After a period of market uncertainty, confidence is returning to the crypto space. The rebound started when Donald Trump announced a pause on proposed tariffs. This news gave investors hope and pushed crypto prices higher. Now, crypto whales are back in action, and they’re buying select altcoins.

These large investors are often early movers, and their choices can reveal which coins have real potential. In this post, we’ll look at the top three altcoins crypto whales are buying right now and why.

MANTRA (OM): A Risky Bet or a Smart Move?

OM, the token of the MANTRA ecosystem, saw a major price crash this week. On April 13, OM dropped by 90% in a single day, falling from $6 to just $0.64. The sudden drop caused panic and sparked rumors of a possible rug pull.

Many blamed the project’s developers, but the team denied any wrongdoing. To calm the community, they announced a recovery plan. This includes burning part of their token supply and launching a buyback program. These efforts aim to reduce supply and build confidence.

Despite the crash, some investors saw an opportunity. On-chain data from Santiment shows that crypto whale addresses holding between 100 million and 1 billion OM tokens increased their holdings.

- On April 13, these whales held 300 million OM.

- As of today, that number has grown to 430 million OM.

At OM’s current price of $0.64, this holding is worth about $275 million. That’s a strong signal that crypto whales are buying the dip.

If this accumulation trend continues, OM could bounce back above $1 soon. But if whale interest fades, the token could fall even lower.

Uniswap (UNI): A DeFi Giant at a Discount

Uniswap is one of the most well-known decentralized exchanges (DEXs) in the crypto world. Its native token, UNI, is used for governance and plays a key role in the platform’s ecosystem.

This year, UNI’s price has dropped by 60%. It’s now trading around $5, down from highs earlier in the year. But some crypto whales see this as a buying opportunity.

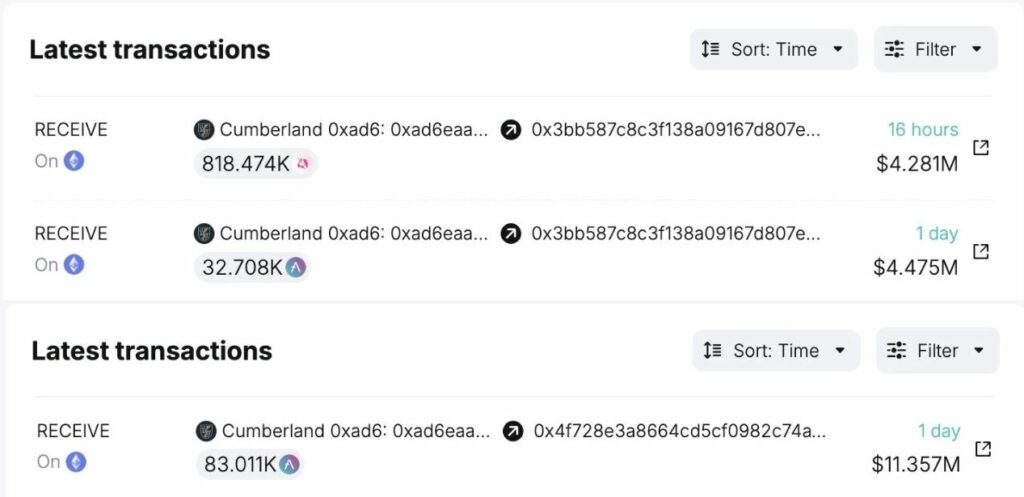

On April 17, data from Spot On Chain showed that a whale bought 818,474 UNI tokens. That’s worth over $4 million.

This same investor also picked up AAVE, another DeFi token. This signals renewed interest in decentralized finance (DeFi) after a long decline.

If demand keeps growing, UNI could double in price and reach $10 in the short term. But if momentum slows, it might revisit its yearly low.

Crypto whales often look for value, and a 60% drop makes UNI an attractive target. It’s a high-risk, high-reward situation.

Threshold Network (T): Quiet but Gaining Strength

Threshold Network’s token, T, is another coin on whales’ radar. The project offers cross-chain liquidity for Bitcoin, allowing users to move assets more freely across blockchains.

In the last 24 hours, T’s price jumped by nearly 50%. This surge followed a major move by Apollo Capital. The asset manager bridged $227,000 into TBTC, a wrapped Bitcoin token powered by Threshold Network.

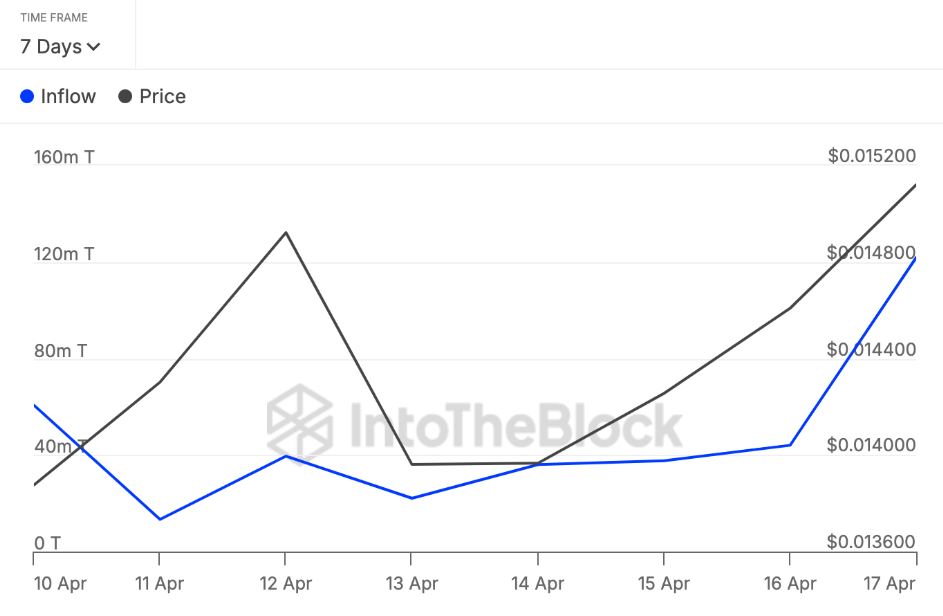

This caught the attention of other big players. According to IntoTheBlock, crypto whale inflows into T rose sharply over the past three days:

- Whale holdings jumped from 44 million to 121 million T tokens.

- That’s nearly $2 million worth of new investments.

This type of action usually signals confidence in a project. If the inflows continue, T could rise even higher. But like the others, it also faces risk if crypto whales start to sell.

Why Whales Matter

Crypto whales are individuals or entities that hold large amounts of cryptocurrency. Their actions can move the market. When they buy a coin in large quantities, it often leads to a price increase. On the other hand, when they sell, it can cause sharp drops.

Whales are usually early to trends. They have access to research, tools, and connections that smaller investors may not. Following their movements can give insight into which coins might be next to rise or fall.

A Rebound After the Bottom?

Many experts believe the crypto market may have found a local bottom. Prices across the board are recovering, and confidence is improving. The recent pause in U.S. tariff plans added to this optimism, creating a short-term relief rally.

This bounce has provided crypto whales with a chance to buy coins at lower prices. They are choosing coins with strong fundamentals, clear roadmaps, and active communities.

OM, UNI, and T are three examples. Each has had its challenges, but all are now seeing whale interest.

What Investors Should Watch

If you’re a retail investor, this is a good time to watch the market closely. Crypto whale activity can provide hints about where prices might go next. But remember, large holders can also exit quickly, and their moves can be unpredictable.

Here are a few tips:

- Keep an eye on on-chain data to track big wallet movements.

- Don’t invest based only on what whales are doing.

- Look at a coin’s use case, community support, and development progress.

- Have a risk management plan.

The crypto market is bouncing back, and crypto whales are taking action. OM, UNI, and T are three altcoins seeing large buying activity right now. These coins have potential for gains, especially if the broader market continues to recover.

However, as always, crypto investments carry risk. Prices can be volatile, and what crypto whales do today may change tomorrow.

Stay informed, do your own research, and invest wisely.