In early 2025, the cryptocurrency market witnessed a major shock. Mantra’s OM token, which had recently become one of the fastest-growing crypto assets, suddenly lost almost 90% of its value. The crash followed rumors of insider trading and large sell-offs by early investors.

Let’s take a closer look at what happened, when it happened, and what it means for the future of Mantra and the crypto world.

The Rise of OM Token

In 2024, Mantra’s OM token gained huge attention. It started as a project focused on real-world asset (RWA) tokenization, which means turning real items like property or bonds into digital assets on the blockchain.

By working with big names like Zand, a bank in the UAE, and Google Cloud, Mantra created excitement in the market. These partnerships helped build trust and brought serious tech power to the project.

In October 2024, Mantra launched its mainnet, which allowed the OM token to move across different blockchains thanks to Cosmos Network integration. This made OM more flexible and useful, especially in DeFi (decentralized finance) and asset tokenization.

Thanks to this momentum, the OM token’s price exploded. It rose by almost 20,000% in just one year. On November 10, 2024, it reached an all-time high of $4.52.

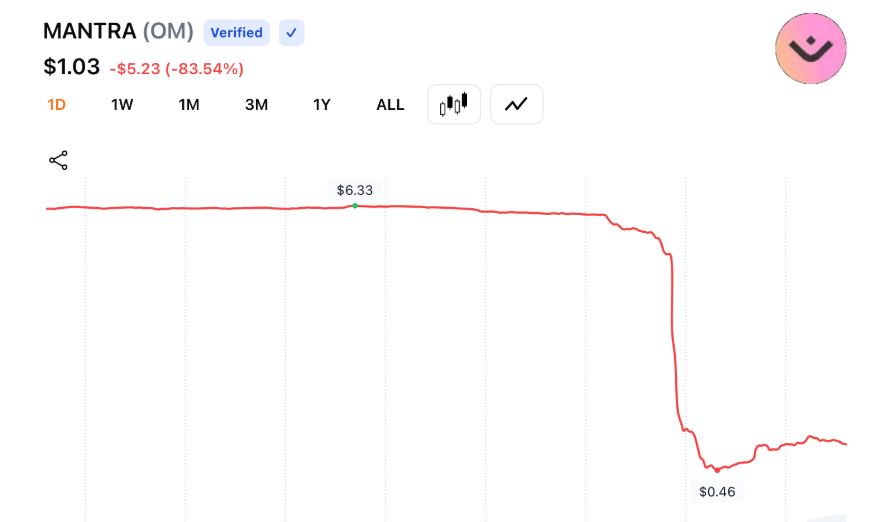

The Sudden Crash

However, this success did not last long.

In mid-November 2024, analysts and investors started to notice unusual activity. On-chain data revealed that several large holders—often called “whales”—were moving large amounts of OM tokens to exchanges like Binance and OKX.

For example:

- One whale moved $1.3 million in OM to Binance.

- Another sent $534,000 in OM to OKX.

At the same time, OM’s supply on exchanges increased by 2% in just three days. This was a red flag. When whales move tokens to exchanges, it often means they are getting ready to sell. And sell they did.

Between November 14 and 17, whale activity dropped by 54%, meaning they had already sold a large portion of their holdings. This caused massive selling pressure in the market.

Insider Trading Allegations

As the price began to fall, rumors spread. Many believed that insiders – people who had early access to OM or inside information – sold their tokens at the peak, before the public knew what was happening.

Although no official names were mentioned, the timing of the whale movements and the sudden price drop led many to believe something was wrong behind the scenes.

These insider trading claims caused panic. As fear grew, more and more investors began to sell, causing the OM token’s price to drop rapidly.

From its peak of $4.52, the price dropped to around $0.45, wiping out months of growth in just a few days.

Market Reaction and Concerns

The crypto community reacted with shock and concern. Many investors felt betrayed. They trusted the project, especially because of its strong partnerships and technical innovation.

But the quick crash showed how dangerous the market can be when there is a lack of transparency.

Experts also pointed to technical indicators. Before the crash, OM had an RSI (Relative Strength Index) above 70. This showed the token was overbought, meaning it had risen too fast and was due for a correction.

Still, few expected such a large drop.

What Happens Next?

As of now, the Mantra team has not fully addressed the insider trading rumors. There has been no detailed explanation or public investigation announced.

To win back trust, the Mantra project may need to:

- Be more transparent about its token distribution.

- Publish audit reports on insider holdings.

- Introduce lock-up periods for team tokens to prevent early dumps.

- Work with regulators to ensure fairness in the market.

Investors are waiting to see what the team will do. Without a clear plan, it will be hard for OM to recover.

Lessons for the Crypto World

The OM token crash is a reminder of how quickly things can change in crypto.

No matter how strong a project looks on the surface, insider behavior and whale actions can shake the market. Investors should always do their research and be cautious of tokens that rise too fast.

This case also shows the need for better rules and monitoring in the crypto space. As more real-world assets move onto the blockchain, trust and transparency will become more important than ever.

Mantra’s OM token went from a top performer to a cautionary tale in just a few weeks. Its 90% price drop, driven by whale sell-offs and insider trading rumors, shows the risks of fast growth without strong safeguards.

For now, the future of OM is unclear. But one thing is certain: the crypto world is watching closely. How Mantra responds in the coming months could decide whether it recovers or fades into history.