Bitcoin’s price momentum has stumbled after a powerful bull run, and new on-chain data now suggests that the world’s largest cryptocurrency might be entering an overheated and vulnerable stage. With four consecutive sell signals appearing on key metrics, market analysts are warning of an impending pullback, possibly below the psychological $100,000 threshold.

Let’s take a closer look at the current signals, the potential scenarios ahead, and what traders can expect as the market cools off.

Bitcoin Slides from Local Top: Are the Bulls Losing Strength?

After hitting a local high of $110,000, Bitcoin [BTC] saw a sharp correction over the past week. As of press time, the price had dropped to around $103,707—down approximately 3.88% in seven days. This decline has sparked debate among analysts over whether Bitcoin’s recent rally has run out of steam.

One of the loudest voices is Axel Adler, an on-chain analyst at CryptoQuant. According to Adler, Bitcoin’s market is now flashing multiple warning signs that could point to a deeper correction ahead, possibly toward the $92,000 level.

Four Consecutive Sell Signals: The Net UTXO Supply Ratio

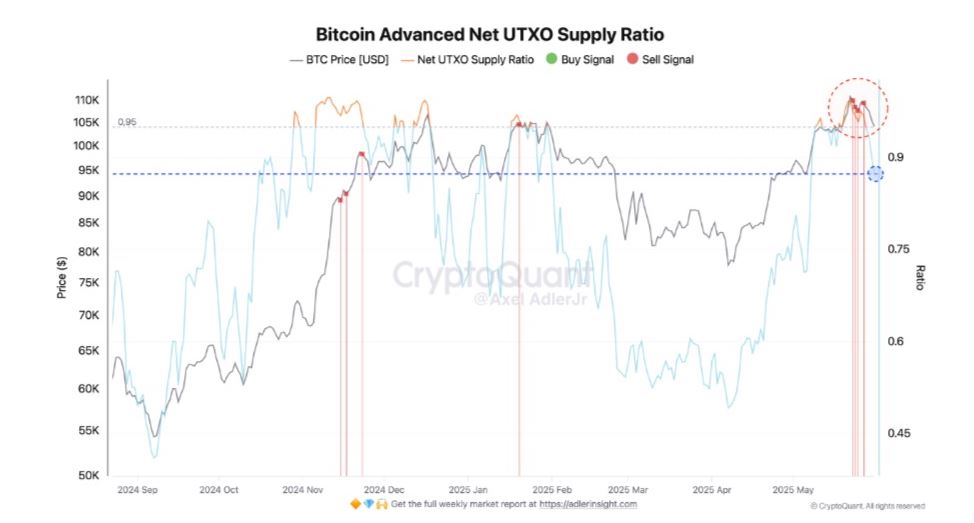

At the heart of Adler’s bearish outlook is the Net UTXO Supply Ratio, a key metric that tracks the activity of Bitcoin holders over time. This metric has now issued four consecutive sell signals, signaling an overheated market.

So, what does this ratio tell us?

When the Net UTXO Supply Ratio starts to drop sharply, it usually means that a growing number of investors are sitting on unrealized profits. As more coins move into profit, the urge to sell and take gains increases. Meanwhile, demand starts to lag behind supply, and that imbalance can push prices lower.

Supporting this idea is another important metric: Net Unrealized Profit (NUP). This figure recently dropped to 0.553, its lowest level in weeks. A lower NUP value suggests that Bitcoin holders are seeing fewer paper gains than before, reducing the incentive to HODL.

This trend means more investors are vulnerable to panic selling, especially those who bought in at higher levels between $104,000 and $112,000. With those positions now underwater, pressure is building in the market for a broader correction.

The Case for a Market Reset

Axel Adler believes that the current signals are pointing toward a necessary market reset. This reset could take one of two forms:

- Sideways consolidation between $95,000 and $105,000, giving the market time to stabilize.

- A sharper dip to $92,000, which would help relieve the overheated conditions more quickly.

- In either case, it’s likely that Bitcoin will fall below the $100,000 mark in the short term.

For a proper reset to occur, Adler suggests the Net UTXO Supply Ratio needs to stabilize in the 0.85 to 0.9 range. That stabilization would signal that excessive profit-taking has eased, and the market is cooling down.

Adding fuel to the bearish outlook is the Taker Buy-Sell Ratio, which has stayed negative for four straight days. This ratio measures aggressive buying vs. selling behavior on exchanges. A negative value indicates more aggressive selling pressure, and that’s exactly what we’re seeing now.

If the current momentum continues, Bitcoin could soon test the $101,488 support level. Should that level break, the next major support is likely around $98,890.

Falling below these levels would reinforce the market reset scenario and potentially set the stage for accumulation by long-term holders.

What Does This Mean for Investors?

While sharp pullbacks can be unnerving, especially after a strong rally, they are also a natural part of healthy market cycles. The data points to a period of profit-taking and consolidation, not a complete reversal of the long-term bullish trend.

Here are some takeaways for traders and investors:

- Short-term caution is warranted. Metrics like the Net UTXO Supply Ratio and Net Unrealized Profit suggest that the market is cooling off, and the probability of further downside is high.

- $101,000 is a key level to watch. If this support fails, Bitcoin may dip further toward $98,890 or even $92,000.

- Long-term fundamentals remain intact, but a temporary pause or correction can help remove weak hands and reset investor expectations.

The crypto market thrives on momentum, but it also needs pauses to catch its breath. Bitcoin’s recent rally to $110,000 was impressive, but now, the data shows clear signs of exhaustion. With sell signals flashing across multiple on-chain indicators, a short-term correction appears increasingly likely.

Whether this takes the form of a sideways range or a deeper pullback, the message from the metrics is clear: the market needs to cool down before the next leg higher can begin.

Investors should stay alert, manage their risk, and watch for signs of stability in the Net UTXO Supply Ratio. If history is any guide, a solid base built during a correction often sets the stage for the next big move.