Bybit continues to solidify its position as one of the leading platforms for derivatives trading in 2025, with an ever-growing suite of features designed to enhance the trading experience. Its innovative platform is tailored to cater to both new and experienced traders with its clean interface, robust tools, and advanced capabilities. The platform’s user interface (UI), diverse order types, and API integration make it an ideal choice for traders looking for efficiency and flexibility in cryptocurrency derivatives trading.

In this article, we’ll delve into the key Bybit platform features for derivatives trading, exploring everything from the User Interface Overview and the various Order Types to API Trading Capabilities. Understanding these features and knowing how to leverage them is critical for traders who wish to navigate the world of derivatives trading efficiently and effectively in 2025.

User Interface Overview

The user interface (UI) is the gateway to a trader’s experience on Bybit. The ease with which a trader can navigate the platform directly impacts their ability to execute trades efficiently and manage their positions effectively. As such, Bybit’s UI is designed to be simple yet powerful, balancing ease of use with a wealth of trading tools.

Clean and Organized Layout

Bybit’s UI is designed for both beginner and experienced traders. Upon logging into the platform, traders are presented with a clean and intuitive dashboard that consolidates essential information in one place. The dashboard provides a quick overview of the user’s account balance, available margin, and open positions. Traders can access the trade history, open orders, and wallet balances without needing to navigate away from the main screen.

The market section is prominently displayed, providing an overview of available trading pairs. Bybit also allows users to set up a watchlist of markets, enabling them to easily track their favorite assets. Traders can quickly jump between markets such as BTC/USDT, ETH/USDT, and others to check real-time prices and volatility, which is especially important for derivatives traders who must react quickly to price movements.

Advanced Market Charting Tools

The charting interface is one of the most critical parts of Bybit’s UI for derivatives traders. Bybit integrates advanced charting features that give traders the ability to conduct in-depth technical analysis. The platform offers interactive charts that allow users to zoom in and out of various time frames, from seconds to days, providing flexibility in trade timing.

Key technical indicators like Moving Averages (MA), Relative Strength Index (RSI), MACD, Bollinger Bands, and Fibonacci retracements are readily available. Bybit also supports the use of custom indicators and drawing tools, such as trend lines, support/resistance levels, and channels, which help traders make more informed decisions. These charting tools can be easily customized, enabling traders to build a personalized charting layout that fits their analysis style.

For traders who prefer a more professional or granular approach to market analysis, Bybit supports integration with popular trading platforms like TradingView, offering more comprehensive charting features that can complement Bybit’s built-in tools.

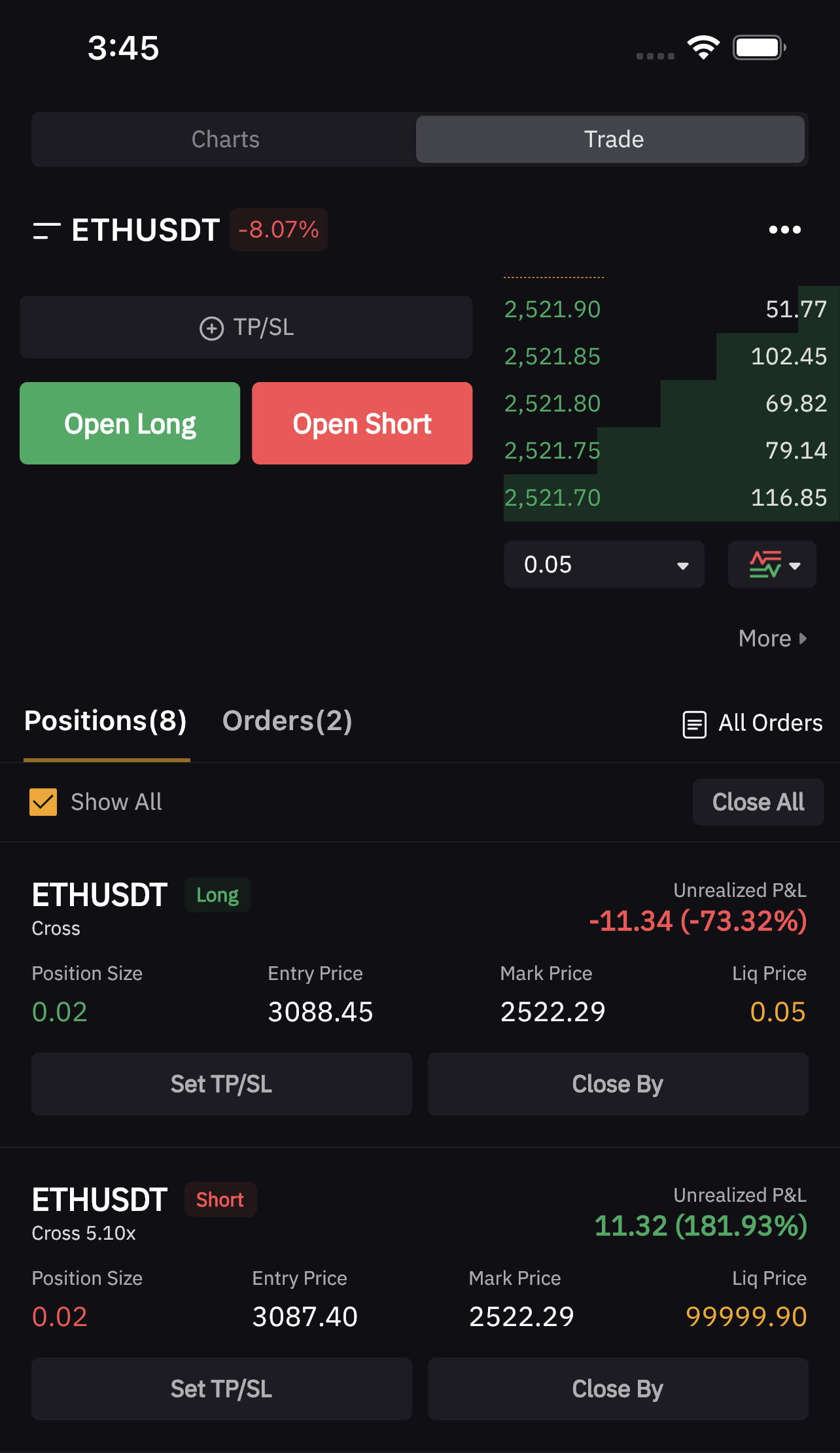

Easy Access to Open Orders and Positions

On the right-hand side of the screen, Bybit displays all relevant information regarding open positions and orders, including order size, price levels, and liquidation points. Traders can place, manage, and modify orders directly from this area. The platform also gives real-time updates on the status of active orders, such as whether they are filled, partially filled, or still pending.

One notable feature of Bybit’s UI is the ability to place conditional orders. Traders can set these orders to automatically execute when specific price conditions are met, allowing for greater flexibility when managing trades. Bybit’s stop-loss and take-profit functionality is also easily accessible via the main screen, allowing traders to quickly set risk management parameters.

Mobile Trading Interface

In addition to the desktop version, Bybit offers a highly optimized mobile app that brings the same user experience to smartphones and tablets. The mobile interface mirrors the desktop version in terms of layout, ensuring that traders can monitor the markets, manage their positions, and execute trades no matter where they are. The mobile app is particularly useful for traders who prefer to stay connected and make trades on the go.

Order Types Explained: Tailoring Your Strategy with Precision

Understanding the different order types available on Bybit is essential for optimizing your derivatives trading strategy. Bybit provides a variety of order types that allow traders to manage entry points, exits, and risk effectively.

Market Orders

A market order is the most basic and common order type. It allows traders to buy or sell an asset at the best available price in the market. Market orders are typically used when traders want to execute trades quickly, regardless of small price fluctuations.

For example, if a trader wants to buy 1 BTC and the current price is $50,000, the order will execute immediately at the best available price close to $50,000. However, due to market volatility, the final price may be slightly higher or lower than the expected entry point.

Limit Orders

A limit order is placed to buy or sell an asset at a specified price. This order type provides more control over entry and exit points compared to a market order, as the trader determines the price at which they are willing to buy or sell.

For instance, if a trader wants to buy Bitcoin at $48,000 but the current price is $50,000, they can set a limit buy order at $48,000. This order will only execute once the price reaches the specified level. Limit orders are ideal for traders who want to control the price at which they enter or exit a position but may have to wait for the market to move in their favor.

Stop Loss Orders

A stop-loss order is crucial for managing risk in derivatives trading. It automatically triggers the closure of a position once the market reaches a specific price level, helping traders minimize losses if the market moves against them.

For example, if a trader buys Bitcoin at $50,000 and places a stop loss at $48,000, the position will be closed if the price drops to $48,000, limiting the loss to $2,000. Traders can use stop-loss orders in conjunction with other order types to protect profits or reduce potential losses.

Take Profit Orders

A take-profit order allows traders to lock in profits by automatically closing a position when the price hits a predefined target. This order type ensures that traders capture profits before the market has the chance to reverse.

For instance, if a trader enters a long position at $50,000 and sets a take-profit order at $55,000, the position will automatically close when the price reaches $55,000, securing the trader’s profit.

Trailing Stop Orders

A trailing stop order is a dynamic order type that automatically adjusts as the market moves in the trader’s favor. As the price rises, the trailing stop moves along with it, locking in profits. If the price reverses, the position is closed at the trailing stop level.

For example, if Bitcoin rises to $55,000, and the trader has set a trailing stop of $1,000, the stop will automatically adjust to $54,000. If the price falls to $54,000, the position will close, ensuring the trader locks in a profit of $4,000.

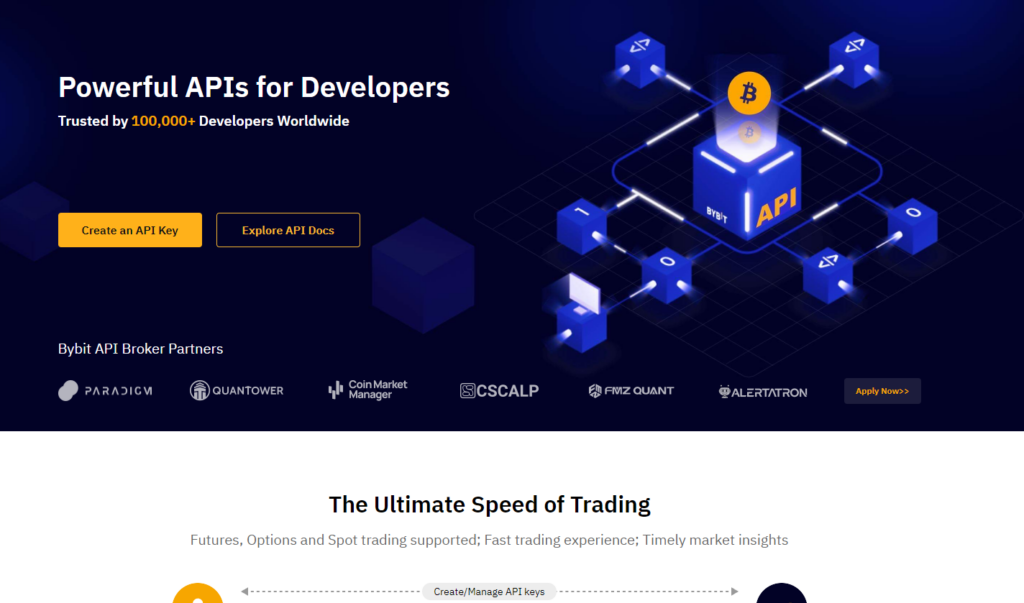

API Trading Capabilities

For traders who want to automate their trading strategies, Bybit offers powerful API trading capabilities. API (Application Programming Interface) allows traders to build custom algorithms and trading bots to interact with the Bybit platform, enabling automated trading 24/7.

How API Trading Works

Bybit’s API allows developers to connect to the platform’s systems to automate order execution, track market data, and manage risk. Traders can set up automated strategies based on pre-set conditions, using various technical indicators, price levels, and other market data points. The flexibility provided by the API allows for customized strategies, offering significant advantages over manual trading.

Key Features of Bybit’s API

- Order Placement and Management: Traders can use the API to place, modify, or cancel orders without having to manually interact with the platform.

- Real-Time Market Data: The Bybit API provides real-time market data, including order book information, trade history, and price updates, allowing traders to make informed decisions based on the latest market movements.

- Risk Management Tools: API trading also allows for the integration of risk management parameters such as stop-loss and take-profit orders, automatically adjusting positions based on predefined rules.

- Backtesting and Simulation: Developers can use the API to backtest strategies, testing them against historical market data to see how they would have performed in the past. This is a powerful feature for ensuring that automated strategies are sound before deploying them with real funds.

- Speed and Efficiency: Bybit’s API offers high-speed execution, crucial for traders who need to capitalize on fleeting opportunities in the fast-paced world of derivatives trading. Automated trading via the API can handle a much larger volume of trades compared to manual trading, reducing human error and increasing trading efficiency.

Mastering Derivatives Trading with Bybit’s Features

Bybit’s platform is designed to provide traders with the tools they need to succeed in derivatives trading, whether they are beginners or professionals. Bybit’s user interface, comprehensive order types, and advanced API trading capabilities are integral to providing a seamless and efficient trading experience.

Bybit’s user interface stands out for its simplicity and accessibility, allowing traders to focus on executing strategies rather than struggling with a complex layout. The platform’s order types offer the flexibility to manage positions and risk effectively, while the API integration makes it possible for traders to automate their strategies and trade with greater precision and efficiency.

As cryptocurrency derivatives trading continues to grow in popularity, Bybit remains at the forefront by offering features that cater to the diverse needs of traders. Whether you’re new to derivatives trading or a seasoned professional, Bybit provides the tools necessary for navigating the market and achieving success.