Argentina is quickly emerging as a key player in the global crypto market. With deepening inflation and ongoing capital controls, digital assets have become a safe haven for both individuals and institutions. Now, in 2025, a potential regulatory breakthrough could accelerate Argentina’s transition into a full-fledged crypto hub.

From Scandal to Strategy: The $LIBRA Incident

In early 2025, a crypto scandal involving Argentine President Javier Milei briefly shook investor confidence. Milei promoted a new cryptocurrency called $LIBRA via his personal X (formerly Twitter) account, describing it as a private initiative to support small Argentine businesses. The post triggered a surge in investment and drove prices up within minutes.

But the hype was short-lived.

Just hours later, $LIBRA crashed, wiping out investor gains and raising concerns about transparency and regulation. Though Milei deleted his original post, the damage had been done. The event sparked debates about potential pyramid schemes and drew international scrutiny.

Still, the broader crypto community in Argentina views $LIBRA as an isolated case. The local ecosystem remains resilient and continues to develop institutional-grade infrastructure.

A Vault for the Future: Cold Storage in Buenos Aires

One of the most significant recent developments is the launch of a crypto cold storage bunker by Prosegur Crypto, the digital asset custody arm of Prosegur Cash. This is only the second such facility in Latin America, following Brazil’s launch in 2023.

Unlike the stereotypical underground bunker, this facility is sleek, modern, and heavily fortified, physically and digitally. At its core is a tamper-proof, air-gapped PC developed with cybersecurity firm GK8. It stores the private keys of digital assets offline, ensuring complete protection from cyberattacks.

“The bunker represents a reverse innovation,” said Hernán Ball, Prosegur Cash’s Regional Innovation Head. “We’re transforming digital assets into physical custody, giving banks, funds, and fintechs a new layer of security.”

The vault is also backed by a full-value insurance policy, adding another layer of confidence for institutional clients. And with meetings already underway with Argentina’s Central Bank and National Securities Commission (CNV), Prosegur is positioning itself for rapid deployment once regulations change.

Anticipating Regulatory Reform

Crypto remains restricted in Argentina’s traditional banking sector. Financial institutions are currently barred from offering digital assets directly to clients. However, optimism is building. According to Prosegur, the Central Bank has indicated that these restrictions may be lifted in 2025.

Such a regulatory shift could be transformational.

Industry leaders expect this change to unlock mainstream crypto services within Argentina’s banks and fintechs. Iñaki Apezteguia, co-founder of Crossing Capital, believes it could dramatically increase trust and adoption.

“Some people still hesitate to buy crypto simply because their bank doesn’t offer it,” Apezteguia noted. “If that changes, the adoption rate could surge.”

A Crypto Nation in the Making

Argentina has become one of the world’s most active crypto markets, especially for stablecoins. According to Chainalysis, between July 2023 and June 2024, the country received $91 billion in crypto transfers, surpassing even Brazil. Over 60% of these transactions involved stablecoins, driven by demand for USD-denominated assets amid hyperinflation.

The country ranks 15th globally in crypto adoption and is home to several innovative projects:

- A crypto pre-loaded debit card, which allows users to spend digital assets while merchants receive Argentine pesos.

- A thriving mining industry.

- And now, the world’s first Bitcoin-native stock exchange.

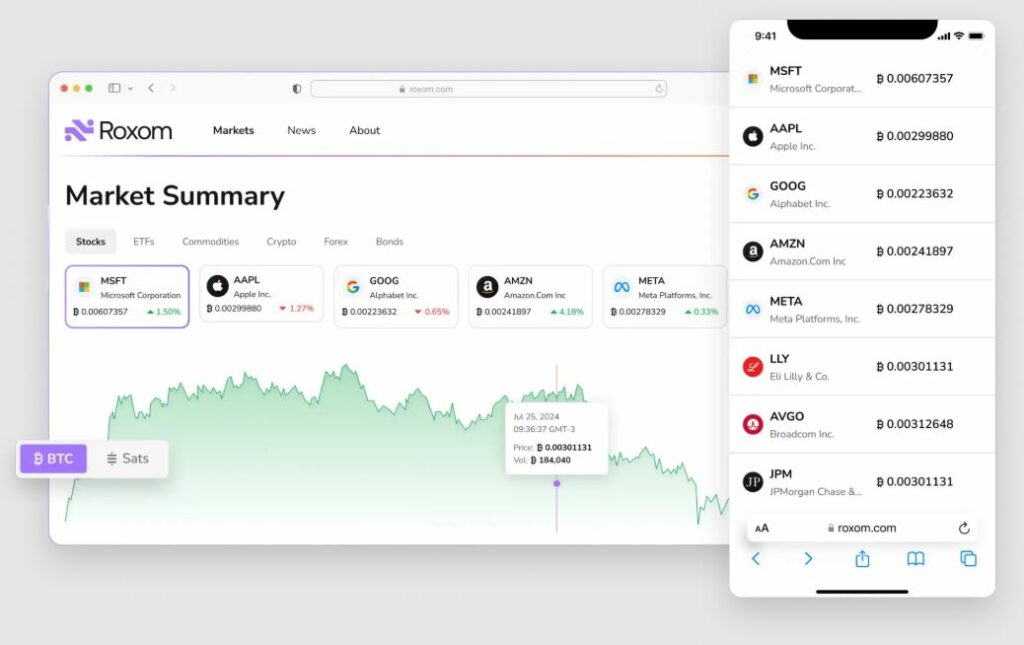

Roxom: The World’s First Bitcoin-Native Stock Exchange

In mid-2024, Argentine entrepreneur Borja Martel Seward and Nick Damico, former CTO of Bitpatagonia, unveiled Roxom, a bold new project backed by $4.3 million in pre-seed funding from Draper Associates, led by legendary venture capitalist Tim Draper.

Roxom aims to create an entirely new financial model: a stock exchange where Bitcoin is the base currency. It’s a vision tailored to Argentina’s crypto-forward culture and offers both retail and institutional investors new ways to engage with digital finance.

“Donald Trump is the first Bitcoin president of the United States,” Seward said. “The global momentum is strong, and Argentina is ready to lead.”

Political Parallels: Trump and Milei

A key source of optimism for the Argentine crypto community lies in the ideological alignment between President Milei and U.S. President Donald Trump. Both leaders are vocal supporters of cryptocurrency and advocate for reduced government intervention in financial markets.

Trump has announced plans to make the U.S. the “global crypto capital”, including the creation of a strategic Bitcoin reserve, mirroring gold and oil holdings. This alignment gives many in Argentina hope that Milei will follow a similar path, ushering in a favorable regulatory climate for digital assets.

Looking Ahead: A Nation on the Edge of a Crypto Breakthrough

Argentina stands at a crossroads. The infrastructure is in place. Innovation is booming. And institutional players are ready.

What’s missing? A clear and supportive regulatory framework.

If the Central Bank lifts the current ban on crypto services, Argentina could enter a new era, one where crypto is not just a workaround for inflation but a fully integrated part of the nation’s financial system.

As Rodolfo Andragnes, president of ONG Bitcoin Argentina, puts it: “Argentina already has the people, the projects, and the expertise. With the right regulations, we could see Bitcoin in bank portfolios, and a new crypto economy taking shape.”

Conclusion

The Argentine crypto story is far from over. In fact, it may just be beginning. With cold storage vaults, innovative exchanges, and a favorable political climate, Argentina could become a blueprint for emerging-market crypto adoption.

2025 might well be the year Argentina transforms from crypto survivor to crypto pioneer.