As the cryptocurrency market matures, investors are increasingly faced with choosing between centralized and decentralized crypto exchanges. While both offer access to digital assets, they operate on fundamentally different models and cater to different types of users. Understanding how each works, their strengths, and their risks is essential to navigating the crypto ecosystem safely and efficiently.

In this guide, we compare centralized crypto exchanges (CEXs) and decentralized crypto exchanges (DEXs) to help you determine which platform aligns best with your trading strategy and investment goals.

What Are Centralized Crypto Exchanges (CEX)?

Definition and How They Work

Centralized exchanges are platforms operated by companies that act as intermediaries between buyers and sellers. These exchanges hold users’ funds and execute trades on their behalf. Users are typically required to register, complete KYC (Know Your Customer) processes, and trust the platform to manage their assets.

Key Features of Centralized Exchanges

- KYC/AML Compliance: Required for regulatory reasons

- High Liquidity: Large volume of buyers and sellers

- Fiat Integration: Support for credit cards, bank transfers

- Custodial Wallets: Platform holds and secures your funds

Pros and Cons of CEXs

- ✅ Beginner-friendly with intuitive interfaces

- ✅ Fast transactions with advanced trading tools

- ✅ Customer support and fiat access

- ❌ Users do not control private keys

- ❌ Centralized structure is vulnerable to hacks or restrictions

centralized vs decentralized crypto exchanges

What Are Decentralized Crypto Exchanges (DEX)?

Definition and Operating Model

Decentralized exchanges operate on blockchain protocols using smart contracts to facilitate peer-to-peer trading. There is no central authority, and users retain full control of their assets.

Key Features of Decentralized Exchanges

- Non-Custodial: You hold your private keys

- Permissionless: No KYC needed, anyone can use

- Privacy-Focused: No personal data is collected

- Interoperability: Many DEXs connect with DeFi protocols

Pros and Cons of DEXs

- ✅ Greater user control and asset privacy

- ✅ Resistant to censorship and bans

- ✅ Transparent and open-source

- ❌ Lower liquidity on some tokens

- ❌ No customer support or fiat onramps

- ❌ Potential smart contract vulnerabilities

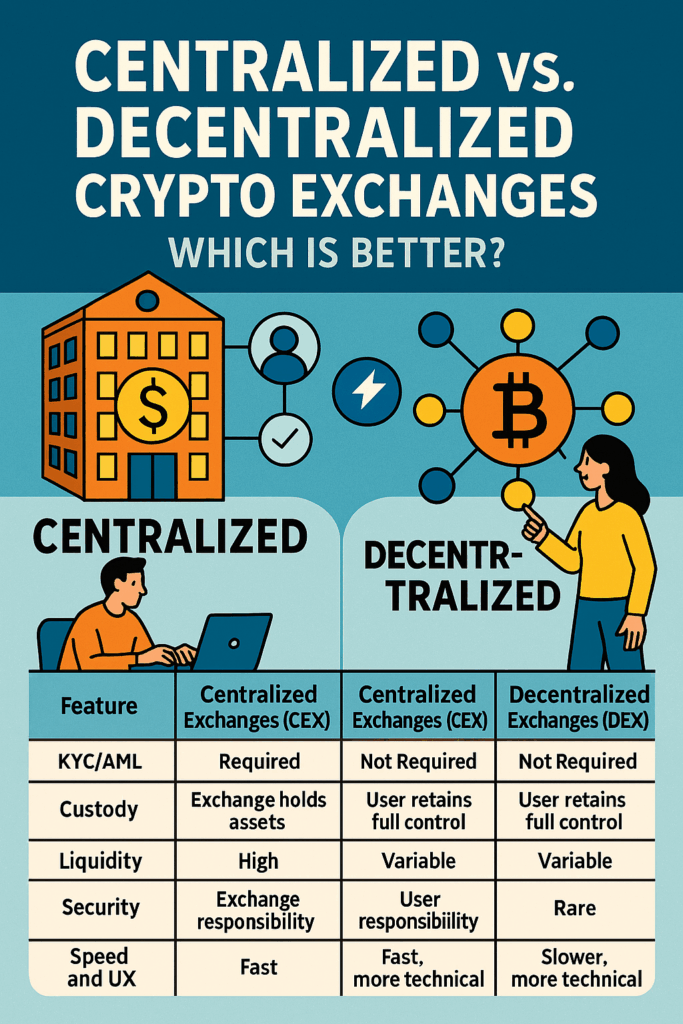

Key Comparison: Centralized vs. Decentralized Exchanges

| Feature | Centralized Exchanges (CEX) | Decentralized Exchanges (DEX) |

|---|---|---|

| KYC/AML | Required | Not Required |

| Custody | Platform-controlled | User-controlled |

| Liquidity | High | Variable |

| Fiat Support | Yes | Rare |

| Speed | Fast | Slower |

| Security | Platform-managed | User-managed |

| Privacy | Limited | Strong |

| Ease of Use | High | Moderate to Low |

| Regulation | Compliant | Often unregulated |

Which Type of Crypto Exchange Is Better for You?

Choose a Centralized Exchange if:

- You’re new to crypto and prefer a user-friendly interface

- You want access to fiat deposits/withdrawals

- You value customer service and account recovery options

Choose a Decentralized Exchange if:

- You want full control over your funds

- You value privacy and freedom from centralized control

- You’re comfortable managing wallets and understanding DeFi

Hybrid Exchanges – A Middle Ground?

Some platforms combine elements of both models. These hybrid exchanges offer users the ability to trade with both centralized liquidity and decentralized custody. Examples include:

- KuCoin: Optional KYC, custodial and non-custodial wallets

- OKX: Combines traditional trading with DeFi tools

- dYdX: Decentralized trading with professional-grade UI

Hybrid models continue to grow in popularity as users seek convenience without giving up control.

Final Verdict: Centralized or Decentralized Crypto Exchange?

There is no one-size-fits-all answer. The “better” option depends on your experience level, risk tolerance, and personal values. Centralized crypto exchanges are best for convenience and ease of use. Decentralized crypto exchanges offer greater freedom and privacy. Many investors ultimately use both to leverage the strengths of each.

Whichever you choose, ensure you understand the risks and stay informed. In the world of crypto, knowledge is your best protection.

Frequently Asked Questions

Are decentralized crypto exchanges safer than centralized ones?

They can be in terms of not being hackable at the platform level, but smart contract bugs and user errors can still result in loss.

Can I use both CEX and DEX at the same time?

Yes, many experienced users operate across both to maximize opportunities and minimize risks.

What are the risks of using decentralized exchanges?

No customer support, higher user responsibility, smart contract exploits, and potential liquidity issues.

Do decentralized exchanges require a wallet?

Yes, you need a crypto wallet like MetaMask to interact with a DEX.

Is KYC mandatory on all crypto exchanges?

Only centralized exchanges require KYC. DEXs are permissionless and anonymous.