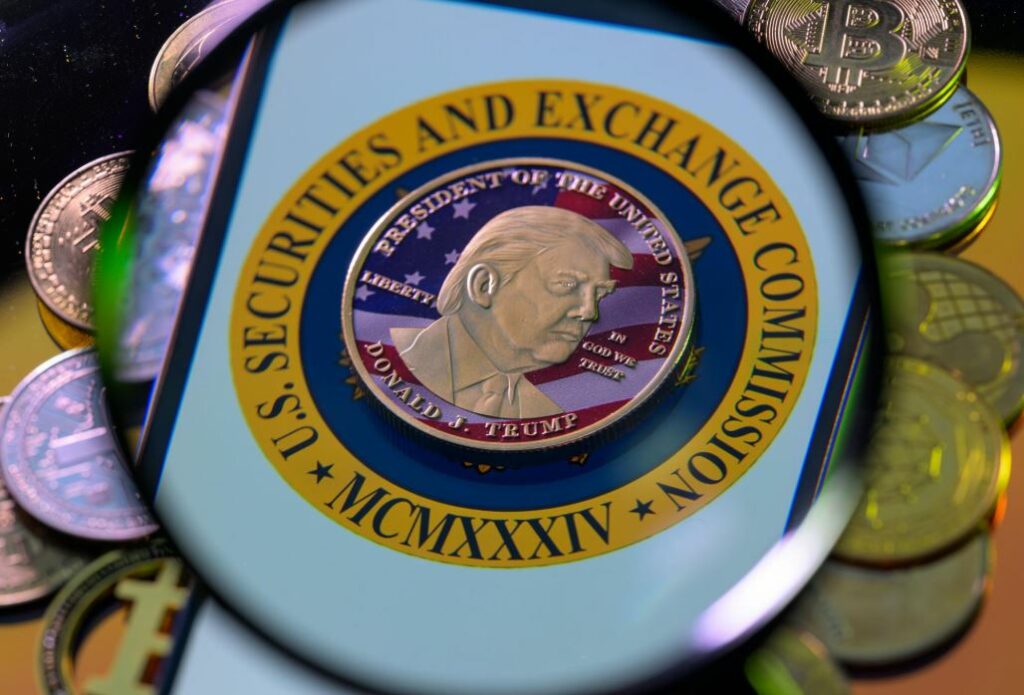

In a move that’s sending shockwaves through political and financial circles, former President Donald Trump’s media company is planning to raise $3 billion to invest in Bitcoin and other cryptocurrencies, according to a report from the Financial Times. The plan is raising serious concerns about conflicts of interest, particularly as Trump continues to push pro-crypto policies from inside the White House.

A Bold Bet on Crypto

The company behind Trump’s social media platform Truth Social, Trump Media & Technology Group (TMTG), reportedly plans to raise $2 billion in equity and another $1 billion in a convertible bond offering. This massive fundraising effort is aimed at building a crypto war chest, potentially including Bitcoin, other major cryptocurrencies, and even Trump-branded assets like his own $TRUMP memecoin.

This bold crypto investment strategy places Trump’s media company at the center of a growing intersection between politics and blockchain finance.

TMTG is majority-owned by Donald Trump himself, though the shares are officially held in a trust managed by his son, Donald Trump Jr., for the duration of Trump’s presidency.

This strategic move comes just months after Trump began his second term as U.S. president, following a controversial and hard-fought election. He has wasted no time in turning the White House into a launchpad for crypto policy — and possibly, personal profit.

Policy and Profits: A Troubling Mix?

Trump has made cryptocurrency a central theme of his second administration. Just weeks after returning to office, he signed an executive order in March to create a strategic Bitcoin reserve and a national stockpile of digital assets. The order also instructed federal agencies to loosen regulations on the crypto industry, a move widely seen as favorable to both investors and companies in the space.

Critics argue that these policies could directly benefit Trump’s own financial interests, especially now that his media company is planning to pour billions into crypto markets. Watchdog groups are calling it a blatant conflict of interest, especially since the president continues to maintain financial ties to the company through his trust arrangement.

“Trump’s use of executive power to boost a sector he’s personally invested in is nakedly corrupt,” one special interest group told The Independent.

The $TRUMP Memecoin and a Private Investor Banquet

The lines between public office and personal gain became even blurrier last week when Trump hosted 200 major investors in his memecoin at a private event held at his Virginia golf club. The exclusive gathering included crypto influencers, hedge fund managers, and even a few venture capitalists known for betting big on meme assets.

Observers described the event as “part fundraiser, part product launch,” with Trump reportedly thanking attendees for their support and touting the memecoin’s rising value. That coin — and other Trump-linked crypto assets — are believed to have boosted the Trump family’s net worth by $2.9 billion, according to a recent report from State Democracy Defenders Action.

This rise in wealth underscores how deeply personal the stakes are for Trump when it comes to crypto investment.

Crypto on the Campaign Trail

This week, the Trump administration is gearing up for a major appearance at the world’s largest Bitcoin conference in Las Vegas. Scheduled attendees include Vice President JD Vance, Donald Trump Jr., Eric Trump, and Trump’s newly appointed “crypto czar” David Sacks.

Trump’s media company is expected to promote its latest crypto investment plans at the conference, marking a major moment for its public relations campaign.

Trump himself made waves at last year’s event in Nashville, where he gave a keynote speech courting support from crypto donors. That appearance helped position him as a pro-crypto candidate, contributing to Bitcoin’s historic rally, which saw the coin hit a record high of $109,000 last week.

Questions about ethics and legality aren’t new to Trump’s presidency, but this time, the stakes are higher.

While cabinet members and federal officials are bound by strict conflict of interest rules, the president is technically exempt from these laws. Trump has long leaned on this exemption to defend his business activities. Back in 2017, just before taking office the first time, he famously declared: “The president can’t have a conflict of interest.”

During that first term, he pledged to transfer control of his businesses to his sons and halt foreign business deals. But this time, he’s made no such promises. Insiders say that Trump and his allies view criticism over conflicts of interest as a political weapon, one used by Democrats to distract from policy victories.

That attitude may have hardened after a string of unsuccessful prosecutions by state and federal prosecutors during Trump’s time out of office. Although one of those cases led to 34 felony convictions, Trump received no substantial punishment due to his re-election victory. A landmark Supreme Court ruling now grants sitting presidents sweeping immunity from prosecution, further emboldening Trump’s actions.

TMTG: No Comment, No Apologies

When contacted by The Independent, both the White House and Trump Media & Technology Group declined to comment. The White House simply referred all inquiries to TMTG.

So far, neither Trump nor his company has addressed concerns about how a $3 billion crypto investment fund, financed while Trump is actively reshaping crypto policy, might be viewed by the public or future regulators.

But given the current political climate and Trump’s enduring influence over both markets and media, the plan may move ahead regardless.

What This Means for the Crypto World

Trump’s pro-crypto stance has already reshaped the digital asset landscape. His policies have:

- Supercharged Bitcoin’s price rally

- Encouraged retail investors to explore Trump-branded tokens

- Given regulatory relief to crypto companies operating in the U.S.

With a possible $3 billion investment from TMTG looming, Trump’s influence could extend even further, possibly making his media company one of the largest institutional holders of Bitcoin and other digital assets.

It also cements Trump’s position as the most crypto-friendly president in U.S. history, for better or worse.

Whether you’re a crypto investor or a concerned citizen, the implications of Trump’s latest moves are impossible to ignore. On one hand, his support has fueled growth in the industry. On the other hand, it raises urgent questions about transparency, conflicts of interest, and the future of democratic accountability.

With Bitcoin booming, memecoins multiplying, and presidential immunity in full effect, Trump’s media company and its bold crypto investment strategy may be just getting started.