As South Korea prepares for its next presidential election, one thing is already clear: the crypto industry is set to benefit, no matter who wins.

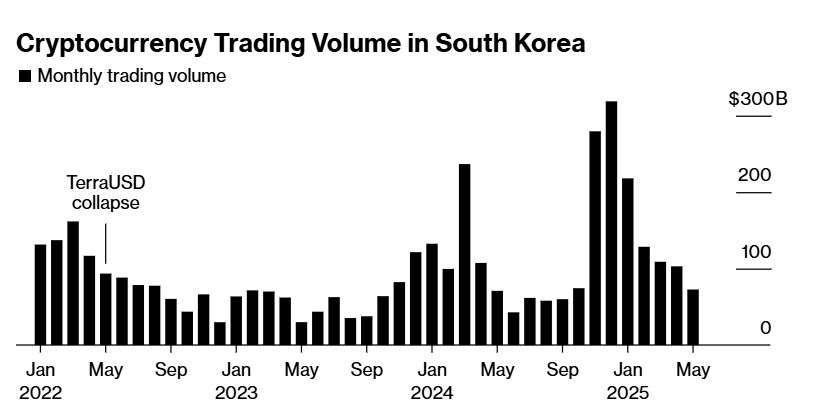

With over 18 million South Koreans — roughly one-third of the population — already participating in crypto markets, digital assets have become a mainstream part of daily life in the country. On some days, trading volume on local crypto exchanges even surpasses that of South Korea’s stock indices, including the Kospi and Kosdaq. This growing influence is now spilling into politics in a major way.

A Pro-Crypto Stance from Both Sides

As voters head to the polls this Tuesday, both leading candidates are offering promises to boost the crypto sector.

Liberal frontrunner Lee Jae-myung and conservative People Power Party nominee Kim Moon-soo have both expressed strong support for digital assets. They’ve pledged to ease regulations, promote innovation, and improve access to cryptocurrencies across the country.

This shift marks a significant departure from the stricter stance South Korean regulators took just a year ago.

Simon Seojoon Kim, CEO of Seoul-based venture capital firm Hashed Ventures, summed it up:

“Since all major candidates support pro-crypto policies, the country’s crypto investors face a clear win regardless of election outcome.”

This isn’t the first time crypto has gained political traction. Back in 2022, both main parties also supported digital asset initiatives. But in 2025, with greater adoption and bigger stakes, the momentum is even stronger.

$74.5 Billion in Crypto Holdings

At the end of 2024, South Koreans held a staggering 104 trillion won, or $74.5 billion, in crypto assets, according to data from the Bank of Korea. This figure highlights the country’s deep commitment to digital assets, and the political motivation to serve such a large user base.

One of Lee Jae-myung’s major policy proposals is to legalize spot crypto ETFs (Exchange-Traded Funds). If passed, this would allow South Korean investors to access regulated crypto investment products, potentially encouraging more institutional participation.

He has also suggested allowing the country’s $884 billion national pension fund to invest in cryptocurrencies — an idea that has drawn attention for its ambition and potential risks.

Surprisingly, this proposal has found support even from his conservative opponent, Kim Moon-soo, signaling a rare moment of bipartisan agreement on crypto policy in the country.

Stablecoin Debate Heats Up

However, not all of Lee’s ideas are welcomed without criticism. One of the most debated aspects of his platform is a call for wider issuance of stablecoins tied to the South Korean won.

Stablecoins are cryptocurrencies pegged to traditional assets, most often the U.S. dollar, and have gained popularity globally. Lee views won-backed stablecoins as a way to modernize South Korea’s financial system and prevent capital from flowing out of the country.

But not everyone agrees.

Just this month, lawmakers revealed that 56.81 trillion won in funds flowed out of South Korean crypto exchanges during Q1 of 2025. Nearly half of these outflows were linked to dollar-based stablecoins like Tether (USDT) and Circle’s USD Coin (USDC). This has raised concerns among regulators about the need for stronger domestic alternatives.

Bank of Korea Governor Rhee Chang-yong pushed back on Lee’s proposal last Thursday. He warned that allowing non-banking institutions to issue stablecoins could seriously weaken national monetary policy. Instead, he argued, the central bank should take the lead in creating any won-denominated stablecoin.

Global Context: The Trump Effect

South Korea’s crypto debate is unfolding in parallel with global shifts in digital asset policy.

In the United States, former President Donald Trump recently signed an executive order encouraging the growth of dollar-backed stablecoins. Trump sees these tokens as essential to maintaining the dollar’s global dominance, especially as other nations explore digital alternatives.

This pro-crypto stance from Trump has influenced lawmakers across Asia, including in South Korea, who are becoming more receptive to blockchain technology and tokenized finance.

Regulation Tightens After TerraUSD Collapse

Despite growing enthusiasm, South Korea’s crypto sector still faces challenges, especially when it comes to regulation and safety.

Many citizens still remember the 2022 collapse of TerraUSD, a stablecoin project led by South Korean developer Do Kwon. The project lost $40 billion in value in just a few days, devastating both retail and institutional investors. Kwon is now awaiting trial in the U.S. on fraud charges related to the incident.

The fallout from TerraUSD triggered swift regulatory reform.

In response, South Korea passed the Virtual Asset User Protection Act, which began rolling out in July 2024. The law sets strict rules for crypto exchanges. These include:

- Mandatory segregation of customer funds

- Liability requirements for hacks and system failures

- Harsh criminal penalties for misconduct, including potential life sentences

The law reflects both the scale of past damages and the urgency to protect investors in one of the world’s most active crypto markets.

A Turning Point for South Korea’s Crypto Industry

Looking ahead, the 2025 presidential election could be a turning point for digital assets in South Korea.

For the first time, crypto is not just a campaign issue — it’s a potential national strategy.

With tens of millions of retail users, billions in digital holdings, and strong political alignment, the foundation is in place for a new era of crypto development.

Key proposals like spot ETFs, pension fund investment, and domestic stablecoin issuance suggest that South Korea could soon become a global leader in digital asset innovation.

But risks remain, ranging from capital flight to regulatory backlash to the lingering memory of TerraUSD. The country must strike a careful balance between promoting growth and ensuring safety.

One thing is certain: no matter who wins the presidency, South Korea’s crypto future looks brighter than ever.