As June 2025 unfolds, Ethereum (ETH) is flashing strong bullish signals backed by key on-chain activity and market momentum. While the token has dipped slightly to around $2,630, it’s still up 40% over the past month. This puts ETH among the top-performing digital assets recently, right next to memecoins like PEPE and DeFi giants like AAVE.

ETH Rides Institutional Momentum and Layer-One Optimism

March Zheng, co-founder and managing partner at Bizantine Capital, has gone all-in on ETH. According to him, Ethereum is ready to reclaim its position as the leading layer-one blockchain. The reasons? Superior scalability and improved fundamentals compared to rivals like Solana.

Zheng believes the recent Pectra upgrade is a turning point. It significantly boosts Ethereum’s performance, making it more attractive for developers and investors alike. ETH also continues to maintain a lower inflation rate than Bitcoin, another bullish factor.

“It may be reaching an inflection point where both of these leads continue to grow,” Zheng told CoinDesk. “It will be a very interesting year.”

But not everyone is convinced just yet. Data from prediction market Polymarket shows only a 26% probability that ETH will break its all-time high of $4,868 from November 2021 this year.

Exchange Balances Drop as Long-Term Accumulation Grows

Despite market doubts, Ethereum continues to attract institutional attention. CoinDesk’s Market Insight Bot reports that ETH holdings on exchanges have fallen to their lowest levels in seven years. At the same time, ETH-focused investment products are seeing heavy inflows. This suggests that major players are buying and holding — a classic sign of long-term bullish sentiment.

Ethereum’s Total Value Locked (TVL) has also surged, now exceeding $60 billion. Much of that rise is credited to strong performances by DeFi protocols like AAVE.

While Ethereum thrives, another major blockchain trend is showing cracks, decentralized artificial intelligence (AI).

In 2025, AI-related tokens have become a hot market segment. Their combined value now exceeds $27 billion, according to CoinGecko. However, infrastructure challenges are starting to limit the sector’s real-world adoption.

Teng Yan, an analyst from the blockchain AI research firm Chain of Thought, recently shared a detailed critique on X (formerly Twitter). He argues that Decentralized Compute Networks (DCNs), the backbone needed for decentralized AI, simply aren’t ready for enterprise use.

Weak Infrastructure Holding Back Decentralized AI

Recent rankings from Semianalysis (March 2025) paint a bleak picture. When listing top GPU cloud providers, only two decentralized names made the list — Akash and Prime Intellect, both at the bottom. Most others didn’t even rank.

This exposes a core weakness: coordination. Unlike centralized giants like AWS and Google Cloud, decentralized compute providers still struggle with job routing, data transfer, and fault tolerance.

Enterprises need stability. They’re used to orchestration tools like Kubernetes and Slurm, which decentralized platforms can’t yet match in functionality or reliability.

Moreover, most DCNs lack important certifications such as SOC2 and ISO 27001. As a result, they face problems with network stability, storage consistency, and latency. Security remains a major concern.

Yan also notes that current platforms often suffer from clunky dashboards, confusing payment models, and poor user onboarding. This fails the “spin-up-and-scale” standard that enterprise customers demand.

Token-Based Models Risk Long-Term Collapse

Another concern is the economic structure of decentralized AI. Many DCNs rely heavily on token incentives to attract users and computing power. This isn’t sustainable in the long run.

For example, Aethir’s ATH token surged 70% over the past month. While this boosts short-term excitement, it raises red flags for inflation if cloud services are priced in the token itself. If incentive emissions slow, the entire network may collapse from within.

Yan argues that DCNs don’t need to fully replace AWS. But to be competitive, they must become stable, cost-efficient, and user-friendly. Until then, decentralized AI will remain tied to centralized infrastructure.

Trump Organization Denies Connection to $TRUMP Wallet

In other news, crypto-related headlines turned political once again. A newly launched crypto wallet named the “$TRUMP Wallet” has caused controversy after claiming ties to the Trump family. But the Trump Organization has now officially denied any involvement.

A spokesperson said the group “knows nothing” about the project, contradicting previous claims made by Magic Eden CEO Jack Lu, who had announced a partnership publicly.

Donald Trump Jr. and Barron Trump have both said the family has no connection to the wallet. Trump Jr. did mention that an official wallet may eventually launch through a separate initiative called World Liberty Financial, a stablecoin project already associated with the family.

Meanwhile, the $TRUMP Wallet website remains active, inviting users to a waitlist but offering few technical details. This confusion adds to a growing list of crypto-related controversies involving the Trump name, including Trump Coin and Melania Coin.

Revolut Eyes Crypto Derivatives Market

Meanwhile, fintech firm Revolut is moving toward a major expansion into crypto derivatives. A new job listing reveals that the company is looking for a general manager to lead and grow this segment.

Revolut has already rolled out its professional-grade crypto exchange, first launched in the U.K. in May 2024 and later expanded into the European Union.

This move aligns with the U.K.’s rising interest in regulated crypto derivatives. For example, GFO-X, the country’s first FCA-approved platform for crypto derivatives, has launched successfully. Galaxy Digital’s U.K. unit, led by Mike Novogratz, also gained FCA approval in April 2025 and is preparing to compete.

- Bitcoin (BTC): Up 2%, trading above $105,000, supported by MicroStrategy’s $84 billion investment plan.

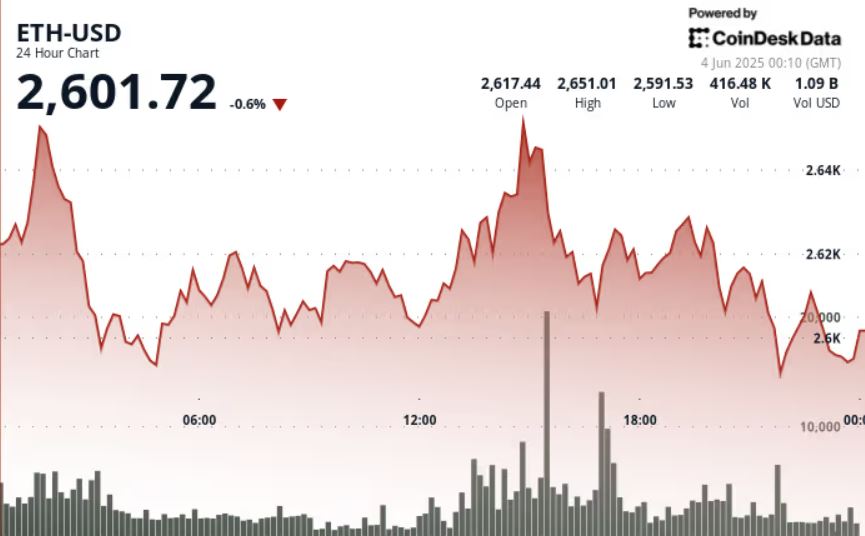

- Ethereum (ETH): Showing strong support near $2,618–$2,620, with resistance at $2,651.

- Gold: Dropped 0.51% to around $3,356/oz, due to a stronger U.S. dollar and rising job openings.

- Nikkei 225: Rose 0.83% on Wednesday, led by tech-driven gains in Asia following a strong performance by Nvidia on Wall Street.

- S&P 500: Increased 0.58% to 5,970.37, driven by optimism over trade deals and Deutsche Bank’s upgraded year-end target of 6,550.

Conclusion

Ethereum’s bullish signals are hard to ignore. With exchange supply shrinking and institutional interest growing, ETH may be gearing up for a major breakout. But at the same time, the limitations of decentralized AI reveal that blockchain success still depends heavily on real-world execution, not just token prices.

As investors evaluate opportunities, the difference between hype and usability is becoming more critical than ever in the evolving crypto landscape.