Cryptocurrency trading is evolving rapidly in 2025, and for those looking to take their trading to the next level, KuCoin leverage trading offers an exciting entry point. Leverage tokens on KuCoin are built for convenience, flexibility, and safety—making them ideal for beginners who want to amplify returns without diving into complex derivatives. This beginner-friendly guide will walk you through everything you need to know about KuCoin leverage tokens, how they work, and how you can start trading them effectively in 2025.

What Is a KuCoin Leverage Token?

A KuCoin leverage token is a special type that gives users leveraged exposure to a cryptocurrency without borrowing funds or managing collateral, making it a key part of KuCoin leverage trading. Each leverage token represents a position in the underlying asset, magnified by a fixed leverage ratio.

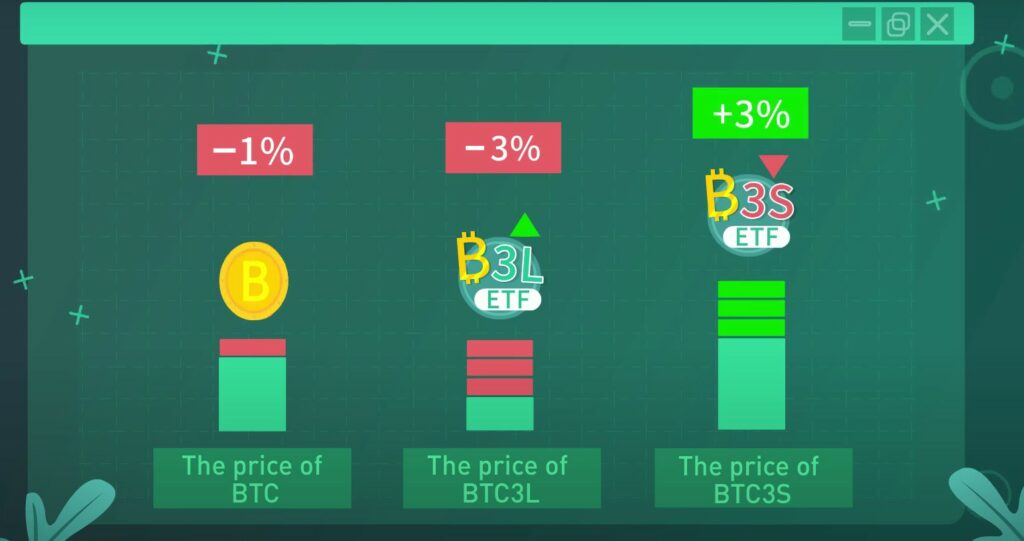

For example:

-

BTC3L = 3x Long BTC (You profit 3x if BTC goes up)

-

BTC3S = 3x Short BTC (You profit 3x if BTC goes down)

These tokens are traded just like spot tokens on the KuCoin platform, making it much simpler than traditional margin or futures trading.

Why Use KuCoin Leverage Tokens in 2025?

Leverage tokens offer multiple advantages for crypto traders in 2025, especially for beginners or those seeking a hassle-free entry into KuCoin leverage trading.

No Liquidation Risk

Unlike futures or margin trading, KuCoin leverage tokens cannot be liquidated. That’s because they’re based on spot trading mechanics. Even if the market moves dramatically, you won’t be forcibly closed out of your position.

No Borrowing or Collateral Needed

When trading with traditional leverage, you need to put down a margin deposit and possibly borrow funds. With KuCoin leverage tokens, none of that is required. You just buy and sell tokens directly—no loans, no collateral.

Easy to Trade

In KuCoin leverage trading, buying a leverage token is as easy as buying Bitcoin on the spot market. Just log in, search for the token (e.g., BTC3L), and trade. There’s no need for a separate margin account or any complex setup.

How to Profit with KuCoin Leverage Tokens

The basic strategy is simple: buy low, sell high—but with leverage applied.

-

If you expect the market to rise, buy a 3x Long token (e.g., BTC3L). For every 1% BTC goes up, you gain ~3%.

-

If you expect the market to fall, buy a 3x Short token (e.g., BTC3S). For every 1% BTC drop, you gain ~3%.

Profits are magnified—so is risk. Therefore, timing the market correctly is key.

When engaging in KuCoin leverage trading, keep the following fees in mind:

- Subscription Fee: When registering a new token (rare for most users), there is a 0.1% subscription fee.

- Conversion Fee: If you convert one leverage token to another (e.g., BTC3L to ETH3L), a 0.1% fee applies.

- Management Fee: KuCoin charges a daily management fee of 0.045%, calculated at 23:45 UTC. This fee is included in the token’s Net Asset Value (NAV), so you don’t need to pay it manually.

Daily Rebalancing: What You Need to Know

In KuCoin leverage trading, KuCoin leverage tokens are automatically rebalanced daily between 23:30–23:45 UTC. This ensures that the token maintains its stated leverage ratio (e.g., 3x long or 3x short). If a token moves too far from its target leverage due to sudden price swings, KuCoin will perform an abnormal rebalance, which can happen intraday when volatility exceeds 15%.

Why Is Rebalancing Important?

Rebalancing in KuCoin leverage trading ensures that tokens don’t drift too far from their leverage target. It helps reduce risk and maintain predictability. However, in highly volatile markets, rebalancing can cause value decay over time, especially during whipsaw price movements.

Example of Rebalancing Loss

Let’s say you buy BTC3L for $100. BTC increases 15%, triggering a rebalance. Later, BTC drops 15%, triggering another. After both rebalances, your token’s net value might be around $97.75 instead of $100 due to value decay from volatility.

Leverage Tokens vs. Margin Trading

-

Margin trading requires collateral and exposes users to liquidation risk.

-

Leverage tokens don’t require collateral, have no liquidation risk, and offer fixed leverage.

Leverage Tokens vs. Futures Trading

-

Futures involve dynamic leverage, margin maintenance, and liquidation.

-

Leverage tokens are simpler, with fixed leverage and daily rebalancing.

This makes leverage tokens ideal for traders who want higher returns without the complexities or risks associated with derivatives.

5 Tips for Trading KuCoin Leverage Tokens in 2025

Here are 10 expert tips to help you get started confidently with KuCoin leverage trading:

-

Understand NAV: NAV represents the fair market value of a leveraged token, calculated based on the underlying asset and leverage ratio. Sometimes, market prices may differ from NAV, especially in volatile periods. Always check NAV before trading to avoid paying a premium. Monitor Net Asset Value to avoid overpaying during price spikes.

-

Avoid Holding During High Volatility: Frequent rebalances can erode value in choppy markets—consider short-term trades instead.

-

Don’t Mix Up Long/Short: BTC3L is for bulls. BTC3S is for bears. Don’t confuse them—leverage magnifies both gains and losses.

-

Track Management Fees: Fees are baked into the NAV, but long-term holding can eat into profits.

-

Diversify: Use different leverage tokens (ETH, SOL, etc.) to spread your risk across assets.

Final Thoughts

KuCoin leverage trading in 2025 offers a simple and low-risk way for crypto investors to access leveraged exposure without margin accounts or liquidation fears. By using KuCoin leverage tokens wisely, you can benefit from both up and down markets—amplifying your gains while minimizing complexity.