Ethereum (ETH) is back in the spotlight after forming a bullish technical signal that has historically led to major price surges. Known as the “Golden Cross,” this pattern occurs when the 50-day moving average moves above the 200-day moving average. Traders consider it a strong bullish indicator, often associated with the start of extended upward trends.

The big question now: will history repeat itself?

Ethereum Prints a Fresh Golden Cross

On May 20, 2025, Ethereum officially formed a new Golden Cross, as highlighted by crypto analyst @MerlijnTrader on X (formerly Twitter). This is the first time the signal has appeared since November 2024, and back then, it marked the beginning of a powerful bull run.

This recent crossover comes after ETH spent months struggling below key levels following a bearish “death cross” earlier this year. But now, with the 50-day moving average back above the 200-day, technical traders are beginning to turn bullish once again.

At the time of writing, Ethereum is trading above $2,500 and approaching the psychologically important $3,000 level.

What Happened the Last Time ETH Flashed This Signal?

In early November 2024, Ethereum formed a similar Golden Cross while trading around $1,800. What followed was a sharp, sustained rally. By late December, ETH had surged to nearly $3,400 — a gain of approximately 89% in under two months.

That rally wasn’t fueled by technical indicators alone. The crypto market was buzzing with speculation around the potential approval of spot Bitcoin ETFs in the U.S., a development that brought institutional interest flooding back into the space. Ethereum, as the second-largest cryptocurrency by market cap, benefited directly from this wave of optimism.

Staking activity also picked up, with more ETH being locked into smart contracts, reducing liquid supply on exchanges and reinforcing upward price pressure.

This Time Feels Different — Or Does It?

So, are we on track for another parabolic move?

While no two rallies are exactly alike, there are a few key similarities between today’s setup and the one from late 2024:

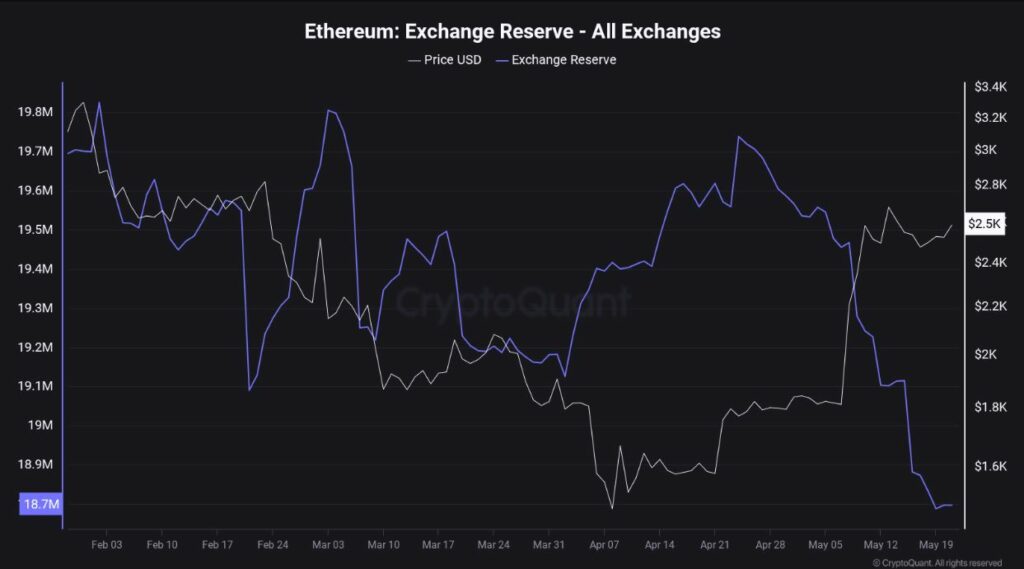

- Exchange Reserves Are Falling: According to data from CryptoQuant, Ethereum exchange balances have dropped to 18.7 million ETH — the lowest level in over a year. This indicates that holders are moving ETH off exchanges, likely into long-term storage or staking. Lower supply on exchanges often reduces selling pressure and supports price growth.

- Funding Rates Remain Neutral: Unlike previous bull traps driven by overly aggressive long speculation, current funding rates are only slightly negative. This suggests that the market is not overcrowded with overleveraged long positions, making the rally more sustainable.

- Technical Momentum Is Building: The Golden Cross has reignited interest from technical traders. Combined with ETH’s stable performance above $2,500, this has added fuel to growing bullish sentiment.

What Could Push Ethereum Even Higher?

If Ethereum is to repeat or exceed its previous 90% gain, it will need more than just technical strength. Here are a few potential catalysts that could drive the next wave:

- Ethereum ETF Hype: After the approval of spot Bitcoin ETFs, attention has shifted to Ethereum. A potential spot ETH ETF approval in the U.S. could trigger the same kind of buying frenzy we saw with Bitcoin.

- Continued Staking Growth: Staking has become one of the most attractive use cases for ETH holders, offering passive rewards and reducing circulating supply. As more ETH gets locked up, the market could tighten further.

- DeFi and Layer 2 Expansion: Ethereum continues to lead in decentralized finance and Layer 2 innovation. As these ecosystems grow, demand for ETH as gas and collateral will likely increase.

Risks and Cautions to Consider

While the setup is promising, investors should still be cautious. Golden Crosses are historically reliable but not foolproof. A few potential risks include:

- Macro Conditions: High interest rates or tighter regulatory policies in the U.S. could dampen the appetite for risk assets like crypto.

- Overreliance on Technical Indicators: Technical patterns can fail, especially if they’re not backed by strong market fundamentals or real demand.

- Delayed ETF Approvals or Legal Challenges: Regulatory setbacks, particularly around Ethereum’s classification as a security, could derail bullish momentum.

Ethereum’s recent Golden Cross is a signal worth paying attention to. The last time this pattern appeared, ETH nearly doubled in value within two months. While nothing is guaranteed in the crypto market, a combination of declining exchange reserves, healthy market sentiment, and increasing institutional interest makes this signal hard to ignore.

With ETH holding firm above $2,500 and a potential breakout toward $3,000 looming, all eyes are now on whether this golden signal will once again lead Ethereum to new heights.

If history repeats itself, Ethereum investors could be in for an exciting summer.