The crypto market started the week with a surprising rebound after an early drop, as Bitcoin managed to recover from a dip and maintain its position above $105,000. The move followed broader market reactions to a significant downgrade of U.S. government debt by Moody’s, which shook both bond and equity markets. Despite the early jitters, risk assets—including cryptocurrencies—bounced back strongly by Monday afternoon.

Bitcoin Rebounds After Moody’s Shock

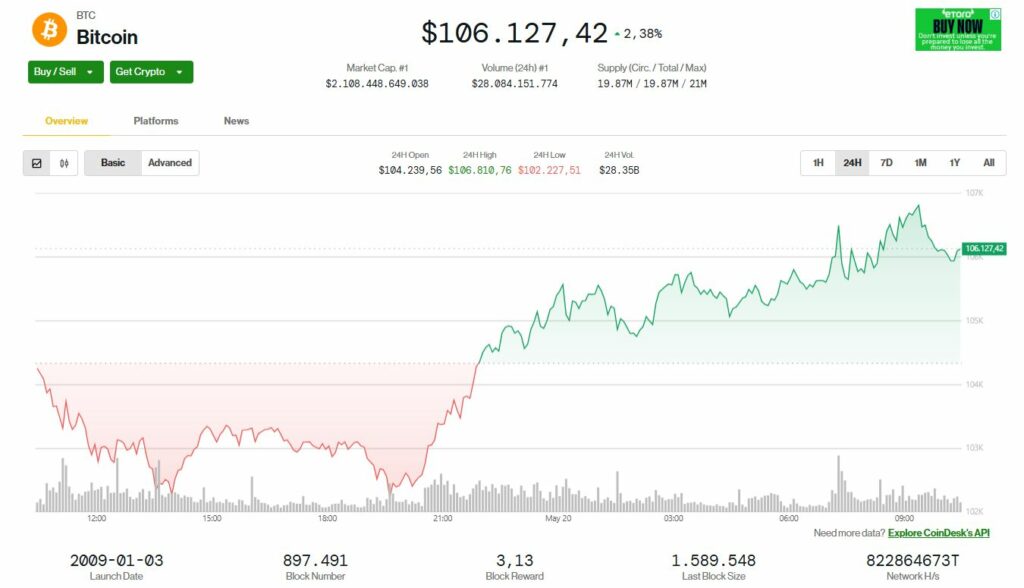

On Monday, May 19, Bitcoin briefly dipped to $102,000 during early U.S. trading hours. The fall followed a rocky start across financial markets after Moody’s Investors Service downgraded the U.S. government’s credit rating late Friday, stripping it of its AAA status. This move pushed U.S. Treasury yields higher, with the 30-year yield jumping past 5% and the 10-year note surpassing 4.5%.

However, Bitcoin quickly recovered and was trading around $105,954 by late afternoon. The largest cryptocurrency by market capitalization gained 0.4% over the previous 24 hours, showing resilience in the face of macroeconomic uncertainty. The rebound also followed a record weekly close at $106,600 the night before.

By the morning of May 20, the price of Bitcoin remained steady at $106,600, marking a gain of over 2% in the past 24 hours. This is a very positive sign for the cryptocurrency.

Ethereum (ETH) also showed strength, climbing 1.2% to reclaim the $2,500 level, closing at $2,576. Among altcoins, the decentralized finance (DeFi) lending platform Aave (AAVE) led the charge with a notable gain, trading at $264.02. In contrast, other major altcoins such as Solana (SOL), Avalanche (AVAX), and Polkadot (DOT) remained in the red, down between 2% and 3% despite bouncing off their daily lows.

The recovery wasn’t limited to the crypto sector. U.S. stock indices like the S&P 500 and Nasdaq also reversed their earlier losses, ending the session in positive territory.

Moody’s Downgrade: Market Shrugs Off Long-Term Risks

Moody’s downgrade was the final nail in the coffin, following previous downgrades by Fitch and S&P in earlier years. However, many analysts believe the long-term impact on markets is minimal.

“What does the downgrade mean for markets? Longer-term – really nothing,” said Ram Ahluwalia, CEO of Lumida Wealth. He pointed out that the immediate reaction in bond markets might be driven by institutional investors rebalancing portfolios, especially those restricted to AAA-rated securities.

Callie Cox, chief market strategist at Ritholtz Wealth Management, echoed that sentiment. “Moody’s is the last of the three major rating agencies to downgrade U.S. debt. This was the opposite of a surprise; it was a long time coming,” she noted on X (formerly Twitter). According to Cox, that’s why stock and crypto investors remained relatively unfazed.

Bitcoin’s Bullish Outlook: $138K Target in Sight

While Bitcoin remains just below its January all-time highs, experts believe a much bigger move is brewing. According to 21Shares, a leading issuer of crypto exchange-traded funds (ETFs), Bitcoin could surge as high as $138,500 by the end of the year, representing a potential 35% upside from current levels.

“Bitcoin is on the verge of a breakout,” wrote Matt Mena, research strategist at 21Shares, in a report published Monday. He emphasized that the current rally is being driven not by speculative retail trading but by deeper structural forces shaping the crypto landscape.

These forces include:

- Institutional Inflows: Large-scale investors and asset managers continue to pour capital into Bitcoin, mainly through regulated investment vehicles like spot Bitcoin ETFs.

- Historic Supply Crunch: Daily Bitcoin issuance through mining is being outpaced by ETF inflows, tightening supply significantly.

- Corporate and Government Accumulation: Companies like Strategy and the new entrant, Twenty One Capital, are steadily acquiring BTC. Some governments are also considering strategic Bitcoin reserves.

These trends point to a more mature and sustainable rally, different from previous bull runs driven by hype and retail speculation.

ETFs Absorbing Supply Faster Than Miners Can Keep Up

The surge in demand from spot Bitcoin ETFs is creating a notable supply shock. These financial products, launched in recent months, have consistently absorbed more BTC than miners are able to produce each day. This imbalance is creating a scarcity effect, which often precedes major price movements in Bitcoin’s history.

With the April 2024 Bitcoin halving event already reducing block rewards, the supply side is further constrained. As more institutions and even sovereign entities consider long-term BTC holdings, the stage is being set for a potential breakout to new all-time highs.

A Changing Market Structure

Unlike previous cycles, today’s crypto market is heavily influenced by macroeconomic trends, institutional players, and regulatory clarity. This shift in market structure is giving investors more confidence that the ongoing rally is not just another bubble, but part of a larger, more sustainable trend.

Matt Mena concluded that Bitcoin is now seen less as a speculative asset and more as a strategic macro asset, particularly in a world where fiat currencies are under pressure due to inflation and rising debt levels.

Despite initial fears following the U.S. credit rating downgrade, Bitcoin and other risk assets showed strong resilience. The broader market recovery reflects a growing confidence in the long-term fundamentals of digital assets. With key institutions buying in and ETF inflows continuing to outpace new supply, Bitcoin may be gearing up for another historic rally, possibly reaching $138,500 by year-end.

As the crypto market matures, it is increasingly clear that Bitcoin is no longer just a fringe asset. It is evolving into a core component of modern portfolio strategies, especially for investors seeking protection against inflation, currency devaluation, and geopolitical uncertainty.

If the current momentum holds, 2025 may go down as the year Bitcoin redefined itself not just as a digital currency, but as a truly global store of value.