In 2025, the demand for efficient, automated trading solutions is higher than ever. Whether you’re a retail trader looking for an edge in the market or an institutional investor managing large-scale orders, the Crypto.com Trading API provides a seamless way to execute trades, manage accounts, and integrate algorithmic strategies.

The Crypto.com API is designed to enhance trading efficiency by allowing direct interaction with the Crypto.com Exchange through REST and WebSocket APIs. This guide will explore everything you need to know about Crypto.com API Trading, including key features, setup processes, and advanced trading automation techniques.

To fully understand the power of the Crypto.com Automated API, let’s start by defining what it is and how it functions within the trading ecosystem.

What Is Crypto.com Trading API?

The Crypto.com Trading API is a comprehensive set of tools that allows developers and traders to automate trading operations, retrieve real-time market data, and manage portfolios efficiently.

By utilizing the Crypto.com API, traders gain access to a powerful system that integrates seamlessly with algorithmic strategies. This API is ideal for traders looking to automate their activities, reduce manual workload, and execute trades faster than humanly possible.

To see how the Crypto.com API Trading works in practice, let’s explore its key functions and capabilities.

Key Functions of Crypto.com API

- Automated Order Execution – Buy and sell cryptocurrencies programmatically.

- Real-Time Market Data – Access live price feeds and order book data.

- Portfolio Management – Retrieve account balances, trade history, and risk settings.

- Algorithmic Trading Support – Develop and implement custom trading bots.

Each of these functions plays a vital role in optimizing a trader’s workflow. Now, let’s dive deeper into the specific features that make the Crypto.com Automated API a must-have tool for serious traders.

Key Features of Crypto.com Trading API

The Crypto.com API is packed with advanced trading tools that give users complete control over their trading experience. It caters to both retail traders and institutional investors who need reliable execution and deep market insights.

Before integrating the API into your trading setup, it’s essential to understand the core features it offers. These features will determine how well the API fits into your automated trading strategies.

REST API & WebSocket Support

The Crypto.com API Trading system supports both REST and WebSocket protocols for seamless data access and trade execution.

- REST API – This is best suited for placing orders, retrieving trade history, and managing user accounts.

- WebSocket API – Ideal for real-time streaming of market data, price feeds, and account updates.

Multi-Market Trading Support

Unlike traditional APIs that focus solely on spot trading, the Crypto.com Trading API provides access to multiple trading markets. This flexibility enables traders to implement a range of strategies across different market conditions.

- Spot Trading – Direct purchase and sale of cryptocurrencies.

- Margin Trading – Leverage-based trading for higher profits.

- Derivatives Trading – Futures and options contracts for risk management and speculation.

High-Frequency Trading (HFT) Compatibility

For professional traders, the Crypto.com Automated API offers ultra-fast execution speeds with minimal latency. The API allows for millisecond-level trade execution, making it a strong choice for HFT strategies.

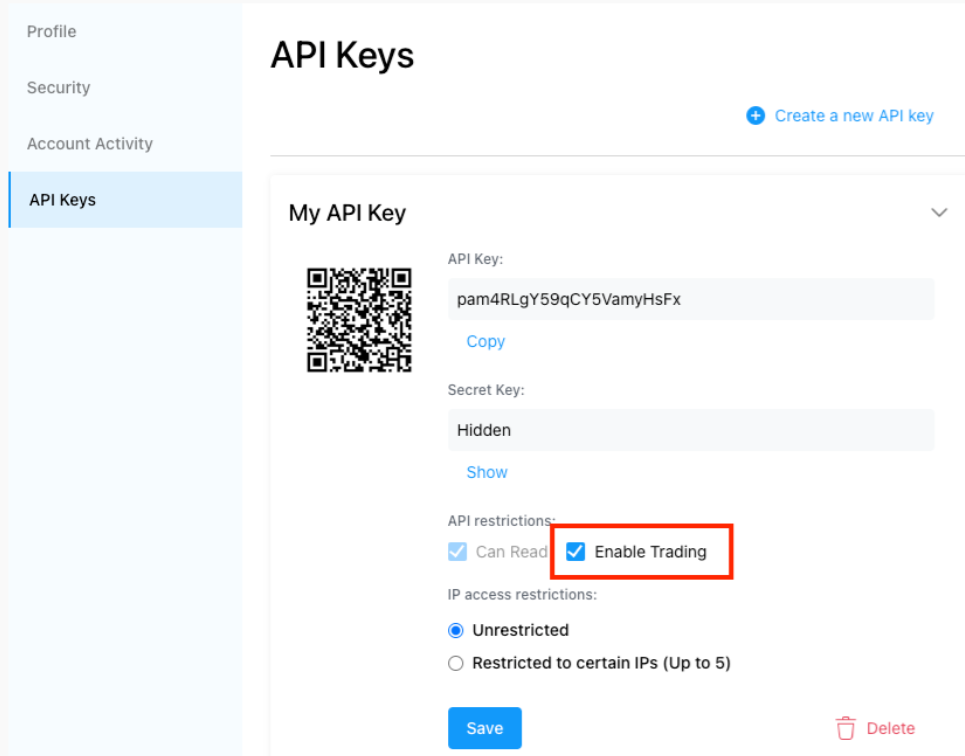

Security and API Key Management

Security is a major priority when using the Crypto.com API. The platform offers:

- API Key & Secret Key Protection – Secure authentication for API access.

- IP Whitelisting – Restrict API access to specific IP addresses.

- Custom Permissions – Define read/write permissions to enhance security.

Now that we’ve covered the powerful features of Crypto.com API Trading, let’s move on to how you can set up the API and integrate it into your trading system.

How to Set Up Crypto.com Trading API

Setting up the Crypto.com Trading API is a straightforward process, but it requires careful attention to security settings and permissions. Following these steps will ensure a smooth integration into your trading system.

Step 1: Generate an API Key

- Log in to your Crypto.com Exchange account.

- Navigate to User Center > API.

- Click Create API Key and save the API key and secret key securely.

Step 2: Configure API Permissions

- Read Access – View balances, trade history, and price data.

- Trade Access – Place buy/sell orders.

- Withdrawal Access – Transfer funds (optional).

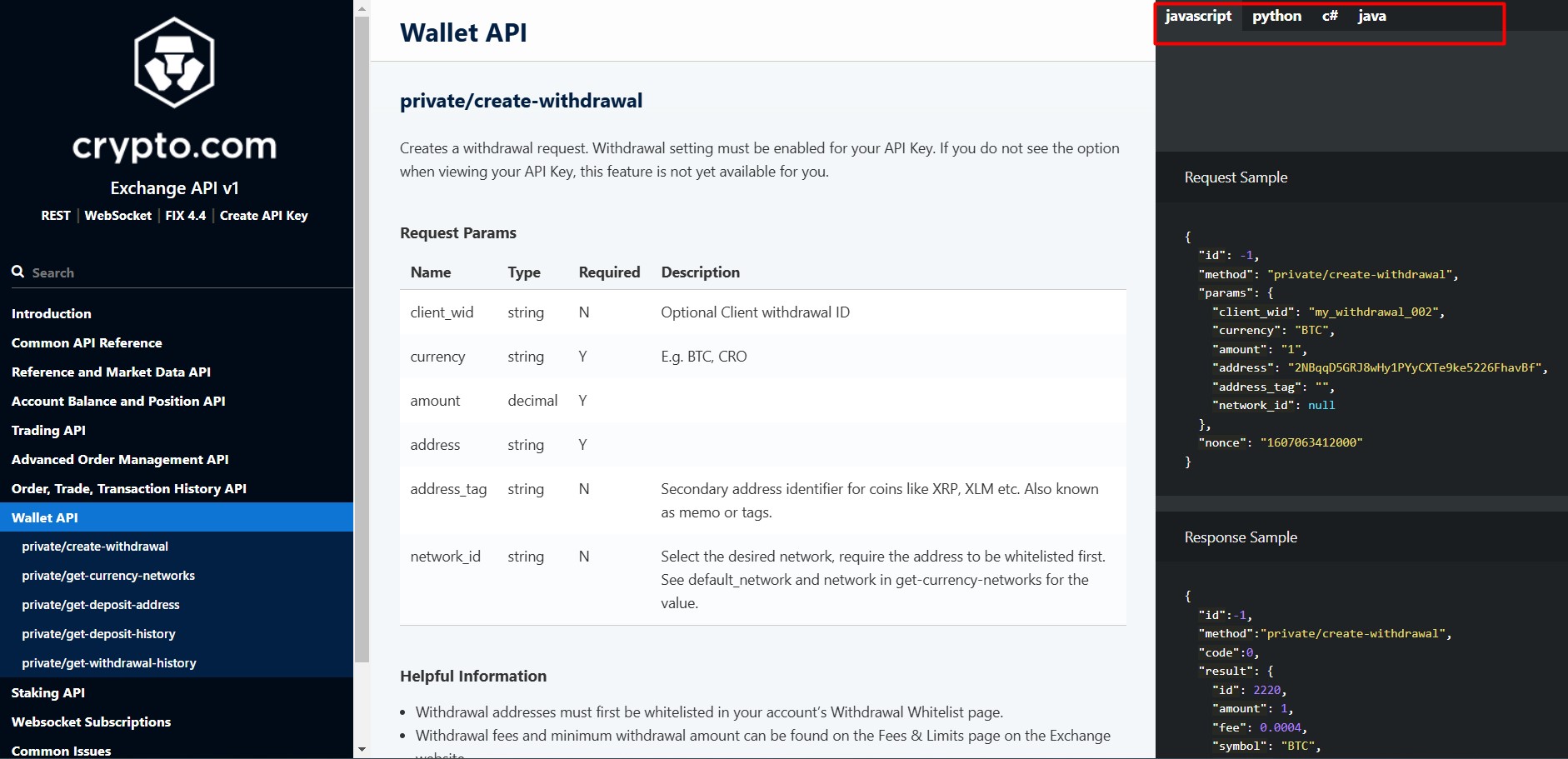

Step 3: Start API Integration

Developers can integrate the Crypto.com Trading API using languages like Python, Java, JavaScript, or C#. Sample API requests are available in the official documentation. With your API setup complete, let’s explore the most effective trading strategies that you can automate using the Crypto.com API.

Crypto.com API Trading Strategies

Automated trading strategies can significantly enhance your trading performance by eliminating emotional biases and optimizing execution speed. The Crypto.com Automated API supports a wide range of trading strategies, from market-making to arbitrage.

Market Making

Market makers place both buy and sell orders to profit from bid-ask spreads. Using Crypto.com Automated API, traders can maintain liquidity and reduce execution costs.

Arbitrage Trading

By leveraging the Crypto.com API, traders can detect price differences across exchanges and execute arbitrage trades in real time.

Trend-Following Bots

Using historical data from the Crypto.com Trading API, developers can create bots that follow market trends and place trades accordingly.

Grid Trading

Grid trading bots use the Crypto.com API Trading to automate buying and selling within predefined price ranges. To maximize the benefits of automated trading, it’s crucial to avoid common issues that traders face when using the API. Let’s discuss some troubleshooting tips.

Common Issues & Troubleshooting

Even the best APIs can run into occasional errors. The Crypto.com Trading API has built-in safeguards, but traders may still encounter rate limits or authentication issues.

TOO_MANY_REQUESTS Error

This error occurs when exceeding API rate limits. To prevent this:

- Add a 1-second delay after connecting to WebSocket.

- Optimize API calls by batching requests.

INVALID_NONCE Error

This happens when the system clock is out of sync. Solution:

Synchronize with an NTP time server.

API Key Authentication Issues

- Ensure correct API Key & Secret Key.

- Verify IP Whitelisting settings in your Crypto.com account.

To understand how the Crypto.com Trading API compares to other APIs, let’s take a look at a comparison table.

Crypto.com Trading API vs. Other APIs

When comparing the Crypto.com Trading API with other popular exchange APIs like Binance and Coinbase, several key differences stand out. Here’s how Crypto.com API Trading stacks up against its competitors:

-

Trading Support:

- Crypto.com API: Supports Spot, Margin, and Derivatives trading, making it a versatile choice for various trading strategies.

- Binance API: Offers Spot and Futures trading but lacks margin trading support.

- Coinbase API: Limited to Spot Trading only, restricting advanced strategies.

-

Execution Speed:

- Crypto.com API: Provides ultra-low latency, making it ideal for high-frequency trading (HFT).

- Binance API: This has low latency but may not be as fast as Crypto.com for institutional traders.

- Coinbase API: Operates at medium latency, potentially leading to slower order execution.

-

Security Features:

- Crypto.com API: Implements API Key authentication, IP whitelisting, and granular permission control.

- Binance API: Uses API Key authentication with IP restrictions, offering a good balance of security.

- Coinbase API: This relies on API Key authentication only, making it less customizable in terms of security.

-

WebSocket Support:

- Crypto.com API: Fully supports WebSocket connections for real-time data streaming.

- Binance API: Also provides WebSocket support for faster market data retrieval.

- Coinbase API: Offers limited WebSocket capabilities, reducing efficiency for real-time trading.

-

API Rate Limits:

- Crypto.com API: Offers high rate limits, making it more suitable for frequent API requests without throttling issues.

- Binance API: Has medium rate limits, which may be restrictive for some traders.

- Coinbase API: Imposes low rate limits, potentially causing delays for active traders.

With a solid understanding of how the Crypto.com Trading API compares to other platforms, let’s explore the future of automated trading on Crypto.com.

Conclusion

Having access to a reliable, secure, and high-performance API is essential for both retail and institutional traders. The Crypto.com Trading API stands out in 2025 as a top-tier solution for automated trading, offering ultra-low latency, robust security features, and comprehensive trading support across Spot, Margin, and Derivatives markets.

With high API rate limits, real-time WebSocket connectivity, and institutional-grade execution speed, the Crypto.com Trading API empowers traders to build sophisticated bots, execute large trades efficiently, and optimize trading strategies with minimal risk of slippage or delays. Compared to other exchange APIs, Crypto.com provides a superior balance of performance, security, and accessibility, making it an excellent choice for high-frequency trading (HFT), algorithmic strategies, and institutional-grade operations.