As crypto adoption grows, many newcomers are surprised to find that signing up for a crypto exchange often involves more than just an email address and password. Most major platforms now require Know Your Customer (KYC) verification—a process that asks users to provide identity documents before they can trade, deposit, or withdraw.

But what exactly is KYC? Why do crypto exchanges enforce it? And what are the implications for your privacy and access to global platforms?

This guide explores everything you need to know about KYC in crypto exchanges before creating your account.

What Is KYC in the Context of Crypto Exchanges?

KYC (Know Your Customer) is a regulatory process that requires financial institutions, including crypto exchanges, to verify the identity of their users. This typically involves collecting:

-

Full name and address

-

Government-issued ID (passport, driver’s license)

-

Selfie or live facial verification

-

Proof of residence (e.g. utility bill or bank statement)

KYC procedures are part of global Anti-Money Laundering (AML) frameworks designed to prevent illicit activities such as:

-

Money laundering

-

Terrorist financing

-

Fraudulent trading or identity theft

Why Do Crypto Exchanges Require KYC?

While cryptocurrency began as a decentralized and privacy-driven system, mainstream adoption and government pressure have led most centralized crypto exchanges (CEXs) to enforce KYC policies.

Reasons include:

-

Regulatory compliance in countries like the U.S., UK, EU, and Japan

-

Banking and payment integration (fiat onramps require ID verification)

-

Fraud prevention and account recovery

-

Trust-building for institutional investors

Exchanges like Coinbase, Kraken, and Binance all require KYC to access full functionality.

What Information Do Crypto Exchanges Collect?

While exact requirements vary by country and platform, most crypto exchanges collect the following:

| Required Information | Purpose |

|---|---|

| Full name | Identity verification |

| Date of birth | Legal age check |

| Government ID | Proof of legal identity |

| Address & proof | Residence verification |

| Facial image | Live photo to match documentation |

Some exchanges may also request source of funds or income declaration for higher withdrawal limits.

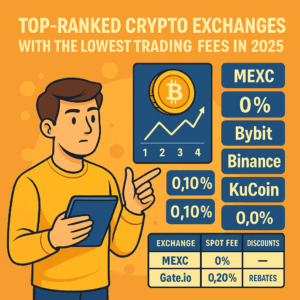

Are There Crypto Exchanges Without KYC?

Yes—primarily decentralized exchanges (DEXs) and some offshore platforms.

Examples:

-

Uniswap, PancakeSwap – No registration or KYC

-

MEXC – Offers limited services without full KYC

-

Gate.io – Allows some features pre-KYC, but withdrawals are capped

However, non-KYC exchanges may have lower legal protection, limited fiat support, and increased risk.

Pros and Cons of Using KYC-Compliant Exchanges

✅ Pros:

-

Higher withdrawal and trading limits

-

Access to fiat deposits/withdrawals

-

Enhanced account recovery and support

-

Complies with regional regulations

❌ Cons:

-

Reduced privacy (ID linked to wallet activity)

-

Risk of data breaches and leaks

-

Exclusion of users from certain countries

-

Slower onboarding process

How to Complete KYC Safely on Crypto Exchanges

-

Use reputable exchanges with transparent privacy policies

-

Ensure the website uses HTTPS encryption

-

Avoid public Wi-Fi when uploading sensitive documents

-

Check jurisdiction – Prefer platforms operating in regulated environments

-

Use unique passwords and enable 2FA (two-factor authentication)

Is KYC Here to Stay in Crypto?

Yes. With global regulatory tightening, KYC is becoming the standard for centralized crypto exchanges. While privacy-focused users may still prefer DEXs or KYC-light platforms, most investors seeking security, support, and legal clarity will need to undergo identity verification.

Exchanges that fail to comply risk being banned or losing banking relationships.

Conclusion

KYC has become a core feature of the crypto exchange landscape. While it goes against the early ethos of crypto anonymity, it plays a key role in bringing digital assets into regulatory frameworks.

Before signing up, understand what information you’re sharing and why. For maximum control, consider using decentralized exchanges for simple swaps and centralized platforms for fiat access and large-scale trading—with your privacy, security, and compliance needs in mind.