As cryptocurrency trading continues to evolve in 2025, one of the most important factors traders need to consider is the cost of executing trades. On platforms like Bitget, understanding Bitget fees—ranging from spot trading fees to futures trading fees—is crucial for maximizing profitability. This comprehensive guide will take you through everything you need to know about Bitget’s fee structure, including maker-taker fees, how these fees work, and strategies for minimizing them to achieve more cost-effective trading.

What Are Bitget Fees?

When you trade on a platform like Bitget, you are required to pay transaction fees based on the type of trade you’re executing. The fee structure is designed to be transparent and straightforward, but understanding how it works is essential for maximizing your profits. In general, Bitget fees vary depending on whether you are trading spot or futures, and whether you are the maker or the taker in a trade.

Bitget Trading Fee Structure

Bitget offers different fee structures depending on the asset type, order type, and whether the user is a market maker or market taker. For spot trading, futures trading, and other types of transactions, Bitget employs a tiered system. This means that traders who engage in more frequent trading or who hold certain amounts of Bitget’s native BGB token may benefit from reduced Bitget fees. In 2025, this fee model will continue to benefit both novice and experienced traders, ensuring that Bitget remains competitive in the global crypto exchange market.

Bitget Spot Trading Fees

Spot trading is one of the most common forms of trading on any cryptocurrency exchange, including Bitget. In spot trading, you buy or sell cryptocurrencies directly at current market prices. The spot trading fees on Bitget are usually quite competitive and are structured using a maker-taker fee model.

Bitget Maker-Taker Fees in Spot Trading

- Maker Fees: In Bitget’s trading model, makers are those who provide liquidity to the market. For example, if you place an order to buy Bitcoin at a lower price than the current market price, you are considered the maker. Your order will be added to the order book until the market price matches your buy order. Bitget maker fees are typically lower than taker fees because makers add liquidity to the market.

- Taker Fees: Takers, on the other hand, are traders who take liquidity away from the order book. If you place an order to buy Bitcoin at the current market price, you’re considered a taker. Bitget taker fees are generally higher than maker fees because the taker removes liquidity from the market.

As of 2025, Bitget’s spot trading fees are typically around 0.1% for both makers and takers, but they may vary depending on the volume of trades or the use of BGB tokens. It’s also important to note that Bitget offers fee discounts for high-volume traders, so frequent traders will see their fees decrease as their trading activity increases.

Bitget Futures Fees

Futures trading is another area where understanding fees is key to maximizing profits. Futures allow traders to speculate on the price of cryptocurrencies without owning the underlying asset. On Bitget, you can trade a wide variety of futures contracts, including perpetual contracts and contracts with specific expiration dates. The Bitget futures fees are also structured using a maker-taker model, similar to spot trading, but with some variations.

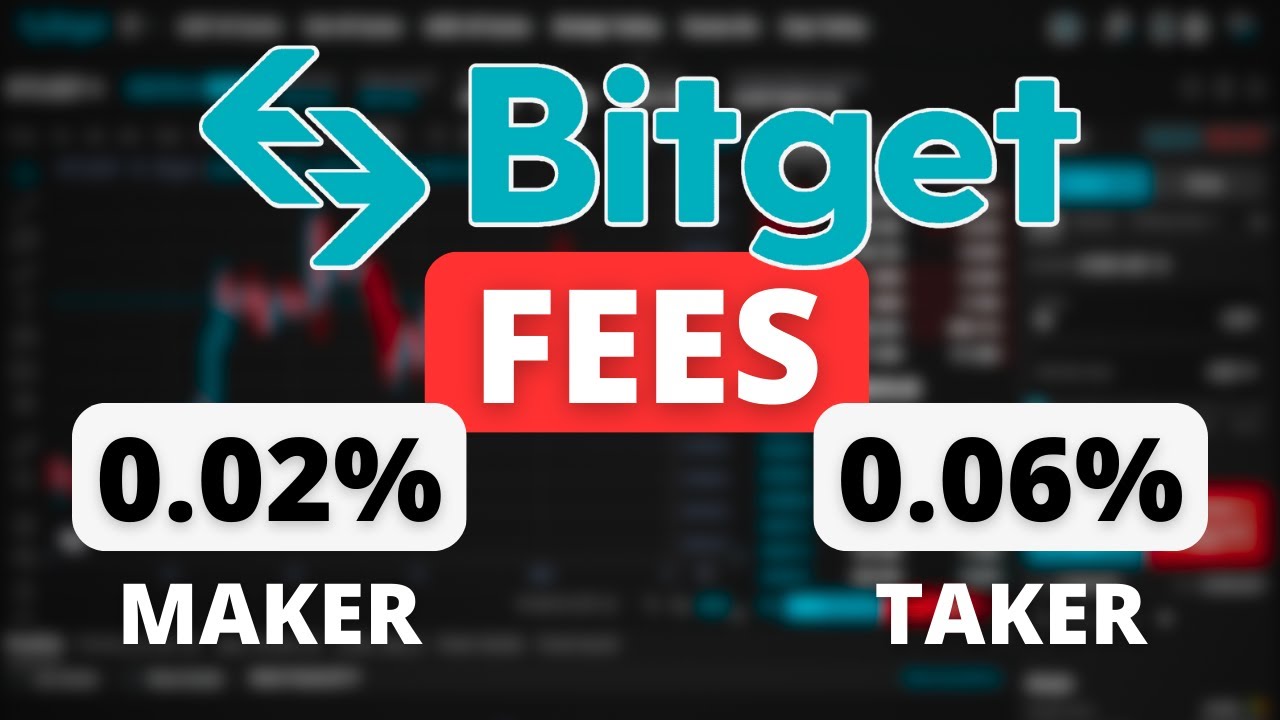

How Bitget Futures Fees Work

Maker Fees in Futures Trading: As a maker in futures trading on Bitget, you provide liquidity to the market by placing an order that isn’t immediately filled. For example, if you place a buy order at a lower price than the current market price, you are a maker. Bitget maker futures fees are typically lower than taker fees because makers provide liquidity for the market.

Taker Fees in Futures Trading: A taker in futures trading is someone who matches an existing order in the order book. If you decide to buy a contract at the current market price, you are the taker. Bitget taker futures fees are generally higher than maker fees because the taker removes liquidity from the market.

In 2025, Bitget futures fees are typically 0.02% for makers and 0.05% for takers. These rates may change depending on your activity level, and again, BGB token holders can enjoy discounted rates.

How to Minimize Bitget Fees

Whether you’re engaging in spot trading or futures trading, there are strategies to minimize your Bitget fees and maximize your profits.

Leverage Bitget Fees Discounts with BGB Tokens

One of the easiest ways to reduce your fees on Bitget is by holding and using the exchange’s native token, BGB. Bitget offers users the ability to use BGB tokens to pay for trading fees at a discount, making it an attractive option for traders looking to save. As you accumulate more BGB tokens, you’ll be able to unlock higher discounts, reducing your overall transaction costs.

Increase Your Trading Volume

Another way to lower Bitget fees is by increasing your trading volume. Bitget rewards users who trade at higher volumes by offering them reduced fees. This tiered structure encourages high-volume traders to make larger and more frequent trades, benefiting from progressively lower fees as their volume grows.

Take Advantage of Maker Orders

As mentioned earlier, makers enjoy lower fees than takers. By placing maker orders, you can reduce the cost of your trades. This strategy may involve being more patient with your trades and waiting for the market to meet your order, but it can significantly reduce your trading costs over time.

Trade on Days with Special Promotions

From time to time, Bitget runs special promotions or discounts on trading fees. These limited-time offers can give traders a temporary advantage when it comes to minimizing Bitget fees. Be sure to stay updated on these offers to capitalize on them.

Bitget Fees Compared to Other Exchanges

When choosing a trading platform, one of the most important factors to consider is how fees compare across different exchanges. Bitget’s fees are highly competitive compared to other major exchanges. For instance, Binance and Coinbase also charge spot trading fees, but Bitget’s low spot trading fees and futures trading fees put it ahead of many other platforms in terms of affordability.

Let’s compare the Bitget fees for spot and futures trading to those of some other major exchanges:

- Bitget Spot Trading Fees: Typically from 0 to 0.1% for both makers and takers.

- Binance Spot Trading Fees: Typically 0.1%, but you can reduce it with BNB token holdings.

- Coinbase Spot Trading Fees: Higher than Bitget, ranging from 0.5% to 1.5%, depending on the payment method.

In terms of futures trading, Bitget also has some of the lowest fees on the market, particularly for traders who maintain a high trading volume.

Why Understanding Bitget Fees Is Essential for Success

Understanding Bitget fees is not just about knowing the numbers; it’s about using that knowledge strategically to enhance your overall trading experience. The way you handle trading fees can significantly impact your profitability and long-term success in the cryptocurrency market.

Make Informed, Data-Driven Decisions

When you understand the fee structure, you can make more informed, data-driven decisions about which trades to execute and when. This can give you a significant edge over other traders who may overlook or underestimate the effect of fees on their trading performance.

High Fees Can Erode Profits Quickly

High fees can erode your profits quickly, especially if you’re trading frequently or making large transactions. If you’re not mindful of the fees, you may end up paying more than necessary, which could lead to lower overall returns.

Maximize Profit by Reducing Fees

By reducing your fees, you increase the amount of profit you keep from each trade, which, over time, adds up. This is particularly important in the volatile cryptocurrency market, where price movements can be small but frequent. Every bit of savings matters when the market moves rapidly, and lowering fees ensures you’re maximizing the impact of even minor market fluctuations.

Choose the Right Time to Trade

Moreover, understanding Bitget’s fee structure gives you a better ability to choose the right time to trade. If you’re aware of how maker-taker fees work or if you know how volume-based discounts can help reduce your costs, you can structure your trades in a way that minimizes unnecessary expenses.

Take Full Advantage of Market Opportunities

This means you can take full advantage of market opportunities, such as entering and exiting trades at optimal points, without being hindered by high transaction costs. Being strategic about when and how you trade can make a big difference to your bottom line.

Bitget’s Tiered Fee Structure

Additionally, Bitget’s tiered fee structure rewards users who increase their trading volume, giving savvy traders the ability to reduce their fees over time by simply staying active on the platform. By consistently executing trades or maintaining a high volume, you’ll find your fees reduced, which directly impacts your ability to reinvest and grow your portfolio.

Mastering Bitget Fees for Winning Strategy

Therefore, mastering the nuances of Bitget fees isn’t just a matter of cost awareness—it’s an integral part of developing a winning trading strategy. By understanding how the fee structure works, you’ll be able to plan your trades with greater precision, reduce your costs, and ultimately, increase your chances of success in the cryptocurrency market.

Trade Smarter, Not Harder with Bitget

In conclusion, understanding Bitget fees in 2025 is a crucial step for any trader aiming to boost their success in the crypto market. By strategically minimizing your trading fees—whether through using Bitget’s BGB token, increasing trading volume, or opting for maker orders—you can significantly reduce costs and maximize your profits. Staying informed about the Bitget fees structure, including spot and futures trading fees, enables you to make smarter decisions and trade more efficiently.

As the cryptocurrency landscape evolves, staying ahead of the game by optimizing your trading costs will give you a competitive edge. By applying these cost-saving strategies, you can not only improve your trading outcomes but also gain more control over your investments. So, take full advantage of the resources available to you on Bitget, and trade smarter to unlock your full potential in 2025.