In a bold move to transform its economy and attract global investment, the Maldives has announced a $9 billion plan to build one of the largest global crypto hubs and blockchain centers. The project, which will be located in the capital city of Malé, marks a significant shift for the island nation as it seeks to diversify its revenue sources beyond tourism and fishing.

A Strategic Partnership to Shape the Future

On May 4, the government of the Maldives signed a landmark agreement with MBS Global Investments, a Dubai-based family office known for its interest in emerging technologies. The deal outlines the development of the Maldives International Financial Centre, a massive 830,000-square-meter crypto hub designed to support the global blockchain and Web3 industries.

The project is expected to take five years to complete and could employ up to 16,000 people, according to sources familiar with the development. The scale of this initiative is staggering; its projected cost exceeds the Maldives’ entire annual gross domestic product (GDP), which currently stands at around $7 billion.

Government officials hope the global crypto hub will serve as a magnet for foreign direct investment (FDI) and technological innovation, setting the stage for a more resilient and future-focused Maldivian economy.

Why the Maldives Is Betting on Crypto

For decades, the Maldives has relied heavily on tourism and fisheries to fuel its economy. While these industries remain vital, the COVID-19 pandemic exposed the risks of over-dependence on a narrow economic base. As a result, leaders are now seeking ways to modernize and expand the country’s financial infrastructure.

The decision to invest in crypto and blockchain is part of a broader national strategy to position the Maldives as a forward-thinking global crypto hub for financial technology. Officials believe that by opening its doors to cutting-edge industries, the country can strengthen its financial independence, reduce debt, and create thousands of new high-paying jobs for its citizens.

Competing on a Global Stage

Despite the Maldives’ ambitions, becoming a major player in the global crypto space will be no easy task. The country faces stiff competition from established financial and tech hubs that have already made significant progress in developing blockchain ecosystems.

Dubai, for example, has rapidly evolved into a Web3 leader, thanks to its innovation-friendly regulatory environment and strong government support. Just last month, on April 6, Dubai’s Land Department and the Virtual Assets Regulatory Authority (VARA) announced a partnership to integrate real estate services with blockchain technology. The initiative aims to digitize land registry processes and enable real estate tokenization, which is a practical application that showcases Dubai’s readiness for blockchain-powered transformation.

Hong Kong is also emerging as a top global crypto hub, leveraging its unique position as a bridge between Western markets and mainland China. Its proactive approach to regulation has attracted hundreds of fintech and Web3 companies. Ivan Ivanov, global CEO of the WOW Summit, one of Asia’s top blockchain conferences, described Hong Kong as a “regulatory sandbox” that fosters experimentation and cross-border innovation.

Singapore continues to dominate the crypto map as well. Known for its stability and open financial policies, the city-state is home to dozens of crypto exchanges and hundreds of blockchain startups. Singapore’s regulators have maintained a delicate balance, encouraging innovation while implementing safeguards to protect investors. This reputation for responsible growth has earned the country a leading position among international crypto hubs.

Can the Maldives Compete?

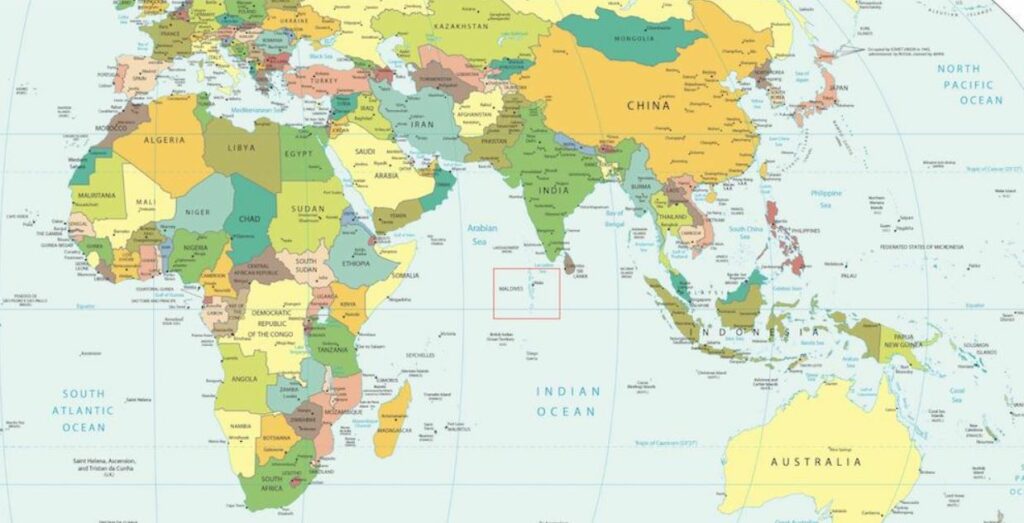

Although the Maldives is entering the crypto race later than its rivals, analysts say there’s room for new players, especially in regions that offer unique advantages. The island nation boasts political stability, a strategic location in the Indian Ocean, and growing interest from Gulf-region investors.

By partnering with MBS Global Investments, the Maldives is tapping into Dubai’s successful formula for attracting capital and talent. If the financial center succeeds in offering competitive tax incentives, streamlined regulations, and robust digital infrastructure, it could become an appealing alternative for businesses seeking a base in South Asia.

The employment potential is also noteworthy. With up to 16,000 jobs projected from the crypto hub alone, the Maldives stands to benefit from a significant boost in skilled labor opportunities. This could help reverse brain drain and encourage more local talent to pursue careers in blockchain development, financial technology, and digital asset management.

Challenges Ahead

While the vision is ambitious, experts caution that there are hurdles to overcome. Raising $9 billion in investment for a developing country is no small feat, especially when global financial markets remain volatile.

There are also regulatory risks. The global crypto landscape is still evolving, with many governments tightening rules around digital assets to prevent fraud, money laundering, and market manipulation. The Maldives will need to carefully craft its regulatory framework to strike a balance between encouraging innovation and ensuring security.

In addition, building a supportive ecosystem around the crypto hub, such as universities, accelerators, and legal infrastructure, will be crucial. Attracting talent from abroad is important, but so is developing local expertise to sustain long-term growth.

What Comes Next?

As the Maldives takes its first major step into the world of blockchain and crypto, global investors are watching closely. If the Maldives International Financial Centre is completed on schedule and delivers on its promise, it could place the island nation on the global fintech map.

In a world where digital assets are becoming mainstream, the Maldives is betting big on the future. And while the journey will be long and filled with challenges, the country’s bold $9 billion initiative signals a clear message: the future of finance is decentralized, and the Maldives wants to be a global crypto hub at its core.