wary of legal fog or ETF speculation, BTCBULL presents an alternative path to passive gains—one that doesn’t rely on regulatory decisions.

Conclusion: Will CME Futures Spark an XRP Breakout?

The launch of XRP futures on CME could be the most important development for Ripple’s token since the initial SEC lawsuit. It signals that, despite regulatory setbacks, institutions still see value in XRP—and are ready to back it with real money.

Whether this marks the start of a sustained rally or just a temporary boost remains to be seen. But one thing is clear: XRP’s story is far from over. With key legal developments, global adoption, and institutional products all evolving in real time, the next few months may decide the token’s long-term fate.

For investors, the choice is between waiting for a favorable court decision or recognizing that the market may already be pricing in a comeback.