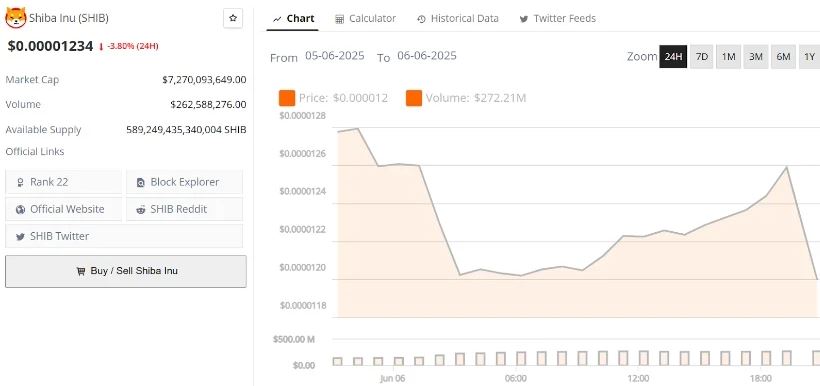

Shiba Inu (SHIB), one of the most well-known meme coins in the crypto world, is entering a critical phase. The token is showing signs of weakness across multiple indicators. From a sharp drop in its burn rate to large-scale whale sell-offs, technical patterns and on-chain data are painting a bearish picture.

In this article, we’ll explore what’s going wrong with SHIB, the key metrics behind its recent decline, and whether there’s still hope for a recovery, or if a deeper crash is looming.

Burn Rate Drops, Deflation Narrative Fades

One of Shiba Inu’s biggest selling points has been its deflationary strategy. By regularly burning tokens, the community hoped to reduce supply and increase price pressure over time. But this strategy seems to be losing steam.

According to Shibburn data, SHIB’s daily burn rate has fallen by 24% over the past week, with just 13.85 million tokens burned. This is a tiny number when compared to its $7 billion market cap and total supply.

Even though there was a brief 4.19% spike in burns, nearly 19 million SHIB destroyed in one day, the overall trend is heading downward. Over 410 trillion SHIB have been burned since the token’s launch, but a staggering 589 trillion tokens remain in total supply, with 584 trillion still circulating. As a result, the project’s long-promoted scarcity model is no longer driving price momentum.

Whales Are Leaving And That’s a Bad Sign

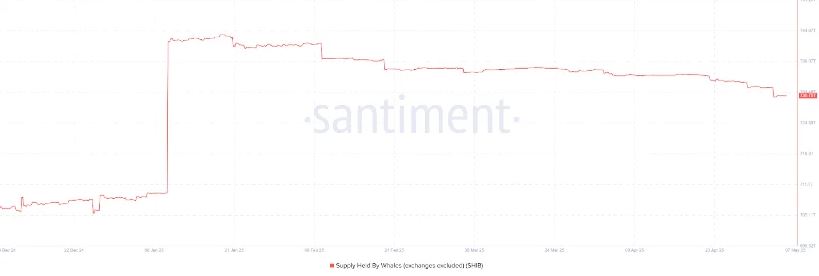

Alongside the falling burn rate, whale movements are raising alarms.

Blockchain analysis firm Santiment reports that the amount of SHIB held by whale wallets has decreased from 743.8 trillion to 730 trillion tokens since February 2025. That’s a drop of 13.8 trillion SHIB in just a few months.

Worse yet, a dormant whale wallet made a major move that spooked the community. After three years of inactivity, the wallet suddenly transferred 105 billion SHIB to Binance, a move that often signals an intent to sell. This coincided with a period of rising market volatility and increasing trader losses.

As whales exit and small investors start to panic, SHIB risks losing the strong community support that once fueled its explosive growth.

Bearish Technical Patterns Take Shape

Technically speaking, SHIB isn’t looking much better.

Analysts are closely watching a head and shoulders pattern, which recently broke below its neckline support. This pattern is a classic bearish reversal signal. If confirmed, it could lead to a 28% price drop, taking SHIB down to $0.000009—a level not seen since January 2024.

Key technical indicators support this bearish outlook:

- Relative Strength Index (RSI) is around 37, close to oversold territory.

- MACD (Moving Average Convergence Divergence) is hovering just below neutral, with no bullish crossover in sight.

- ADX (Average Directional Index) is trending upward, indicating that downward momentum is strengthening.

- “If SHIB doesn’t reclaim the neckline soon, a deeper correction seems likely,” one analyst warned.

Ecosystem Engagement Is Shrinking

The Shiba Inu ecosystem is also losing steam.

DeFiLlama data shows that Total Value Locked (TVL) on Shibarium, SHIB’s Layer-2 blockchain, has plummeted 33% year-to-date. As of now, the TVL stands at just $2.25 million, a disappointing figure for a network once positioned as a serious DeFi player.

Shibarium was meant to give SHIB more utility, enabling faster transactions, lower fees, and dApp development. But with declining developer interest and reduced user activity, Shibarium’s role in the broader crypto space is fading.

This weakens SHIB’s long-term use case and reduces investor confidence in the project’s future.

Is There Still Hope for a Rebound?

Despite the grim outlook, there are still a few bright spots.

The RSI nearing oversold territory suggests that SHIB might be due for a short-term bounce. A minor support level seems to be forming between $0.00001255 and $0.00001260, offering potential for a recovery if broader market sentiment improves.

Also, more than 4.7 trillion SHIB are currently staked, taking them out of circulation. This could ease some of the sell pressure in the short term.

Historically, the Shiba Inu community has played a major role in reviving the token during downtrends. If sentiment shifts—perhaps due to a new development or broader crypto rally, SHIB could stage a comeback.

However, analysts are warning investors to manage expectations. “Right now, SHIB is in a vulnerable zone,” one trader noted. “It needs either a strong narrative shift or a major ecosystem upgrade to reverse this trend.”

What Comes Next?

The next few weeks will be crucial for Shiba Inu.

If the current technical breakdown continues, SHIB could fall back to $0.000009, wiping out most of its 2024 gains. However, if the project announces meaningful updates, reignites its burn rate, or sees renewed whale interest, a reversal could begin.

The crypto community is also watching external events like “Pi Day 2” promotions and mid-year crypto market catalysts, which could have an indirect impact on SHIB’s sentiment.

In the meantime, all eyes are on whether Shiba Inu can find a solid floor or if the recent declines will snowball into a full-blown crash.

Final Thoughts

Shiba Inu is facing a perfect storm:

- Burn rate is falling

- Whales are leaving

- Technical indicators point down

- Ecosystem engagement is cooling

While short-term relief is possible, the long-term picture will depend on community resilience, developer activity, and real-world use cases. SHIB has surprised the market before, but unless the fundamentals improve, this time may be different.