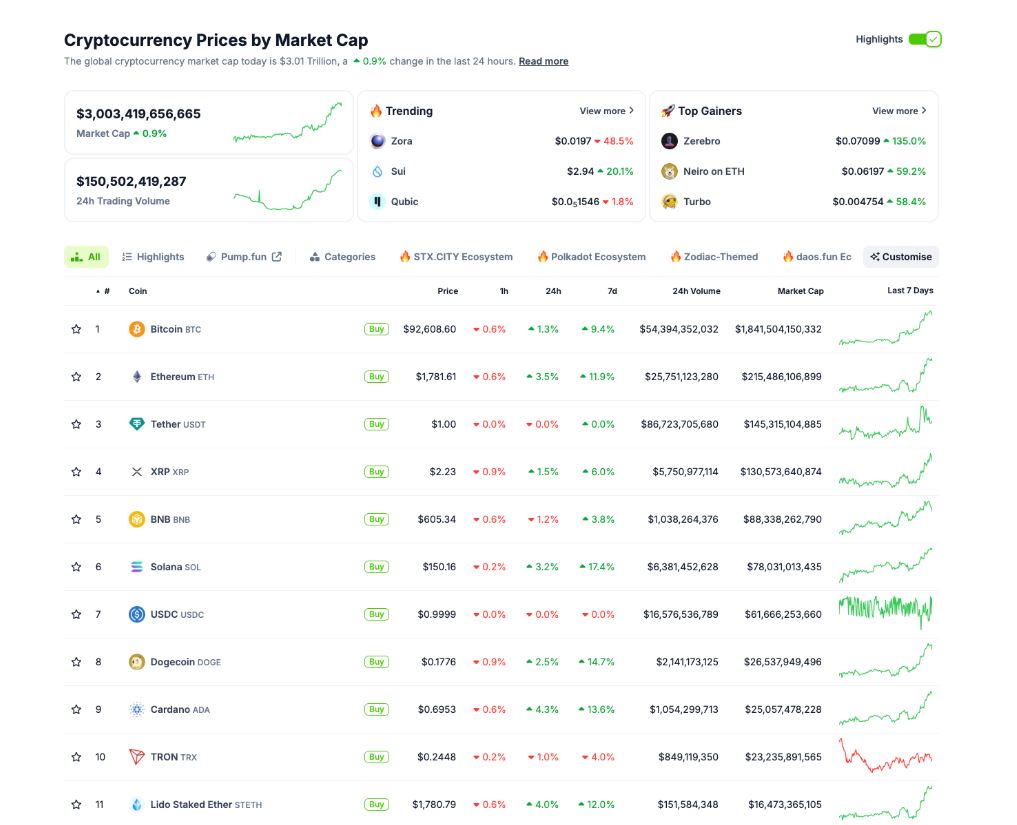

The cryptocurrency market is on fire this week. On Wednesday, the total market capitalization rose by 1%, crossing $3 trillion for the first time in April. This move shows strong investor confidence in both Bitcoin and altcoins.

Bitcoin Hits New Highs

Bitcoin (BTC) continues to lead the market. On Wednesday morning, the price jumped 4% to reach $94,200. This marks the third day in a row that BTC has hit a new all-time high.

This rally started earlier in the week and has been fueled by strong buying from institutional investors. Many believe the rise in Bitcoin’s price is linked to growing uncertainty in traditional markets and the return of Donald Trump’s administration, which favors crypto-friendly policies.

Bitcoin ETFs Break Records

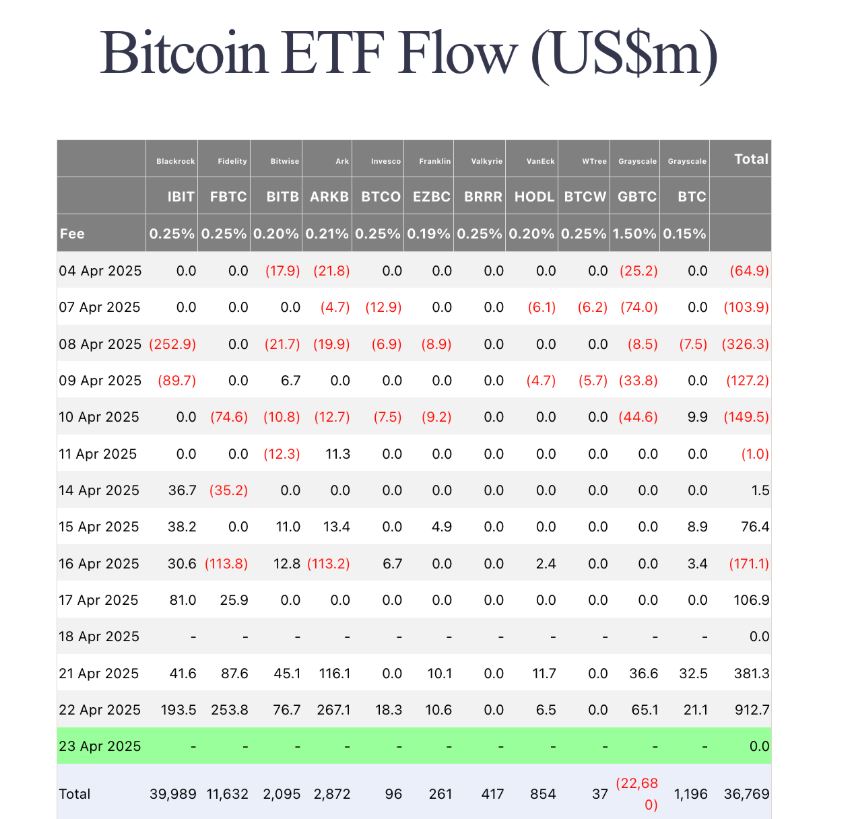

One of the biggest drivers of Bitcoin’s rally is the growing popularity of Bitcoin ETFs.

On Tuesday, Bitcoin ETFs recorded $921 million in single-day inflows — the highest since the U.S. Securities and Exchange Commission (SEC) approved them in January 2024.

Among the funds, Ark Invest’s ARKB led the way with $267 million in net deposits. Fidelity’s FBTC followed with $253.8 million, while BlackRock’s IBIT came in third with $193.5 million.

This large movement of funds into Bitcoin ETFs shows that big investors are entering the crypto space. Many are pulling money out of U.S. stocks due to trade war fears and shifting it into digital assets like BTC.

Altcoins Join the Rally

Bitcoin isn’t the only winner this week. Altcoins are also showing strong performance. One of the standout tokens is SUI.

SUI surged more than 20% in 24 hours. This sharp move makes it one of the top-performing mid-cap tokens. The rally seems to be driven by developer activity and fresh announcements from the SUI ecosystem.

Investors are showing strong interest, and the price jump is supported by high trading volumes.

Cardano also performed well. ADA rose 4.3% on Wednesday and has gained more than 13% over the past week.

The rise in Cardano’s price is linked to its upcoming scaling upgrades and a growing presence in decentralized finance (DeFi). ADA is now close to $1 — a key resistance level last seen in mid-March.

With trading volume increasing, many analysts expect the bullish trend to continue.

Ethereum (ETH), the second-largest cryptocurrency by market cap, rose 3.5% to trade near $1,782.

Despite facing challenges like scaling issues and competition from Solana (SOL), Ethereum has regained strength. The bounce-back is driven by renewed interest in DeFi staking and steady demand from both retail and institutional investors.

However, not all altcoins joined the rally. Binance Coin (BNB) and Tron (TRX) fell slightly, with losses around 2%. This shows that while market sentiment is improving, investors are still cautious and selective.

SEC Cracks Down on Crypto Fraud

In other news, the U.S. SEC is taking action against crypto fraud.

On Tuesday, the SEC filed charges against Ramil Palafox, the founder of PGI Global. The agency claims Palafox ran a fake investment scheme that raised nearly $198 million from investors around the world.

According to the SEC, over $57 million of investor money was used for personal purchases, including several luxury items and Lamborghini cars. The scheme operated like a Ponzi, using money from new investors to pay old ones.

The SEC wants the court to ban Palafox from future securities activities and make him return the stolen money with interest. Civil penalties are also being considered.

Gate.io Promises to Reimburse Futures Users

Meanwhile, crypto exchange Gate.io is addressing a recent service issue.

The platform announced it will fully compensate users who suffered losses during a sudden system upgrade on its futures trading platform. The upgrade was triggered by a traffic spike and caused a temporary suspension of futures and copy trading services.

However, spot trading, deposits, and withdrawals continued as normal. The company has now restored all affected services and assured users that compensation will be offered for any system-related losses. Losses due to market price changes will not be covered.

Details about how the compensation will be calculated and distributed are expected soon.

Final Thoughts

The crypto market is having a strong April. Bitcoin’s price surge above $94,000 has brought back excitement and new investors. At the same time, altcoins like SUI and Cardano are showing impressive gains.

Bitcoin ETFs continue to attract large sums of capital, highlighting the growing role of institutional players in the market. While not all coins are rising, the general trend remains positive.

On the legal front, the SEC continues to clean up the crypto space by targeting fraud. Meanwhile, platforms like Gate.io are taking user responsibility seriously during technical failures.

As we move further into 2025, all eyes will be on how long this bullish momentum can continue — and which tokens will lead the next wave.