Bitcoin is showing strong signs of recovery. In the first week of April 2025, the price of BTC jumped by 10%, reaching over $70,000. This is the biggest weekly gain in months, and it’s happening while the U.S. economy is facing some worrying signs. Many crypto traders believe this could be a turning point for Bitcoin and the wider crypto market.

Bitcoin’s Strong Weekly Performance

On April 7, Bitcoin ended the week with a 10% gain, making it one of the best-performing assets during that time. The price rose from below $65,000 to over $70,000, a level it had not reached consistently since early March.

This upward trend is important because Bitcoin had been moving sideways for weeks. It struggled to break past resistance levels near $70,000. Now, that resistance seems to be turning into support, which is a bullish sign for many investors.

Crypto analyst Rekt Capital pointed out that this weekly performance shows that the market sentiment is changing. More people are becoming optimistic about BTC’s future.

Long-Term Holders Are Accumulating

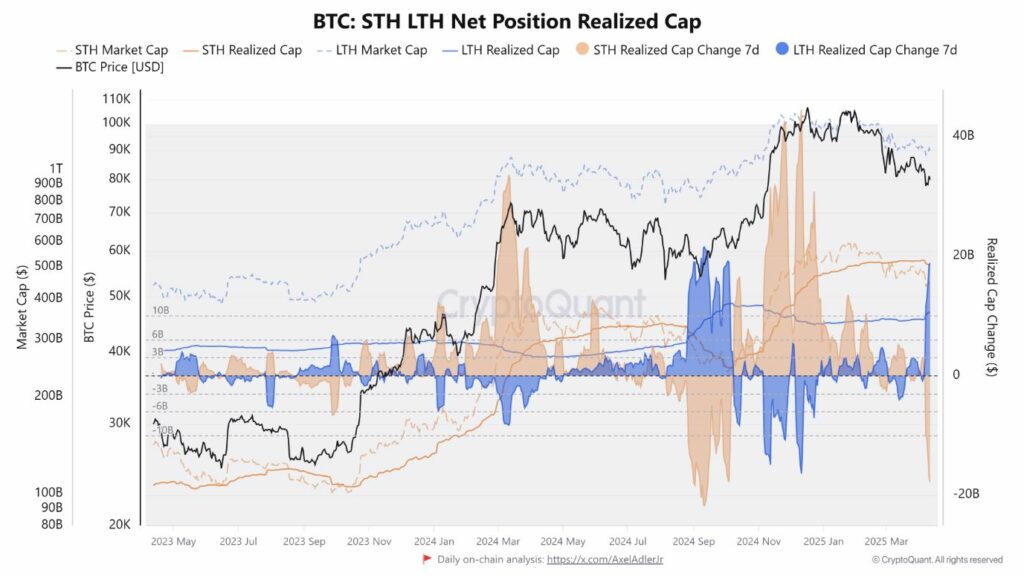

Another positive sign is that long-term Bitcoin holders are buying again. According to data from CryptoQuant, these investors have started accumulating Bitcoin after weeks of selling.

In March 2025, long-term holders were selling their coins, likely taking profits after BTC reached its all-time high of nearly $74,000. But now, that trend has reversed. These holders are once again building their positions, which suggests they believe the price will go even higher in the future.

This change in behavior is often seen as a strong bullish signal. Long-term holders usually buy when they see good value and sell when they think prices are too high. Their confidence can help drive the market forward.

Economic Data Is Pushing People Toward Crypto

The rise in BTC’s price is also happening while there are problems in the U.S. economy. On April 5, the U.S. unemployment rate increased to 3.9%, higher than expected. At the same time, job growth is slowing down, and wage increases are not keeping up with inflation.

These weak economic signs have made many people think that the Federal Reserve might start cutting interest rates sooner than expected. Lower interest rates usually make traditional savings accounts less attractive, and investors start looking for better opportunities like Bitcoin and other cryptocurrencies.

As expectations grow for rate cuts, money is flowing back into riskier assets, including crypto.

Crypto Sentiment Turns Positive

Investor mood in the crypto space is improving. After weeks of fear and uncertainty, traders are becoming more confident. The Crypto Fear & Greed Index, which measures investor emotions, has moved from “Neutral” back toward “Greed,” suggesting more people are ready to buy.

The improvement in sentiment is also helped by strong demand from institutional investors. Spot Bitcoin ETFs in the U.S., which were approved earlier this year, have attracted billions of dollars. These ETFs give big investors a safe and easy way to invest in this coin.

As more institutions enter the market, it gives Bitcoin more credibility and increases demand.

Ethereum and Altcoins Are Also Rising

Bitcoin is not the only cryptocurrency that is gaining value. Ethereum (ETH), the second-largest cryptocurrency, has also seen a price increase. On April 7, Ethereum was trading above $3,500, up about 5% in a week.

Other altcoins are following the same trend. Popular coins like Solana (SOL) and Avalanche (AVAX) have also gained value in recent days. This shows that the positive mood is spreading across the entire crypto market.

What’s Next for Bitcoin?

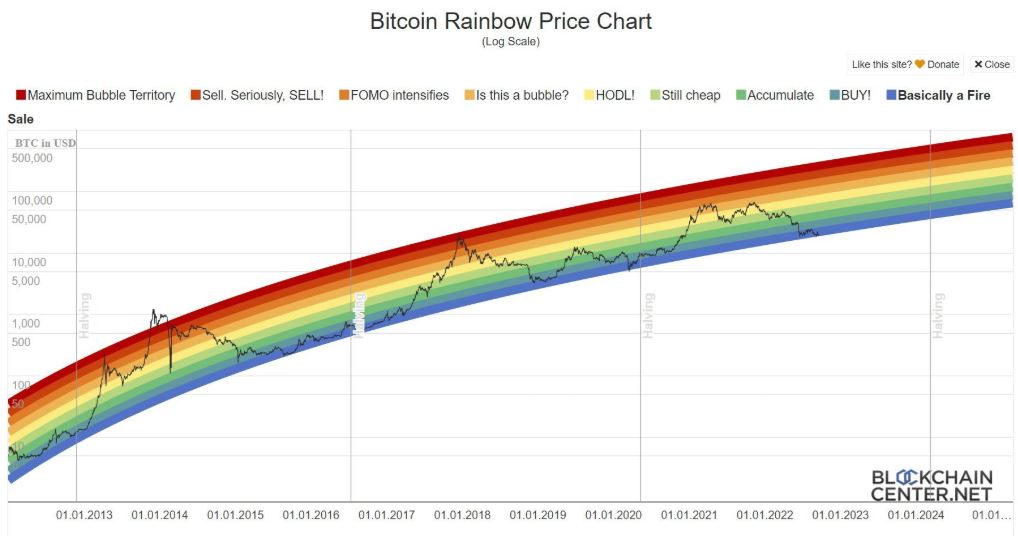

Many crypto experts believe that Bitcoin could be heading toward new highs. If the price stays above $70,000 and breaks through the $74,000 level, we could see a new all-time high soon.

However, there are still some risks. Global economic uncertainty, potential regulation, and geopolitical tensions could affect the crypto market. But for now, the outlook is positive.

Traders will also be watching for upcoming events, such as the Bitcoin halving expected in mid-April 2025. This event, which cuts the block reward for Bitcoin miners in half, has historically led to price increases in the months that follow.

Bitcoin’s recent 10% gain is a strong sign that the market is turning more positive. Long-term holders are buying again, the U.S. economy is showing weakness, and investor sentiment is improving. All of these factors are helping to push Bitcoin higher.

While it’s still too early to say whether this is the start of a long-term bull run, many signs point in that direction. As always, investors should stay informed and cautious, but there’s no denying the momentum building in the crypto world right now.