Margin Trading can be an exhilarating yet complex aspect of financial markets. It permits traders to control larger positions with a smaller amount of capital, effectively leveraging their investments to enhance returns. However, this increased buying power comes with greater risks, making it essential for traders to fully understand the mechanisms behind margin trading before participating.

What is Margin Trading?

Gate.io margin trading is a financial strategy that allows investors to borrow money from a broker or exchange to trade assets at a higher volume than they could afford using only their own capital. By leveraging borrowed funds, traders aim to maximize potential returns, but this comes with increased risk. Let’s dive deeper into how it works, the key concepts involved, and the risks and rewards associated with it.

How Margin Trading Works

To engage in Gate.io margin trading, a trader deposits an initial amount known as margin with their broker. This margin serves as collateral for the borrowed funds. Depending on the broker’s or platform’s policy, the trader may be allowed to borrow multiple times the value of their margin deposit, known as leverage. For example, with a leverage of 5:1, a trader can control $50,000 worth of assets with only a $10,000 deposit.

The borrowed amount is used to open a position in an asset. If the price of that asset rises and the position is profitable, the trader can repay the loan and keep the remaining profits. However, if the price drops and the position moves against the trader, losses can quickly accumulate. In some cases, the broker may issue a margin call, requiring the trader to either deposit more funds or close the position to prevent further losses.

Key Terms in Margin Trading

To effectively navigate the complex landscape of Gate.io margin trading, it is crucial to familiarize yourself with specific terminology that is commonly utilized in this domain. Understanding these terms will not only deepen your comprehension but also enable you to make well-informed decisions as you participate in trading activities. Below are some essential concepts that every trader should be aware of:

- Leverage: This term refers to the use of borrowed capital to increase the potential return on investment. In Margin Trading, leverage is expressed as a ratio, indicating how much money a trader can control relative to their own funds. For instance, if a trader has a leverage ratio of 10:1, it means they can trade ten times the amount of their own capital. While leverage can amplify profits, it also significantly increases the risk of losses, making it crucial for traders to use it judiciously.

- Margin Call: A margin call occurs when the value of a trader’s account falls below the broker’s required minimum equity level. In such situations, the broker will issue a request for the trader to deposit additional funds into their account to restore the necessary margin balance. If the trader fails to meet this demand, the broker may take action to close out positions to mitigate further losses. Understanding margin calls is vital, as they can happen quickly and unexpectedly, especially in volatile markets.

- Liquidation: This process involves the broker selling off a trader’s open positions when their account equity drops below the required margin threshold. Liquidation serves as a protective measure for brokers to recover the funds they have lent to traders. When liquidation occurs, the trader may incur significant losses, as their positions are closed at current market prices, which may be unfavorable. Being aware of the liquidation process is crucial for traders, as it underscores the importance of maintaining sufficient equity in their accounts.

Grasping these fundamental terms is of utmost importance for anyone interested in participating in Gate.io margin trading, particularly in the dynamic and often unpredictable realm of cryptocurrencies. The fast-paced nature of this market demands that traders not only understand these concepts but also stay vigilant about their implications. By doing so, traders can better manage their risks and enhance their overall trading strategies, ultimately leading to more successful outcomes in their trading endeavors.

Risks Associated with Gate.io Margin Trading

The allure of increased profits through leverage must be balanced with the inherent risks involved in Margin Trading. Since you are trading with borrowed funds, a small adverse movement in the asset price can result in significant losses.

Traders should be wary of potential pitfalls such as over-leveraging, which occurs when one borrows too much relative to their actual capital, leading to quick liquidation. Additionally, insufficient risk management strategies can exacerbate losses, making it vital for traders to apply effective risk management techniques, like stop-loss orders.

Getting Started with Gate.io Margin Trading

Gate.io margin trading is a well-known cryptocurrency exchange that offers a comprehensive platform for margin trading. To begin, it’s crucial to understand the platform’s requirements and the steps needed to set up your account for successful trading. Let’s explore each stage in detail.

Setting Up Your Gate.io Account

Before you can access Gate.io margin trading features, you’ll need to create and secure your Gate.io account. The registration process is straightforward, but it includes important steps to ensure your account is both functional and protected.

Start by signing up on Gate.io. You’ll be required to provide personal information such as your email address and create a password. Once registered, you must complete identity verification (KYC) as part of Gate.io’s compliance with security and regulatory policies. This verification process usually involves submitting a government-issued ID and other documentation.

After your account is verified, take the time to secure it by enabling two-factor authentication (2FA). This step adds an extra layer of protection by requiring a secondary verification code whenever you log in or perform key actions. Additionally, it’s a good practice to set up anti-phishing codes and activate login alerts to prevent unauthorized access.

Once your account security is in place, you can deposit funds. Gate.io supports deposits in various cryptocurrencies, providing flexibility if you wish to trade a specific coin. Always verify the deposit address and currency type to avoid errors, as crypto transactions are irreversible. By securing your account and funding it properly, you’ll be fully prepared to explore the opportunities offered by Gate.io margin trading.

Understanding Gate.io Margin Trading Margin Requirements

Gate.io margin trading on Gate.io is governed by several key rules and requirements that every trader must fully grasp before engaging in trades.

One of the core concepts is leverage, which allows you to borrow funds to control a larger position than your initial investment. For example, with 5x leverage, you can trade an asset worth $50,000 by depositing just $10,000 as collateral. While leverage can significantly amplify your profits, it can also magnify your losses, making risk management critical.

Gate.io enforces both an initial margin and a maintenance margin. The initial margin is the minimum deposit needed to open a position, while the maintenance margin is the minimum balance required to keep that position open. If your account balance falls below the maintenance margin due to adverse market movements, the platform will issue a margin call. At this point, you’ll need to deposit additional funds to restore your margin balance or risk having your position liquidated.

Gate.io also specifies the interest rates charged on borrowed funds. Since holding a leveraged position incurs ongoing interest costs, it’s vital to factor these into your overall trading strategy. Understanding the full scope of these margin requirements helps you prepare for both potential gains and risks.

Funding Your Margin Account

After understanding Gate.io’s margin policies, the next step is to fund your margin account. You will need to transfer funds from your spot wallet to your margin wallet to begin trading.

To initiate the transfer, navigate to your account dashboard, locate the Spot Wallet section, and select the cryptocurrency you wish to move. Specify the amount to transfer and choose the Margin Wallet as the destination. This process is typically instant, allowing you to start trading as soon as the funds appear in your margin account.

Once your margin wallet is funded, you can access various trading pairs on the platform. Gate.io offers a wide selection of cryptocurrencies for margin trading, each with different leverage options. Remember to regularly monitor your margin balance and available collateral to avoid liquidation risks.

Step-by-Step: How to Use Gate.io for Margin Trading

Gate.io margin trading is a sophisticated process that requires careful planning and execution. It consists of several strategic steps, starting from the selection of a trading pair to effectively managing your position. Each of these steps plays a vital role in reducing potential risks while simultaneously enhancing the opportunity for greater returns on your investment.

To help you become proficient at using this platform, let’s delve into each step in detail. First, choosing the right trading pair is essential; it involves analyzing various cryptocurrencies and their market dynamics to find pairs that align with your trading strategy. Once you’ve made your selection, the next phase is to understand how to leverage your investments through margin, which allows you to borrow funds to increase your buying power.

After establishing your position, ongoing management becomes critical. This includes monitoring market trends, setting stop-loss orders to protect against significant losses, and being prepared to adjust your strategy based on real-time data. By breaking down these components and understanding their significance, you’ll be better equipped to navigate the complexities of margin trading on Gate.io like an experienced trader.

Choosing a Trading Pair

Your trading journey commences with the crucial step of selecting an appropriate trading pair. Gate.io margin trading provides a wide array of cryptocurrency pairs, each characterized by distinct levels of volatility and liquidity. It is essential to choose a pair that aligns well with your specific trading objectives and your personal risk tolerance.

- Volatility: When considering volatility, it’s important to note that trading pairs like BTC/USDT or ETH/USDT exhibit high levels of price fluctuations. While these pairs can present opportunities for rapid and significant profits due to their price movements, they also carry a higher degree of risk. This means that while you might be able to capitalize on quick gains, there is also the potential for substantial losses if the market moves against you.

- Liquidity: Another critical factor to consider is liquidity. Trading pairs that boast high liquidity enable traders to enter and exit their positions with ease, minimizing the chances of experiencing significant price slippage. High liquidity ensures that there are enough buyers and sellers in the market, which facilitates smoother transactions and helps maintain more stable prices during trades.

- Historical Performance: Additionally, examining the historical performance of various trading pairs can provide valuable insights into their price behavior over time. By analyzing past trends, traders can gain a better understanding of how a particular cryptocurrency has reacted to different market conditions, which can aid in predicting future price movements. This analysis can be instrumental in developing a more informed trading strategy.

Before proceeding to the next phase of your trading activities, it is vital to invest time in thorough research and careful evaluation of which trading pair best fits your overall strategy. Utilizing Gate.io margin trading during this process will not only enhance your understanding of the market but also increase your chances of making successful trades that align with your financial goals.

Placing a Margin Order

After you have selected your desired trading pair, the next step is to place a margin order. Gate.io Margin Trading offers a variety of order types, each designed to fulfill different trading needs and strategies:

- Market Order: This type of order is executed instantly at the prevailing market price. It is particularly advantageous when you need to enter or exit a trade swiftly, as it guarantees immediate execution. However, one should be cautious of potential price slippage, especially during periods of high market volatility, where the price can fluctuate significantly in a short amount of time. This means that while you may intend to buy or sell at a specific price, the actual transaction could occur at a less favorable rate.

- Limit Order: In contrast, a limit order allows you to specify the exact price at which you wish to buy or sell an asset. This order will only be executed if the market price reaches your predetermined target. By using a limit order, you gain greater control over your trading decisions, allowing you to strategically plan your entry and exit points. This can be particularly useful in volatile markets, as it helps you avoid executing trades at undesirable prices.

Grasping the nuances of when to utilize each order type is essential for crafting an effective trading strategy. Many traders prefer to use limit orders as a way to shield themselves from adverse price movements or to lock in profits at levels they have previously identified. By doing so, they can better manage their risk and enhance their overall trading performance. Understanding these concepts not only aids in making informed decisions but also contributes to developing a disciplined approach to trading in the dynamic world of cryptocurrency.

Monitoring Your Position

Once you have successfully placed your order, it becomes critically important to manage your trading position effectively. This management is vital not only for safeguarding your invested capital but also for maximizing the potential returns on your investment. To achieve this, you need to be proactive in monitoring various essential factors that can significantly impact your trading outcomes, such as fluctuations in price, prevailing market trends, and the overall equity level of your trading account.

Gate.io provides a comprehensive array of monitoring tools designed to assist traders engaged in Gate.io margin trading. Among these tools are:

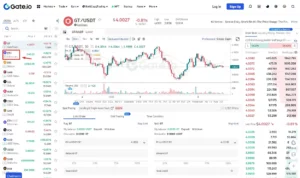

- Real-Time Charts: These dynamic charts allow you to closely observe price movements over time. By analyzing these movements, you can identify specific patterns and trends that may influence your trading decisions. Understanding these patterns is crucial, as they can provide insights into potential future price actions, enabling you to make more informed choices regarding when to enter or exit trades.

- Position Overview: This feature presents you with essential metrics that give you a clear picture of your current trading position. It includes critical information such as your profit and loss (P&L) status, the leverage ratio you are utilizing, and the maintenance margin level required to keep your positions open. Having access to this data allows you to assess the health of your trades and make necessary adjustments to mitigate risks.

Moreover, it is equally important to stay updated on relevant market news and events that could affect the cryptocurrency landscape. This includes keeping an eye on regulatory changes, significant announcements from influential figures or organizations within the crypto industry, and any other developments that could lead to market volatility. Being well-informed about these factors can equip you with valuable insights, enabling you to make timely adjustments to your trading strategies and optimize your overall performance in the market. In summary, effective position management involves a combination of utilizing advanced monitoring tools and staying abreast of market dynamics to enhance your success in Gate.io margin trading.

Key Strategies for Successful Gate.io Margin Trading

To succeed in Gate.io margin trading, it is crucial to adopt and implement effective trading strategies. The cryptocurrency market is known for its high volatility, which can lead to significant price fluctuations within short periods. Therefore, having a carefully crafted plan in place can greatly impact your trading outcomes.

A well-defined strategy not only helps in navigating the unpredictable nature of cryptocurrency prices but also aids traders in making informed decisions. This involves conducting thorough market analysis, setting clear entry and exit points, and managing risk effectively. By understanding market trends and utilizing various analytical tools, traders can position themselves advantageously.

Moreover, it’s important to remain adaptable, as the market conditions can change rapidly. Continuous learning and staying updated with the latest news and developments in the crypto space can further enhance a trader’s ability to respond to market movements. In summary, a strategic approach to Gate.io Margin Trading, characterized by careful planning and ongoing education, is vital for achieving success on platforms like Gate.io.

Utilizing Stop-Loss Orders

Managing risk is a top priority in margin trading, and one of the most effective tools for protecting your capital is the stop-loss order. This feature automatically closes a position when the market reaches a specific price, preventing further losses from unfavorable price movements.

Setting the right stop-loss level is crucial. If placed too close to the entry price, normal market fluctuations could trigger the order prematurely, causing you to miss potential gains. Conversely, if set too far, the order may not provide adequate protection against significant losses. Successful traders carefully evaluate market volatility and their risk tolerance to determine optimal stop-loss levels, ensuring that their capital is safeguarded without compromising on profit opportunities.

Additionally, advanced traders often use trailing stop-loss orders, which adjust automatically as the market moves in their favor. This allows them to lock in profits while still providing downside protection.

Diversifying Your Portfolio

Relying solely on a single asset or trading pair can expose traders to unnecessary risk. Diversifying your portfolio by investing in multiple trading pairs can help spread risk and reduce the impact of any one asset’s underperformance. Platforms like Gate.io margin trading allow traders to access a variety of assets, enabling them to diversify more effectively and manage risks.

Cryptocurrency markets can be unpredictable, with individual coins experiencing sharp price fluctuations for various reasons, such as news events or project updates. By diversifying, traders can balance losses from one position with potential gains from others. For example, pairing high-risk assets with more stable cryptocurrencies, like Bitcoin or Ethereum, can create a more balanced risk profile.

In addition to diversifying across different assets, traders can also explore various sectors within the crypto space, such as decentralized finance (DeFi), gaming tokens, or blockchain infrastructure projects. This broader exposure enhances the potential for long-term gains while mitigating risks tied to specific market segments. Platforms such as Gate.io margin trading offer tools and features that support this diversified strategy, providing traders with greater flexibility in managing their portfolios.

Continuous Learning and Adaptation

The cryptocurrency landscape evolves rapidly, driven by technological advancements, regulatory changes, and shifting market trends. To stay competitive, traders must commit to ongoing education and adaptation.

Learning opportunities are abundant through online courses, webinars, trading forums, and expert analyses. These resources can provide valuable insights into advanced trading techniques, market sentiment analysis, and emerging opportunities. However, learning alone is not enough—traders must also apply this knowledge by continuously refining their strategies based on real-world experiences and market changes.

Maintaining a trading journal is a powerful way to track and improve performance. Documenting trades, including the reasoning behind each decision and the outcomes, helps identify patterns and areas for improvement. Over time, this self-reflection enables traders to make more informed and calculated decisions, ultimately leading to greater success in margin trading.

Adapting to new market conditions while staying disciplined and informed gives traders an edge in the ever-changing crypto market, allowing them to maximize opportunities and mitigate risks.

Gate.io Margin Trading Features Explained

Risk management is the cornerstone of successful margin trading, especially in a volatile market like cryptocurrency. One of the most effective tools for risk management is the stop-loss order. This mechanism automatically closes your position when the market price reaches a predetermined level, thus preventing further losses.

Setting an appropriate stop-loss level requires a balance between limiting risk and allowing room for market fluctuations. If the stop-loss is set too close to the entry price, minor market swings may trigger the order prematurely, causing you to exit the trade unnecessarily. On the other hand, if it’s set too far, it might not protect your capital effectively. It’s essential to base your stop-loss levels on factors such as market volatility, your trading strategy, and personal risk tolerance. For better protection, some traders also use trailing stop-losses, which adjust automatically as the market moves in their favor.

The Importance of Diversifying Your Portfolio

In the unpredictable world of Gate.io margin trading, putting all your capital into one asset or trading pair can be highly risky. Market conditions can shift dramatically, and if your investments are not diversified, a sudden downturn could result in significant losses. Diversifying your portfolio reduces this risk by spreading your capital across multiple assets.

For instance, if one trading pair underperforms, gains from other pairs may offset those losses, helping you maintain a balanced risk-to-reward ratio. Diversification can involve trading different types of cryptocurrencies, such as combining high-risk altcoins with more stable assets like Bitcoin or Ethereum. Additionally, you can explore various market sectors, such as DeFi, metaverse projects, or blockchain infrastructure, to further spread risk. However, it’s important to research each asset thoroughly to ensure it aligns with your trading goals when navigating Gate.io margin trading opportunities.

Continuous Learning and Adaptation to Market Changes

The cryptocurrency market is highly dynamic, with new technologies, regulations, and trends emerging frequently. To remain successful in margin trading, continuous learning is essential. Engaging in educational activities such as attending webinars, enrolling in online courses, and reading expert analysis can expand your knowledge and improve your trading acumen.

Beyond acquiring knowledge, it’s crucial to apply what you’ve learned by adapting your strategies to the current market environment. Market conditions that favored a specific strategy in the past may no longer be effective due to changes in liquidity, trading volume, or sentiment. Keeping a detailed trading journal can help you track and analyze your past trades, identify recurring patterns, and refine your strategies. Documenting your entries, exits, stop-losses, and the reasoning behind each trade offers valuable insights for continuous improvement.

Additionally, learning from other experienced traders by participating in trading communities can provide exposure to different perspectives and tactics. This collaborative approach can help you stay ahead of market developments and make more informed trading decisions.

Understanding Leverage Ratios in Gate.io Margin Trading

Leverage is a powerful tool that allows traders to borrow funds to increase their market exposure beyond the capital they have in their account. In margin trading on Gate.io, leverage is expressed as a ratio. For example, a leverage ratio of 2:1 means you can trade with double your capital by borrowing an equal amount from the platform. Similarly, a 5:1 leverage ratio allows you to control a position five times the size of your initial investment.

The advantage of using leverage is that it amplifies both potential profits and losses. If your trade is successful, leverage can significantly enhance your returns. However, if the market moves against you, your losses will also be magnified. Therefore, understanding how leverage works and carefully selecting an appropriate ratio is essential. Higher leverage ratios can be tempting, but they come with increased risk. Traders should choose a leverage ratio that reflects their risk tolerance, trading experience, and financial goals. Beginners may find lower leverage ratios (e.g., 2:1 or 3:1) more manageable, while experienced traders might opt for higher leverage after gaining confidence in their strategies.

Risk Management with Leverage

Effective risk management is crucial when trading with leverage to avoid substantial losses. Leveraged positions, such as those in Gate.io margin trading, can quickly lead to liquidation if the market moves unfavorably and you fail to maintain the required margin levels. To mitigate this risk, traders must implement strict protective measures.

One of the most important risk management tools is the stop-loss order, which automatically closes your position when the market price reaches a predetermined level. This helps prevent excessive losses and protects your capital. Additionally, maintaining a margin buffer—keeping more funds in your account than the minimum margin requirement—can provide extra protection against sudden market volatility, especially when engaging in Gate.io margin trading.

Regularly monitoring your leveraged positions is another essential practice. Market conditions can change rapidly, and what might have been a safe trade initially could become risky due to shifts in price trends, news events, or liquidity issues. By staying vigilant and reassessing your positions frequently, particularly in Gate.io margin trading, you can make timely adjustments to minimize risks and preserve your trading account.

Emotional Discipline in Leveraged Trading

Trading with leverage can evoke strong emotions, especially when significant profits or losses are at stake. The amplified potential of leveraged trades, such as those offered in Gate.io margin trading, often tempts traders to act impulsively, either by chasing profits or panicking in response to losses. Emotional trading is one of the primary reasons why many traders fail to succeed in margin trading.

Developing emotional discipline starts with having a clear and detailed trading plan. This plan should include your entry points, target profits, stop-loss levels, and conditions for exiting a trade. Sticking to this plan helps prevent emotional decision-making during volatile market conditions.

Moreover, it’s important to accept that losses are a natural part of trading. Successful traders are those who can manage losses without letting emotions cloud their judgment. Maintaining a rational mindset involves practicing patience, staying focused on long-term goals, and learning from both successes and failures. Journaling your trades, including your thought process and emotional state, can also aid in identifying patterns of emotional behavior and help improve your discipline over time.

By mastering emotional control, traders can make more objective decisions, reduce impulsive mistakes, and enhance their overall performance in Gate.io margin trading and other leveraged trading environments.

Conclusion

Gate.io margin trading can be an exciting opportunity for traders aiming to maximize their investment potential. However, it also carries significant risks that must be carefully managed. Platforms like Gate.io provide robust features and tools that can facilitate successful Margin Trading, but traders must remain vigilant and informed.

As you embark on your Margin Trading journey, remember the importance of continuous learning, strategic planning, and disciplined execution. By understanding the intricacies of Margin Trading and the functionalities offered by platforms like Gate.io, you can navigate the complexities of the market and work toward achieving your financial objectives.