Cryptocurrency trading has evolved rapidly, with traders seeking fast, secure, and user-friendly platforms to optimize their trading strategies. Bybit, a leading cryptocurrency exchange, has gained massive popularity due to its innovative trading features, competitive fees, and robust security measures. While Bybit is widely known for its derivatives trading, its spot trading platform has become increasingly popular among traders looking for direct asset ownership and immediate transactions.

This article provides an in-depth overview of Bybit Spot Trading, covering its core features, user interface, and how to set up an account for seamless trading. Whether you are a beginner or an experienced trader, this guide will help you understand why Bybit is a top choice for spot trading in 2025.

Features of Bybit for Spot Trading

Thanks to its robust features, user-friendly design, and commitment to security, Bybit has become one of the leading cryptocurrency exchanges for spot trading. The platform is designed to cater to a wide range of traders, from beginners to professional investors, by offering competitive fees, deep liquidity, advanced order types, and strong security protocols.

Extensive Selection of Spot Trading Pairs

One of the main advantages of Bybit is its wide range of supported cryptocurrencies. As of 2025, Bybit offers over 500 trading pairs, covering major assets like Bitcoin (BTC), Ethereum (ETH), Solana (SOL), XRP, and emerging altcoins.

- Example 1: A trader interested in investing in Layer-2 scaling solutions can trade Arbitron (ARB/USDT) or Optimism (OP/USDT) directly on Bybit’s spot market.

- Example 2: If a trader wants exposure to AI-driven cryptocurrencies, they can buy Render (RNDR), Fetch.ai (FET), or SingularityNET (AGIX) without using multiple exchanges.

- Bybit continuously adds new tokens to its spot market, ensuring users have access to trending and high-potential assets.

- Stat: Bybit listed over 100 new tokens in 2024, demonstrating its commitment to expanding trading opportunities.

Zero Trading Fees on Selected Pairs

Bybit has introduced a zero-fee trading policy on select trading pairs, making it one of the most cost-effective exchanges for spot trading.

- Example: In 2025, Bybit will offer zero trading fees on BTC/USDT, ETH/USDT, and SOL/USDT—allowing traders to buy and sell without incurring additional costs.

- Comparison: While Binance and Coinbase charge 0.1%–0.5% per trade, Bybit’s zero-fee initiative significantly reduces trading expenses, especially for high-frequency traders.

- Stat: A trader making 100 BTC/USDT trades per month on a 0.1% fee exchange would pay around $5,000 in fees annually. On Bybit’s zero-fee pairs, that cost is $0.

High Liquidity for Faster Order Execution

Liquidity is crucial in spot trading, ensuring that traders can buy or sell assets without significant price slippage. Bybit ranks among the top exchanges in 24-hour trading volume, often exceeding $10 billion across various trading pairs.

- Example: A trader placing a $500,000 market buy order for Ethereum (ETH) on a low-liquidity exchange might experience a price impact of 1-2%. On Bybit, with deep liquidity, the order executes without major price fluctuations.

- Stat: Bybit consistently ranks in the top 5 exchanges by liquidity, reducing spreads and improving trade execution times.

Advanced Order Types for Strategic Trading

Bybit offers a variety of order types to help traders execute their strategies more effectively.

- Market Orders: Execute trades instantly at the best available price.

- Limit Orders: Allow traders to set a specific price at which they want to buy or sell.

- Stop-loss orders: Automatically sell an asset if it falls below a predetermined price to minimize losses.

- Take-Profit Orders: Automatically sell an asset when it reaches a target price to secure profits.

- One-Cancels-the-Other (OCO) Orders: Combines stop-loss and take-profit into a single strategy.

Example 1: A trader expects Bitcoin’s price to increase from $45,000 to $50,000 but wants to limit potential losses. They can set:

- A take-profit order at $50,000

- A stop-loss order at $44,500

- If one order is executed, the other is automatically canceled.

Example 2: A long-term investor wants to buy Ethereum (ETH) only when it drops to $2,400. They place a limit buy order, ensuring they don’t overpay.

- Stat: Over 60% of traders on Bybit use advanced order types to optimize risk management.

Security Measures to Protect User Funds

Bybit places a high emphasis on security, implementing institutional-grade protection to safeguard user assets.

- Cold Wallet Storage: Over 95% of user funds are stored in multi-signature cold wallets, making them immune to hacks.

- Two-factor authentication (2FA): Users must verify logins and withdrawals via Google Authenticator or SMS.

- Anti-phishing codes: Users can set a custom security code in emails to distinguish genuine Bybit messages from phishing attempts.

- Withdrawal Whitelist: Allows users to restrict withdrawals to trusted wallet addresses only.

- Example: In 2023, a competitor exchange suffered a $200 million security breach due to hot wallet vulnerabilities. Bybit’s cold wallet system prevented similar incidents.

- Stat: Bybit has maintained a 0% hack record since its launch, reinforcing its security credibility.

Fiat On-Ramp & Multiple Deposit Options

Bybit simplifies the crypto purchasing process by supporting fiat-to-crypto transactions via:

- Credit/Debit Cards (Visa, MasterCard)

- Bank Transfers (SEPA, SWIFT, Faster Payments)

- P2P Trading (Buy crypto from other users with local payment methods)

- Example 1: A trader in the U.S. can buy USDT with a bank transfer and immediately start trading without waiting for blockchain confirmations.

- Example 2: A user in Vietnam can purchase BTC via P2P using MoMo or Vietcombank, avoiding high foreign exchange fees.

- Stat: Bybit supports more than 40 fiat currencies, making crypto more accessible worldwide.

AI & Copy Trading for Spot Market

Bybit has integrated AI tools and copy trading features into its spot trading platform to help beginners make smarter decisions.

- AI Trading Insights: Provides real-time market analysis based on price trends and order book movements.

- Copy Trading: Users can follow professional traders and replicate their spot trading strategies automatically.

- Example: A beginner wants to trade SOL/USDT but lacks experience. They can copy a top trader with consistent 20% monthly returns.

- Stat: Bybit’s copy trading feature has over 200,000 active users, with some top traders having over $1M in follower assets.

User Interface Walkthrough

The user interface (UI) of a trading platform plays a crucial role in delivering a smooth and efficient trading experience. Based on the images provided, we can break down the UI of Bitget’s spot trading platform into several key sections and functionalities.

Homepage and Navigation Bar

At the top of the Bitget platform, there is a navigation bar that allows users to quickly access different sections of the platform, including:

- Buy Crypto – Users can purchase cryptocurrencies using various fiat methods.

- Markets – This section provides an overview of different trading pairs, including real-time prices, volume, and trends.

- Trade – Offers access to Spot, Futures, and Margin trading.

- Futures & Bots – For users looking for derivative trading and automated trading strategies.

- Copy Trading – A unique feature that allows users to follow and copy expert traders.

- Earn – Provides staking, savings, and other passive income opportunities.

- Wallet & Account – Quick access to user accounts, settings, and security features.

Example: A user looking to trade BTC/USDT can quickly navigate to the “Trade” section, click on “Spot,” and enter the trading interface.

Converter Tool

One of the standout features visible in the UI is the Converter Tool, which allows users to exchange one cryptocurrency for another with zero fees.

The interface is clean and simple, allowing users to:

- Select the cryptocurrency they want to convert (e.g., USDT to BGB).

- See the minimum and maximum conversion limits (e.g., 0.1 USDT – 10,000 USDT).

- Preview the conversion before executing the trade.

Example: If a user has 100 USDT and wants to convert it to Bitget’s native token (BGB), they simply select USDT as the input currency and BGB as the output currency, input the amount, and confirm the transaction.

Web3 and DApp Integration

Bitget’s UI includes a Web3 section that integrates with Bitget Wallet, Markets, Bitget NFT, and DApps (Decentralized Applications).

- The Bitget Wallet allows users to manage their crypto assets securely.

- DApp support makes it easier for users to interact with decentralized finance (DeFi) platforms and NFT marketplaces without leaving Bitget.

Example: A user interested in staking NFTs or interacting with DeFi lending platforms can do so directly through Bitget’s Web3 menu.

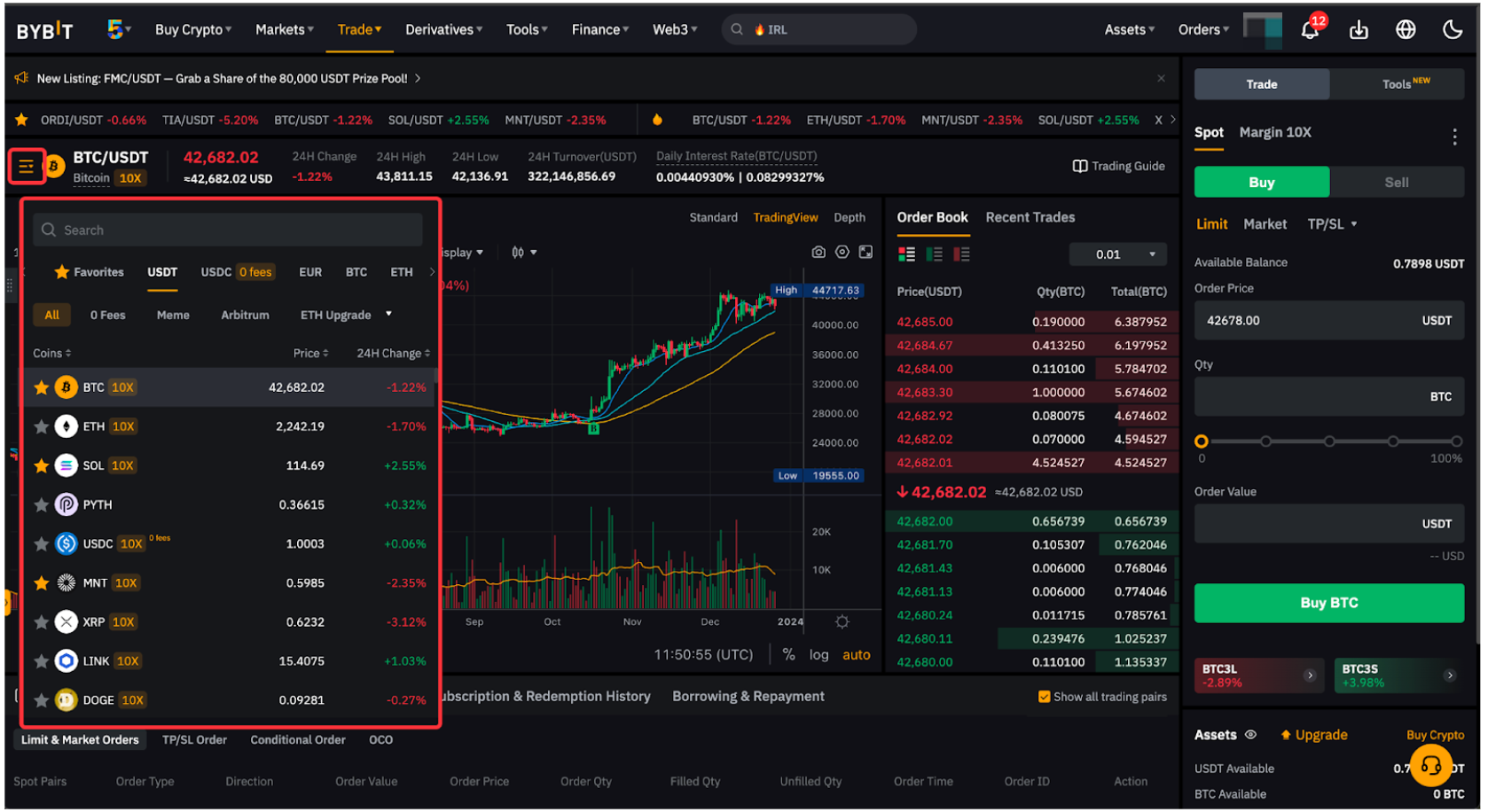

Trading Interface & Order Placement

The Spot Trading Interface provides essential trading functionalities, including:

- Price Chart – Integrated with TradingView, offering various indicators for technical analysis.

- Order Book – Displays real-time buy and sell orders.

- Trade History – This shows completed trades on the exchange.

- Order Placement Panel – Users can choose from:

- Market Orders (execute instantly at the best available price).

- Limit Orders (buy/sell at a specific price).

- Stop-loss orders (to limit potential losses).

Example: If a trader wants to buy BTC at $42,000, but the current price is $42,500, they can set a Limit Order for 1 BTC at $42,000. Once the price reaches that level, the order will be executed automatically.

Copy Trading Interface

The Copy Trading section allows users to follow professional traders and copy their strategies automatically. Key features include:

- Leaderboard – Displays top-performing traders based on ROI, win rate, and total followers.

- Subscription Model – Users can subscribe to a trader and allocate funds to mimic their trades.

- Performance Analytics – Provides historical data and statistics of each trader.

Example: A beginner trader who wants to follow a professional trader with a win rate of 85% and a $500,000 total profit can subscribe to them and let trades execute automatically.

Footer & Additional Resources

At the bottom of the UI, there are several useful sections, including:

- Company Information – About Bitget, partnerships (La Liga, Messi, etc.), and media presence.

- Product Offerings – Direct links to Spot, Futures, Margin, API trading, etc.

- Copy Trading & Services – Includes VIP programs, affiliate programs, and support services.

- Legal & Compliance – This covers AML/CFT policies, regulatory licenses, and risk warnings.

Example: If a new user wants to learn about Bitget’s compliance and regulations, they can find legal policies in the footer section.

Account Setup for Spot Trading on Bybit

Getting started with Bybit’s spot trading is simple. Here’s a step-by-step guide:

Step 1: Sign Up for a Bybit Account

New users must register by visiting Bybit’s website or downloading the Bybit app. The sign-up process requires:

- Email or mobile number

- Secure password

- Verification via email/SMS

- For example, entering [email protected] and receiving a verification code via SMS completes the initial signup process.

Step 2: Complete Identity Verification (KYC)

Bybit requires KYC verification to enhance security and comply with regulations. Users need to submit:

- Government-issued ID (passport, driver’s license, or national ID)

- Selfie verification for identity confirmation

- For example, uploading a passport and a selfie ensures higher withdrawal limits and access to all features.

Step 3: Deposit Funds into Your Bybit Account

Users can fund their accounts via:

- Crypto deposits: Transfer BTC, ETH, or USDT from external wallets.

- Fiat deposits: Buy crypto using credit cards or bank transfers.

- For instance, transferring 0.1 BTC from a personal wallet to Bybit takes a few minutes and incurs minimal fees.

Step 4: Start Spot Trading

Once funds are available, users can:

- Select a trading pair (e.g., BTC/USDT).

- Choose an order type (market, limit, or stop-loss).

- Enter trade details and confirm execution.

For example, placing a limit buy order for ETH at $2,500 ensures the trade executes only when the price matches.

Final Thoughts

Bybit Spot Trading Platform is an excellent choice for traders in 2025, offering low fees, deep liquidity, advanced security, and an intuitive interface. Whether you are a beginner or a seasoned trader, Bybit provides a powerful yet user-friendly environment for buying and selling crypto assets directly.

By following this guide, you can set up your account, explore trading features, and start executing profitable trades on Bybit. With continuous innovations and user-centric upgrades, Bybit remains a top-tier exchange for spot trading in the evolving crypto landscape.

Would you like to learn more about specific trading strategies or technical analysis on Bybit? Let me know how I can help!