Bitcoin has had a turbulent start to June 2025. After soaring to an all-time high of $111,814, the world’s largest cryptocurrency experienced a brief correction, dropping as low as $101,000 on Friday, June 6. While this kind of volatility is common in the crypto market, it has raised questions among investors: Has Bitcoin already peaked for this cycle?

According to one crypto analyst, the answer may be no. In fact, a powerful long-term indicator suggests that Bitcoin could still have up to four months of growth left in this bull cycle.

Let’s break down what’s happening in the market, what this signal really means, and why now might still be a key opportunity window for BTC investors.

Market Snapshot: BTC Faces Volatility But Holds Strong

Bitcoin has shown resilience in the face of growing volatility. After its brief dip on June 6, it bounced back quickly and is now trading around $104,400, according to CoinGecko. That’s a 2% increase in the past 24 hours, although the weekly gain is only 0.2%, a sign that the market is currently in a phase of consolidation.

This sideways trading has tested investor patience. With prices hovering around the $100,000 mark for days, many are wondering whether the current rally is running out of steam. But according to crypto analyst Joao Wedson, the peak may still be ahead.

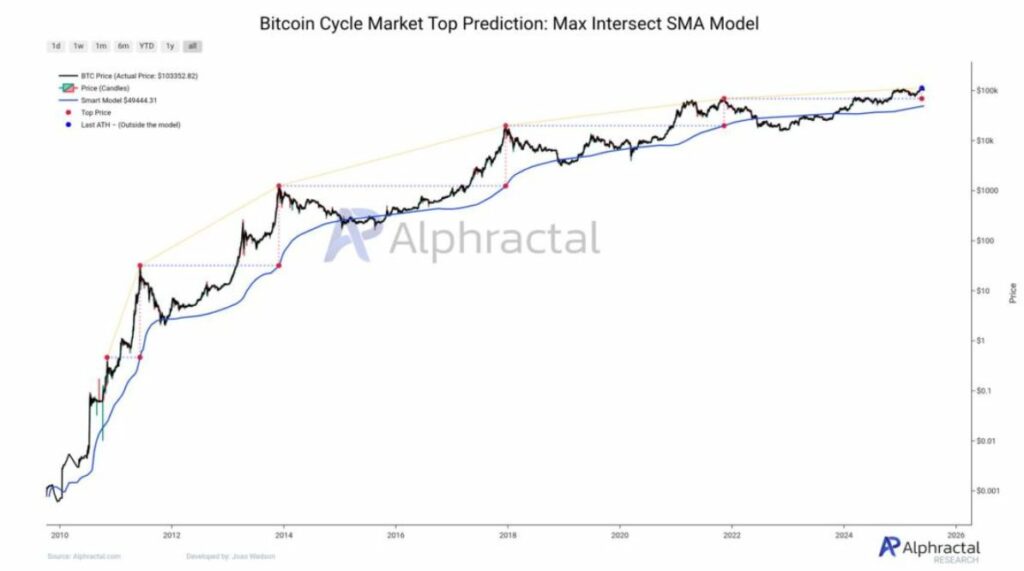

In a recent post on X (formerly Twitter), Wedson introduced a model that has accurately predicted previous Bitcoin cycle tops. Known as the Max Intersect SMA Model, this tool uses a moving average that tracks when the current cycle intersects with the peak of the previous cycle.

So far, the model has performed impressively. In November 2021, the model hit the $19,000 mark, the top of the 2018 cycle, and shortly after, Bitcoin surged to a then-record $69,000.

Wedson’s model now suggests that the next cycle peak will be signaled when the Max Intersect SMA hits the $69,000 level, the top of the last cycle. As of early June 2025, this hasn’t happened yet. That means the current bull run could still have more room to grow.

According to Wedson, this model is “backed by 200 tested algorithms,” adding another layer of credibility to its predictive power. If history repeats, we could still be several weeks or even four months away from the true peak.

What This Means for Bitcoin Investors

If Wedson’s model holds, it may provide some comfort to long-term holders (HODLers) and institutions sitting on the sidelines. Here’s what investors should consider:

- Time Is Still on the Table: The model’s estimate of four more months of potential upside could align with the final leg of a typical crypto bull cycle.

- Volatility Isn’t Unusual: While price fluctuations between $101,000 and $104,000 might feel like uncertainty, these movements are normal in any late-stage bull market.

- Market Sentiment Is Mixed: Despite the recent price softness, positive indicators like rising ETF inflows, increased corporate adoption, and solid on-chain fundamentals continue to support bullish sentiment.

The Psychology of a Late Bull Market

Every Bitcoin cycle shares a familiar emotional arc—hope, excitement, fear of missing out, euphoria, and then a dramatic correction. As BTC approaches new price territories, investors must manage their expectations and emotions carefully.

The current phase appears to be in the latter half of that arc. Price is climbing, but with increasing resistance and erratic short-term swings. That’s exactly when models like the Max Intersect SMA become helpful, they offer a structured, data-driven signal in a market often driven by headlines and hype.

Key Data Points at a Glance:

- Bitcoin All-Time High (ATH): $111,814 (early June 2025)

- Recent Low: $101,000 (June 6, 2025)

- Current Price: ~$104,400

- 7-Day Change: +0.2%

- 24-Hour Change: +2%

- Next Predicted Cycle Peak: When Max Intersect SMA hits $69,000

- Estimated Time to Peak: ~4 months

Should You Buy the Dip?

With Bitcoin hovering well below its ATH, some traders are eyeing this dip as a buying opportunity. However, like all market moves, the decision should be guided by strategy, not emotion. Key considerations include:

- Risk tolerance: Bitcoin can move 10%+ in a day, can your portfolio handle that?

- Investment horizon: Are you holding for the short term or long term?

- Fundamentals: Are you basing your decisions on sound analysis or social media hype?

Tools like Wedson’s model offer long-term signals, not day-trading tips. For investors focused on the broader trend, these insights suggest that Bitcoin’s momentum may still have fuel left, despite the market noise.

Final Thoughts

Bitcoin’s current cycle has already broken records, but it may not be over yet. With the Max Intersect SMA model suggesting another four months of potential upside, investors have a rare opportunity to observe and act on a historical trend in real time.

Whether you’re a seasoned investor or new to crypto, keeping an eye on data-driven signals like this could make all the difference. But remember, while indicators can provide guidance, no model can predict the future with absolute certainty.

As always in crypto, staying informed is your best investment.