Ethereum may soon break past the $3,000 mark as macro events align with a bold new scaling plan from co-founder Vitalik Buterin. Meanwhile, South Korea’s booming crypto activity, now surpassing its stock market in daily active users, signals a strong appetite for digital assets in Asia, especially under the nation’s new administration. Together, these forces are fueling a new narrative for Ethereum’s long-term growth and global adoption.

Vitalik Buterin’s Plan to Scale Ethereum Without Layer 2s

Vitalik Buterin’s latest comments at ETHGlobal Prague have shifted the Ethereum conversation. Instead of focusing primarily on Layer 2 scaling solutions like sharding or rollups, Buterin now proposes a direct, 10x scalability improvement to Ethereum’s Layer 1 — the core blockchain infrastructure.

This move could simplify Ethereum’s development stack and remove its heavy reliance on complex Layer 2 systems, which often present usability and integration challenges.

According to Lennix Lai, Chief Commercial Officer at OKX, this change could be a “game-changer.” In a recent note to CoinDesk, Lai said:

“Vitalik’s pivot to scale Ethereum Layer 1 by 10x will be a game-changer, shifting focus away from heavy reliance on Layer 2 solutions like sharding.”

OKX data shows strong investor interest in Ethereum, with ETH perpetual futures making up 44.2% of the platform’s trading volume over the past week. This suggests that traders are positioning themselves for a significant breakout, possibly past $3,000 in the near term.

$3,000 ETH Possible Amid Macro Tailwinds

Beyond Buterin’s roadmap, macroeconomic factors could also drive ETH upward. Lai highlights this week’s key global events:

- The European Central Bank’s interest rate decision

- U.S. non-farm payroll data

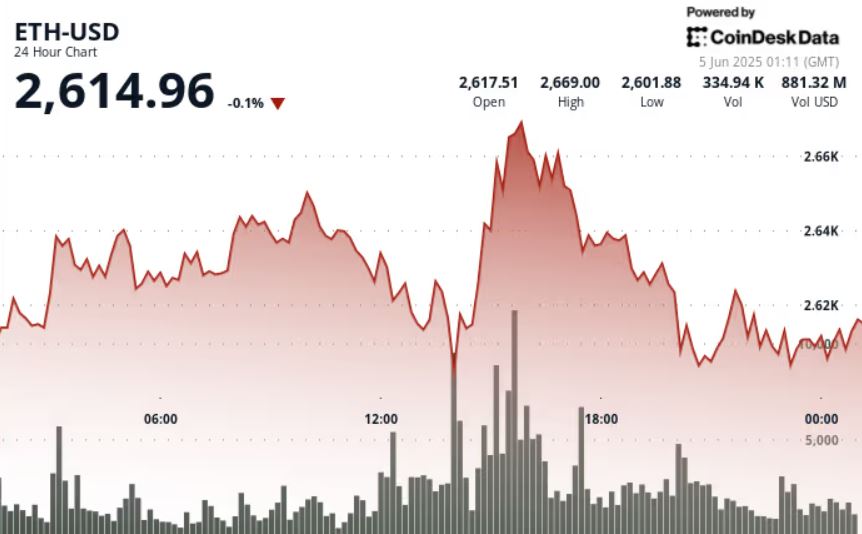

Both are likely to influence investor sentiment and the broader appetite for risk-on assets like cryptocurrencies. If markets respond positively, Ethereum could push past the $2,600 resistance and toward the $3,000 psychological level.

Technical models from CoinDesk Research also indicate strong support near $2,600, backed by over $1.2 billion in institutional inflows and whale accumulation, laying the foundation for an altcoin rally led by ETH.

In South Korea, Crypto Beats the Stock Market

As Ethereum gains momentum globally, South Korea is emerging as a major driver of crypto demand in Asia. In a recent interview with CoinDesk, Simon Kim, CEO of Korea’s largest crypto fund Hashed, shared a surprising statistic:

“Officially, crypto is more popular than the stock market in Korea.”

According to Kim, 16.29 million Koreans actively trade crypto daily, compared to 14.24 million equity traders. With such widespread adoption, it’s no surprise that crypto has become a political issue in the country’s elections.

Despite the recent victory of left-leaning President Lee Jae-myung, Kim expects little disruption to crypto policy.

“It’s going to be business as usual,” he said, noting that both conservative and progressive parties see crypto support as essential to winning votes.

One of the key topics Kim touched on is stablecoins, which now account for about 10% of Korea’s crypto trading volume. However, issuing a stablecoin tied to the Korean won is challenging due to strict capital controls and currency regulations.

Some Korean policymakers reportedly believe there’s “no benefit” to launching a local stablecoin, especially given the country’s already advanced payments infrastructure.

Still, Kim emphasized that stablecoins are here to stay and will likely play a role in future regulation and taxation:

“Stablecoins are not just a payment network. It’s building a unique digital platform enabling smart contracts and making an autonomous economy.”

In addition to crypto, the new Korean administration is expected to prioritize artificial intelligence. However, Kim remains skeptical about attempts to build a sovereign AI model like OpenAI.

Instead, he believes Korea’s edge lies in “physical AI” — AI applications in sectors where the country already leads, such as semiconductors, electronics, and advanced manufacturing.

“We have unfair advantages in the physical AI ecosystem. That’s the point I’m very excited about,” Kim said.

Other Crypto Market Highlights

Beyond Ethereum, several key developments across the crypto market are shaping investor sentiment and influencing short-term price action:

Circle’s IPO Hits $6.9B Valuation

Circle, the issuer of the USDC stablecoin, priced its IPO at $31 per share, above expectations. This move raised around $1.1 billion, valuing the company at $6.9 billion. The stock will begin trading on the New York Stock Exchange under the ticker “CRCL”.

This public debut is seen as a major step for the stablecoin sector, especially after Circle’s failed SPAC attempt in 2021. It also arrives at a time when stablecoin regulation is a hot topic in the U.S. Congress.

Trump and the Digital Asset Market Clarity Act

In Washington, the Digital Asset Market Clarity Act is making progress, with House Republicans holding two hearings to prepare for a markup. The bill aims to create a clear legal framework for crypto markets, but Democrats are pushing back due to concerns over consumer protection and Donald Trump’s alleged conflict of interest related to his crypto business dealings.

As the U.S. debates regulation, global markets like Korea are watching closely. Kim noted that “all Korean politicians are following the U.S.” when shaping their crypto policies.

Market Snapshot (As of June 5)

As of June 5, major financial markets showed mixed performance, reflecting investor reactions to global economic data and shifting risk sentiment.

- BTC: Volatile, dropped 1.67%, now struggling above $105,000 amid trade tensions

- ETH: Up 4%, bouncing off $2,590 with institutional support

- Gold: Gained 0.8%, hitting $3,382 amid safe-haven demand

- Nikkei 225: Fell 0.39% on weak U.S. job data

- S&P 500: Rose slightly to 5,970.81, boosted by tech gains despite macro uncertainty

Conclusion

Ethereum’s near-term outlook is bright, fueled by Vitalik Buterin’s new scaling strategy, favorable macro events, and rising crypto enthusiasm in Asia, especially South Korea. With institutional capital, regulatory momentum, and strong technical support, ETH could soon reach $3,000, and perhaps go even further in the long run.

As the crypto world keeps evolving, all eyes remain on Ethereum, Korea’s next policy steps, and the global race for digital asset dominance.