Bybit Earn allows users to generate passive income through liquidity mining. This process involves users supplying assets to decentralized finance (DeFi) protocols or centralized exchanges to enhance trading liquidity. In return, users receive a share of trading fees and governance tokens.

Liquidity mining on Bybit differs from traditional staking or lending since it involves participating in liquidity pools rather than locking assets for interest payments. Bybit Earn offers liquidity mining options with varying risk levels, catering to both beginner and experienced investors.

Bybit, one of the leading cryptocurrency exchanges, offers liquidity mining through its Bybit Earn platform. This method allows users to contribute to the liquidity pools and receive rewards. But how does liquidity mining work, and what are its benefits? In this article, we will dive deep into liquidity mining, its advantages, and a step-by-step guide to getting started on Bybit Earn.

What is Liquidity Mining?

Liquidity mining is a decentralized financial strategy that allows crypto investors to earn rewards by supplying liquidity to trading platforms. It plays a critical role in the crypto ecosystem by ensuring smooth trading operations and reducing price slippage.

How Liquidity Mining Works

Liquidity mining involves depositing funds into liquidity pools, which are smart contracts that facilitate decentralized trading. These pools enable token swaps without relying on traditional order books. Instead, users trade against the liquidity pool, and in return, liquidity providers (LPs) earn fees generated from transactions.

For example, a liquidity pool for the ETH/USDT pair requires users to deposit an equal value of both ETH and USDT. When traders swap ETH for USDT (or vice versa), they pay a fee, which is distributed among liquidity providers based on their contribution to the pool.

Types of Liquidity Mining

- There are two primary types of liquidity mining:

- Centralized Exchange (CEX) Liquidity Mining

- Platforms like Bybit Earn facilitate liquidity mining by allowing users to deposit assets into trading pools.

- Rewards come from transaction fees and exchange incentives.

Decentralized Exchange (DEX) Liquidity Mining

- Users provide liquidity directly to DEXs such as Uniswap or PancakeSwap.

- Rewards include trading fees and governance tokens.

- Bybit’s liquidity mining service is designed to simplify the process, offering a more secure and user-friendly experience for investors.

Benefits of Liquidity Mining

Liquidity mining offers several advantages to crypto investors, making it an attractive option for those looking to maximize their passive income.

5 Benefits of Liquidity Mining

- High Yield Potential: Compared to traditional bank savings or even some crypto staking programs, liquidity mining offers significantly higher annual percentage yields (APYs). Bybit Earn’s liquidity mining pools can offer APYs ranging from 10% to 50%, depending on market conditions and trading volume.

- Passive Income Generation: Liquidity providers earn passive income from trading fees generated by users swapping assets in the pool. This income can be compounded over time, increasing overall returns.

- Access to Governance Tokens: Some liquidity mining programs reward providers with governance tokens, which grant voting rights on protocol changes. These tokens can also appreciate, providing an additional revenue stream.

- Enhanced Market Efficiency: By contributing liquidity, investors help stabilize asset prices and reduce slippage, leading to more efficient trading experiences. This is especially beneficial for emerging projects looking to improve their market depth.

- Low Barrier to Entry: Bybit Earn simplifies liquidity mining, making it accessible to both novice and experienced investors. Unlike traditional DeFi liquidity mining, which often requires technical knowledge, Bybit offers an intuitive interface and automated processes.

Risks and Considerations in Liquidity Mining

While liquidity mining offers the potential for high returns, it is not without risks. Understanding these risks is crucial for investors who want to make informed decisions and protect their funds. Below are some of the most significant risks associated with liquidity mining, along with ways to mitigate them.

Impermanent Loss – A Major Consideration for Liquidity Providers

One of the biggest risks in liquidity mining is impermanent loss. This occurs when the price of one asset in the liquidity pool fluctuates significantly compared to the other. Since liquidity providers must deposit an equal value of two assets into a pool, any major shift in price can result in losses when withdrawing funds.

For example, if you deposit ETH and USDT into a liquidity pool and the price of ETH doubles while USDT remains stable, the automated market maker (AMM) mechanism adjusts the asset ratio in the pool. This means that when you withdraw funds, you may receive fewer ETH than you initially deposited, even though the total value of your investment has grown. This is called impermanent loss because the loss is only realized if you withdraw when the price difference is significant.

How to Mitigate Impermanent Loss:

- Choose stablecoin pairs (e.g., USDT/USDC) to minimize price fluctuations.

- Opt for pools with high trading volume, as transaction fees can help offset potential losses.

- Monitor market trends and avoid withdrawing during extreme price swings.

Market Volatility – Affects Liquidity Mining Rewards

Cryptocurrency markets are highly volatile, and price swings can significantly impact the value of assets in a liquidity pool. When market conditions are unstable, liquidity providers may see fluctuations in their expected returns.

For example, if you are providing liquidity for a BTC/USDT pair and Bitcoin suddenly drops by 20%, the value of your holdings will be affected. While trading fees generated in the pool can provide some buffer, extreme market conditions can reduce overall profitability.

How to Mitigate Market Volatility Risks:

- Diversify your investments across different liquidity pools.

- Avoid overexposure to highly volatile assets unless you are comfortable with the risk.

- Regularly monitor market trends and adjust your positions accordingly.

Smart Contract Risks – The Technical Vulnerability Factor

Liquidity mining relies on smart contracts, which are automated programs that execute transactions without intermediaries. While smart contracts enhance efficiency and security, they are not immune to vulnerabilities. Bugs or exploits in the contract code can lead to fund losses, as seen in past DeFi hacks where attackers drained millions of dollars from liquidity pools.

Bybit’s liquidity mining platform operates within a controlled environment, reducing the likelihood of smart contract failures. However, users engaging in DeFi liquidity mining (on platforms like Uniswap or SushiSwap) face additional risks, as these protocols are fully decentralized and may not have the same level of security oversight.

How to Mitigate Smart Contract Risks:

- Only participate in liquidity mining on reputable platforms like Bybit Earn.

- Research security audits of liquidity pools before investing.

- Use smart contract insurance services to protect against potential exploits.

Regulatory Uncertainty – Changing Legal Landscapes

The regulatory environment for cryptocurrency and DeFi is evolving rapidly. Governments worldwide are implementing new laws that may affect liquidity mining, and some jurisdictions have banned or restricted certain DeFi activities.

If regulations tighten in a specific country, liquidity providers might face restrictions on accessing their funds, additional taxation, or limitations on earning rewards. While Bybit ensures compliance with legal frameworks in multiple regions, investors should stay informed about local regulations before engaging in liquidity mining.

How to Stay Ahead of Regulatory Risks:

- Regularly check for updates on cryptocurrency regulations in your country.

- Choose platforms like Bybit that adhere to compliance requirements.

- Diversify across multiple platforms to minimize exposure to regional legal changes.

Low Liquidity and Withdrawal Delays

Some liquidity pools may suffer from low liquidity, which can lead to withdrawal delays. If a pool has fewer users contributing liquidity, there may not be enough funds available for immediate withdrawals. Additionally, certain pools have lock-up periods, preventing users from accessing their funds until a specific duration has passed.

For instance, DeFi liquidity pools can become illiquid during extreme market conditions, making it difficult for users to exit without incurring significant slippage.

How to Avoid Low Liquidity Risks:

- Check the total value locked (TVL) in a pool before depositing funds.

- Choose pools with high trading volume and active participation.

- Avoid long lock-up periods unless you are comfortable with restricted access to funds.

How to Get Started Liquidity Mining on Bybit Earn

Liquidity mining on Bybit Earn is designed to be straightforward, ensuring that both beginners and advanced investors can participate with ease. Below is a step-by-step guide to getting started.

Step 1: Create and Verify Your Bybit Account

- If you don’t already have a Bybit account, visit the official website and sign up.

- Complete the KYC (Know Your Customer) verification process to gain full access to Bybit Earn features.

Step 2: Navigate to Bybit Earn

- Once logged in, click on the “Earn” section in the top navigation bar.

- Select “Liquidity Mining” from the list of available earning options.

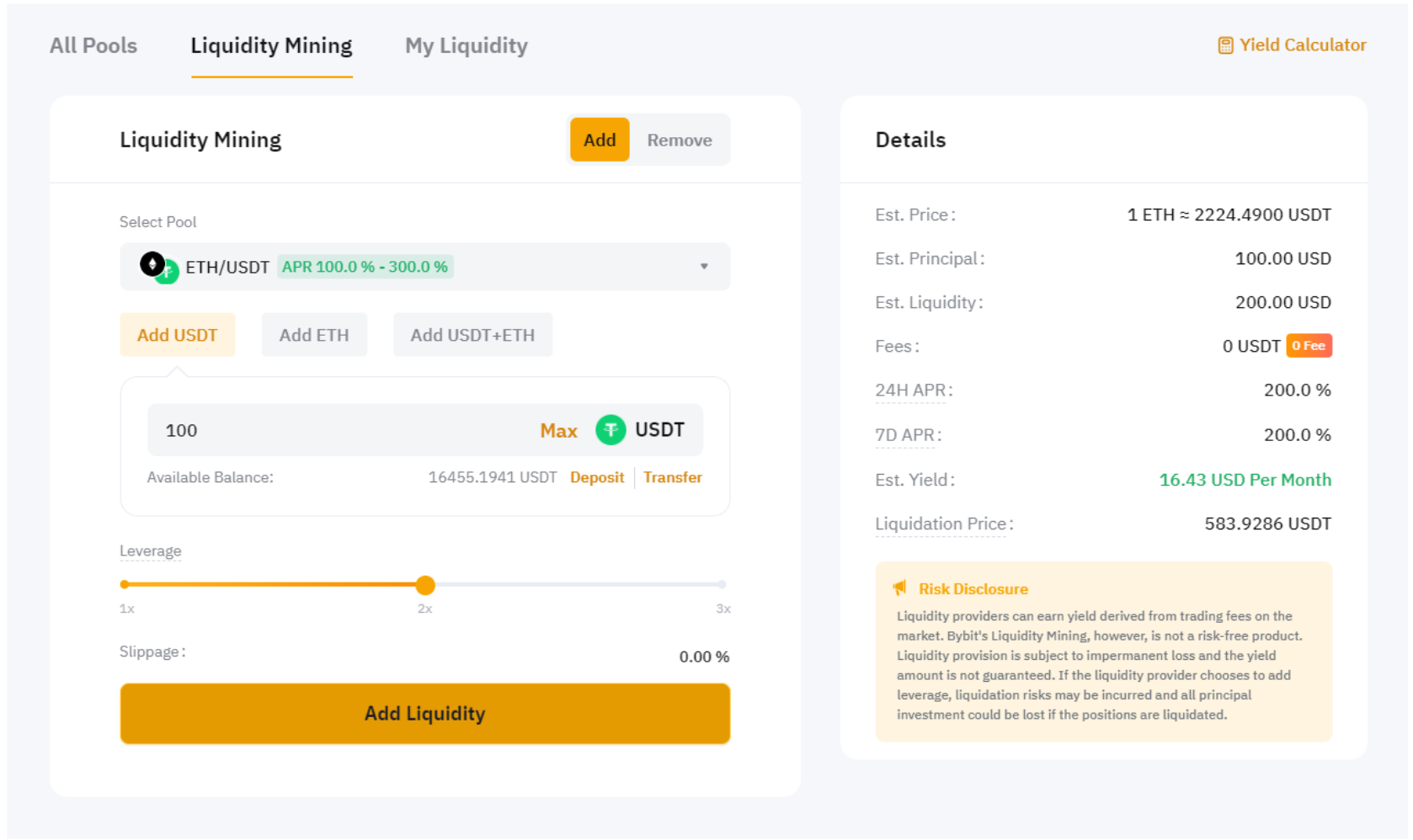

Step 3: Choose a Liquidity Pool

- Browse the list of available liquidity mining pools.

- Review the estimated APY, supported assets, and potential risks before selecting a pool.

Step 4: Deposit Assets into the Pool

- Select the amount of cryptocurrency you want to contribute to the liquidity pool.

- Some pools require an equal deposit of two tokens (e.g., ETH/USDT), while others allow single-token deposits.

- Confirm your deposit and approve the transaction.

Step 5: Monitor and Manage Your Investment

- Once your funds are deposited, you will start earning rewards based on your share of the pool.

- Regularly check your earnings and reinvest profits if desired.

- Bybit provides real-time analytics to help you track your APY and potential returns.

Step 6: Withdraw Your Liquidity and Rewards

- If you decide to exit the pool, navigate to the withdrawal section.

- Select the amount you wish to withdraw and confirm the transaction.

- Rewards earned can be transferred to your Bybit wallet or reinvested.

Conclusion

Liquidity mining on Bybit Earn presents an excellent opportunity for crypto investors to generate passive income while supporting the broader cryptocurrency ecosystem. By contributing liquidity to trading pools, users can earn attractive APYs, receive governance tokens, and benefit from a streamlined staking process.

Bybit’s user-friendly interface, competitive rewards, and risk-management features make it one of the top platforms for liquidity mining in 2025. Whether you are a beginner or a seasoned investor, Bybit Earn provides a secure and efficient way to engage in liquidity mining.